Configure Deduction Benefits Plans for PPACA Reporting

PPACA Configuration for Medical Plans or Individual Coverage Health Reimbursement Accounts

Two different PPACA plans can be configured using the UKG Pro™ solution. One is for

Deduction/Benefit Medical Plans and the other is for Individual Coverage Health

Reimbursement Accounts (ICHRA).

There are two main types of plans that employers can offer using the options in the business rule:

- A medical plan – This plan can be offered as coverage under PPACA

- An individual coverage HRA – This plan can be offered as an Individual Coverage HRA (ICHRA) under PPACA

- Deduction/Benefit Medical Plans Configuration for PPACA Reporting

- PPACA Reporting for Health Reimbursement Arrangements

- Configure PPACA Reporting for a Medical Deduction/Benefit Plan

- Considerations When Using Open Enrollment Pending Effective Date Worksheet

- Qualified Deduction/Benefit Plans Preparation for PPACA Reporting

For configuration steps for an ICHRA plan, please reference:

- Deduction/Benefit ICHRA Configuration for PPACA Reporting

- Configure PPACA Reporting for an ICHRA Plan

- Considerations When Using Open Enrollment Pending Effective Date Worksheet

- Qualified Deduction/Benefit Plans Preparation for PPACA Reporting

These configurations are an either/or option and cannot both be selected in the process of configuration.

Deduction/Benefit Medical Plans Configuration for PPACA Reporting

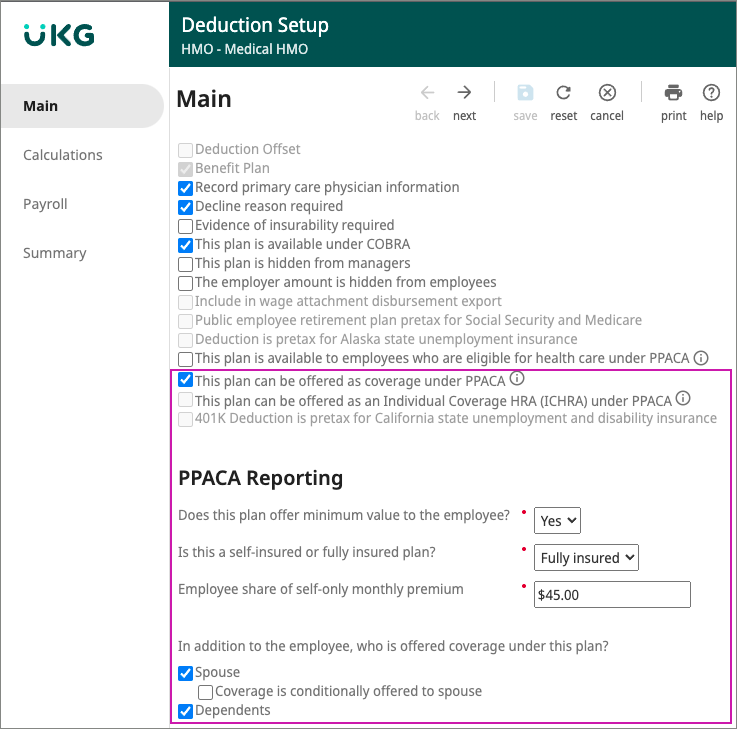

Benefit Plans that can be offered as coverage under Patient Protection and Affordable Care Act (PPACA) must be configured for PPACA reporting on the Deduction Setup Main page (System Configuration > Business Rules > Deduction/Benefit Plan).

Configuration of these fields is required to leverage the UKG Pro solution's auto-population of Form 1095-C Part II - Employee Offer and Coverage and Part III - Covered Individuals.

If selected, this plan can be offered under PPACA. The related fields to configure on the Deduction/Benefit plan business rule include:

| Field | Description |

|---|---|

| General Information | |

| This plan is available to employees who are eligible for health care under PPACA. | When selected, indicates that the plan is available in Open Enrollment and Life

Events only to employees who are eligible under PPACA. This setting works with the

Health Care Eligibility Measurement Groups configured to track employee eligibility.

This option is not required for 1095-C reporting. |

| This plan can be offered as coverage under PPACA. | When selected, indicates that the plan can be offered as coverage under PPACA,

and the PPACA Reporting section dynamically becomes visible and required for

completion. This option is required for 1095-C auto-population. |

| PPACA Reporting | |

| Does this plan offer minimum value to the employee? | When selected, the employer is affirming that the plan meets PPACA requirements for minimum value. For guidance calculating minimum value, refer to the IRS website. |

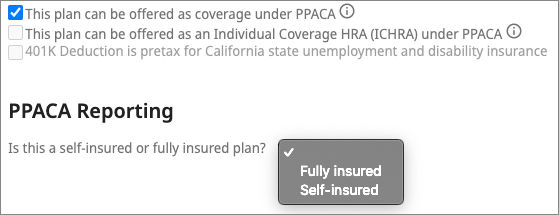

| Is this a self-insured or fully insured plan? | Indicates whether the plan is self-insured or fully insured. For self-insured plans, the employer assumes the direct risk for payment of the claims for benefits. Employers who offer self-insured plans are required to complete Form 1095-C, Part III. Employers who offer fully insured plans are not required to complete Form 1095-C, Part III. |

| Employee share of self-only monthly premium | The amount entered represents the employee share of the monthly premium for self-only coverage under that specific plan. |

In addition to the employee, who is offered coverage under this plan?

|

Indicates whether coverage is available for a spouse, dependents, or both. And, whether coverage is conditionally offered to the spouse. |

Employee share of self-only monthly premium is a fixed amount. Employers who base premium contributions on the employee's salary, or another variable, must populate this field with a single value. Options for how to populate this field, include:

- Populate with the value corresponding to the salary band of a majority of the employees. Use the import report template to correct the amount for employees to which the value does not apply.

- Populate with a value that is easily identifiable (for example, $1.00 or $0). Use the import report template to correct the amount for each employee and import the data into the UKG Pro solution.

- Populate with a value representative of the lowest cost regardless of salary bands.

Keep in mind that when using auto-population for Form 1095-C, the amount entered in this field is used to determine the appropriate Offer and Coverage and Safe Harbor codes.

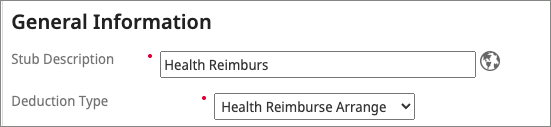

PPACA Reporting for Health Reimbursement Arrangements

A Health Reimbursement Account (HRA) is a type of health spending account provided by an employer. An ICHRA is specific type of HRA. Both an HRA and ICHRA enable employers to reimburse their employees for individual health insurance, but an ICHRA has higher limits and more flexibility in design.

ALE members are required to report individuals enrolled only in a Health Reimbursement Arrangement (and not enrolled in major medical plans) on Part III of Form 1095-C. HRA deduction/ benefit plans are excluded from Form 1095-C Part II reporting.

A single PPACA Reporting option displays for selection when configuring HRA deduction/benefit plans to be offered as coverage. Select if the plan is fully insured or self-insured.

At this time, to include individuals enrolled only in HRA plans, enrollment information must be imported using the appropriate Part III - Covered Individuals template.

Configure PPACA Reporting for a Deduction/Benefit Plan

PPACA reporting must be configured in order to have employees' Form 1095-C auto-populate.

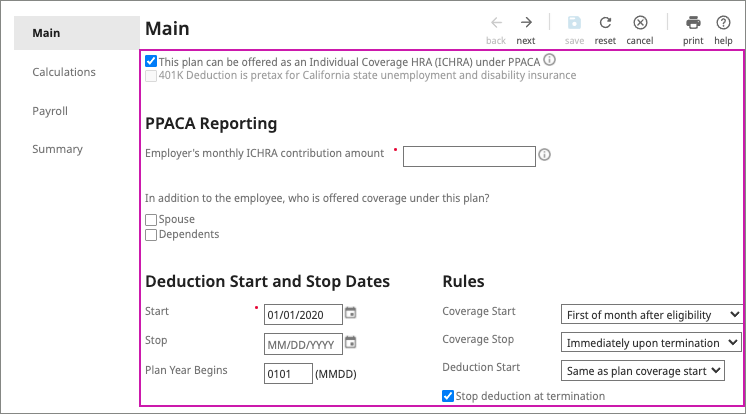

Deduction Benefit ICHRA Plan Configuration For PPACA Reporting

New regulations allow organizations to offer employer-funded health care coverage for your

employees via individual coverage reimbursement arrangements or Individual Coverage Health

Reimbursement Arrangement (ICHRA) plans.

An ICHRA is an alternative to standard group insurance plans. Employees can accept the ICHRA offer and buy individual insurance on the public marketplace. The ICHRA plan satisfies the ACA employer share responsibility requirements. The employees are reimbursed tax-free, and the ICHRA plan still meets PPACA requirements. (System Configuration > Business Rules > Deduction/Benefit Plans)

If selected, this plan can be offered as an Individual Coverage HRA (ICHRA) under PPACA. The related fields that are to be configured include:

| Field | Description |

|---|---|

| General Information | |

| This plan is available to employees who are eligible for health care as an Individual Coverage (ICHRA) under PPACA. | Indicates the plan can be offered as an ICHRA under PPACA and the PPACA

Reporting section dynamically becomes visible and required for completion. This option is required for 1095-C auto-population. Note All ICHRA

plans are considered self-insured. |

| PPACA Reporting | |

| Employer’s ICHRA contribution amount | The amount that the employer will contribute to the employee’s ICHRA. |

In addition to the employee, who is offered coverage under this plan?

|

Indicates whether coverage is available for a spouse or dependents. |

Configure PPACA Reporting For ICHRA Deduction/Benefit Plans

PPACA reporting must be configured in order to have employees' Form 1095-C

auto-populate.

- From the Deduction/Benefit Plans business rule, use the search to locate the plan.

- Select the Code link to edit the deduction /benefit plan.

- From the Edit Deduction/Benefit Plan, enter the applicable Effective Date.

- From the Main page, General Information section, select This plan can be offered as an Individual Coverage HRA (ICHRA) under PPACA.

- Enter the Employer's monthly ICHRA contribution amount.

- Select the spouse and/or dependents check box if coverage is offered under the plan.

- Enter the Deduction Start and Stop Dates and when the Plan Year Begins.

- Review the Rules, Check Handling, Arrears Handling, and the Enrollment disclaimer sections.

-

Select Next, repeatedly, to navigate to the Summary page.

- Select Save.

Considerations When Using Open Enrollment Pending Effective Date Worksheet

The effective date used when updating a deduction/benefit plan impacts open enrollment sessions, payroll deductions and PPACA Forms 1095-C reporting.

When using the Pending Effective Date Worksheet to determine the effective date for plan changes (and open enrollment session), consider your PPACA reporting requirements:

- Is the plan offered as coverage under PPACA?

- Is there a change in the amount of self-only coverage?

- Are there plan changes to dependent coverage?

The auto-population function for PPACA reporting uses the effective dated record that is closest to, without going past, the first of the month. The Pending Effective Date Worksheet uses payroll deduction and benefits start and stop dates to calculate a recommended effective date, which may not coincide with the first of the month. If the Pending Effective Date Worksheet results in a date that is after the first of the month, any changes impacting PPACA Reporting are reported the following month.

| Scenario Example: A rate increase impacts the option/rates for a medical plan. The rate increase affects the amount entered for PPACA Reporting of self-only coverage. | |

|---|---|

| Description | Task/Result |

| Pending Effective Date Worksheet results | Worksheet calculates an effective date of January 5th. |

| Action taken based on worksheet results |

Deduction/benefit plan is modified to reflect new rates using the January 5th effective date. PPACA reporting field for self-only coverage amount is updated. |

| Auto-Populate Form 1095-C result based on deduction/benefit plan changes | For the month of January, the self-only coverage reflects the same amount as December. |

| Action required to reflect new amount in January | Make an additional change to the deduction/benefit plan.

|

| Auto-Populate Form 1095-C result based on additional deduction/benefit plan change | For the month of January, the self-only coverage reflects the new amount entered in the January 1st effectively dated record. |

Qualified Deduction/Benefit Plans Preparation for PPACA Reporting

Benefits administrators can configure new and existing Deduction/Benefit plans to be designated "offered as coverage" under PPACA.

By using the features in the ACA Toolkit, data in the UKG Pro solution can be used to auto-populate Form 1095-C. To leverage the auto-populate feature for Form 1095-C, when configuring a deduction/benefit plan's PPACA Reporting, the correct effective date must be used. In some cases, a new effective date for qualifying benefit plan(s) may need to be added to reflect the start of the reporting year and appropriately capture reporting information for the calendar year.

Identify and review deduction benefit plans to offer under PPACA. The effective date applied to a deduction/benefit plan depends on the management of your company's qualified plan. Changes in plan design or rates could have resulted in multiple effective dates for a single deduction/benefit plan in a year. When multiple effective dates exist, benefits administrators must configure PPACA Reporting for every effectively dated record applicable to the months for which you are reporting under PPACA.

| Example Plan Scenario | Action Required for 2015 |

|---|---|

| Example #1 Benefit Plan effective 1/1/2015 with no other changes in 2015 |

Using an effective date of 1/1/2015, edit the deduction/benefit plan to configure the PPACA Reporting fields. |

| Example #2 Benefit Plan effective 1/1/2015 was updated with new rates on 06/01/2015 with no other changes in 2015 |

1. Using an effective date of 1/1/2015, edit the deduction/benefit plan to configure the PPACA Reporting fields. 2. Using an effective date of 06/01/2015, edit the deduction/benefit plan to configure the PPACA Reporting fields. (rate change may impact self-only monthly premium) NOTE: Configuration changes performed in one effective dated record do not automatically populate to an already existing effectively dated record with a future date. |

| Example #3 Benefit Plan effective 9/1/2014 with no other changes in 2015 |

Using an effective date of 1/1/2015, edit the deduction/benefit plan to configure the PPACA Reporting fields. Since reporting is not required prior to 1/1/2015, an effective date of 9/1/2014 would not be used. |

| Example #4 Benefit Plan effective 3/1/15 with plan design change to include dependent coverage on 9/1/15. The UKG Pro solution was not used prior to 3/1/15. |

1. Using an effective date of 3/1/2015, edit the deduction/benefit plan to configure the PPACA Reporting fields. 2. Using an effective date of 9/1/2015, edit the deduction/benefit plan to configure the PPACA Reporting fields. (plan design may require a change in selection of who is offered coverage) For 1095-C reporting, use the import report template to populate information for months of January and February. |

Cognos Analytics PPACA Eligible Deduction Codes Report

The PPACA Eligible Deduction Codes report lists all US-based deduction codes, including codes that are currently configured for PPACA reporting purposes.

Additional fields, such as the Plan Can Be Offered As Coverage Under PPACA and Plan Offers Minimum Value to Employee fields, are included in the report and may be helpful when determining which codes should be configured for PPACA reporting.

You can also use this report to review both the current and effective-dated configurations for your deduction codes to determine if any updates are needed. To run the PPACA Eligible Deduction Codes Report in Business Intelligence:

- Enter the 4-digit PPACA reporting year.

- Select Finish.

© UKG Inc. All rights reserved. For a full list of UKG trademarks, visit www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG Inc. (“UKG”). Information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. Nothing herein constitutes legal advice, tax advice, or any other advice. All legal or tax questions or concerns should be directed to your legal counsel or tax consultant.

Liability/Disclaimer

UKG makes no representation or warranties with respect to the accuracy or completeness of the document or its content and specifically disclaims any responsibility or representation for other vendors’ software. The terms and conditions of your agreement with us regarding the software or services provided by us, which is the subject of the documentation contained herein, govern this document or content. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.

Links to Other Materials: The linked sites and embedded links are not under the control of UKG. We reserve the right to terminate any link or linking program at any time. UKG does not endorse companies or products to which it links. If you decide to access any of the third-party sites linked to the site, you do so entirely at your own risk.