Configure Coefficient Overtime Earnings and Pay Statements

Coefficient Overtime

Coefficient Overtime is the calculation of overtime defined by the Wages and Fair Labor Standards Act (FLSA).

The coefficient overtime rate of pay is an equivalent rate of all earnings made that are subject to FLSA standards. The calculation includes all earnings configured for FLSA for an employee divided by the total hours worked. If an employee works more than one job type at different pay rates, the overtime rate is the weighted average of those jobs. Shifts are included in the overtime calculation if flagged.

- Pay for expenses incurred on the employer's behalf

- Premium payments for overtime work or the true premiums paid for work on Saturdays, Sundays, and holidays

- Discretionary bonuses

- Gifts on special occasions

- Payments for occasional periods when no work is performed due to vacation, holidays, or illness

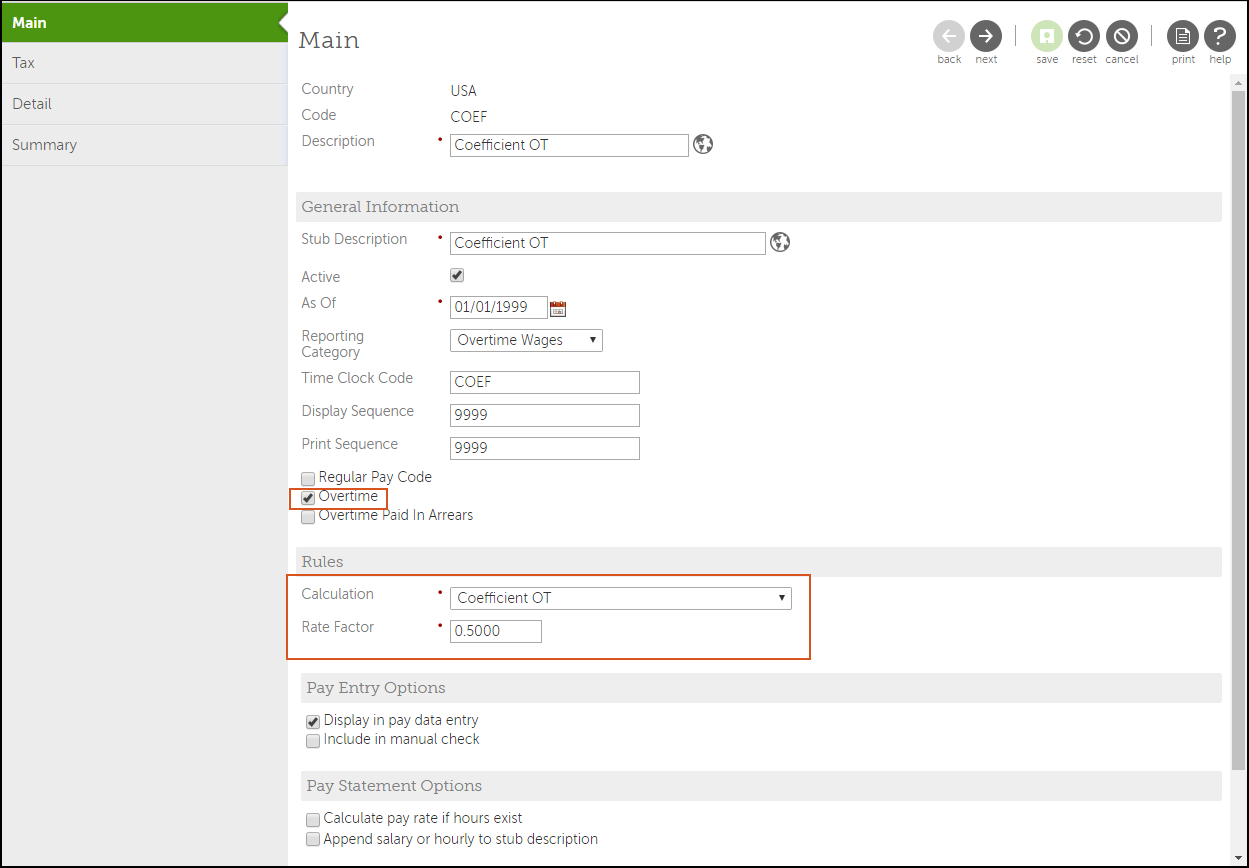

Configure Coefficient Overtime Earnings Calculation

Create a coefficient overtime earnings using the coefficient calculation rule. Associate this calculation to any earnings that are subject to the Wages and Fair Labor Standards Act (FLSA) standards.

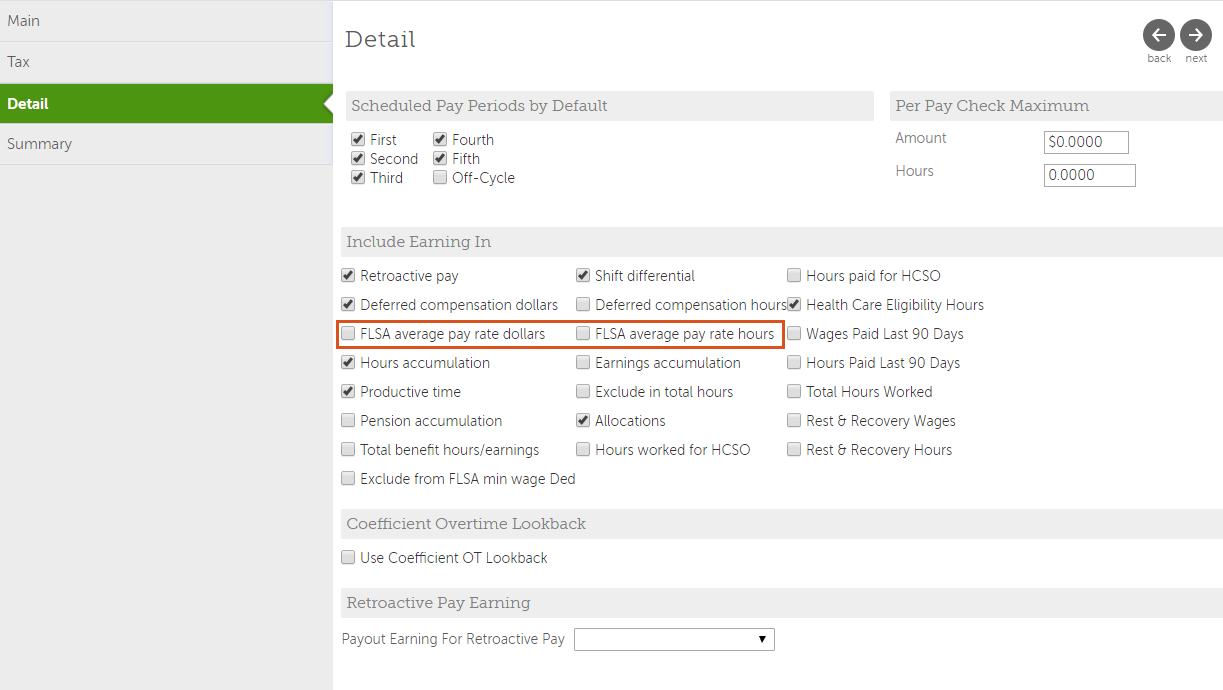

Configure Earnings to Qualify for Coefficient Overtime Calculation

Configure earnings that are subject to the Wages and Fair Labor Standards Act (FSLA) overtime standards. Associate those earnings to the coefficient overtime calculations earnings rule.

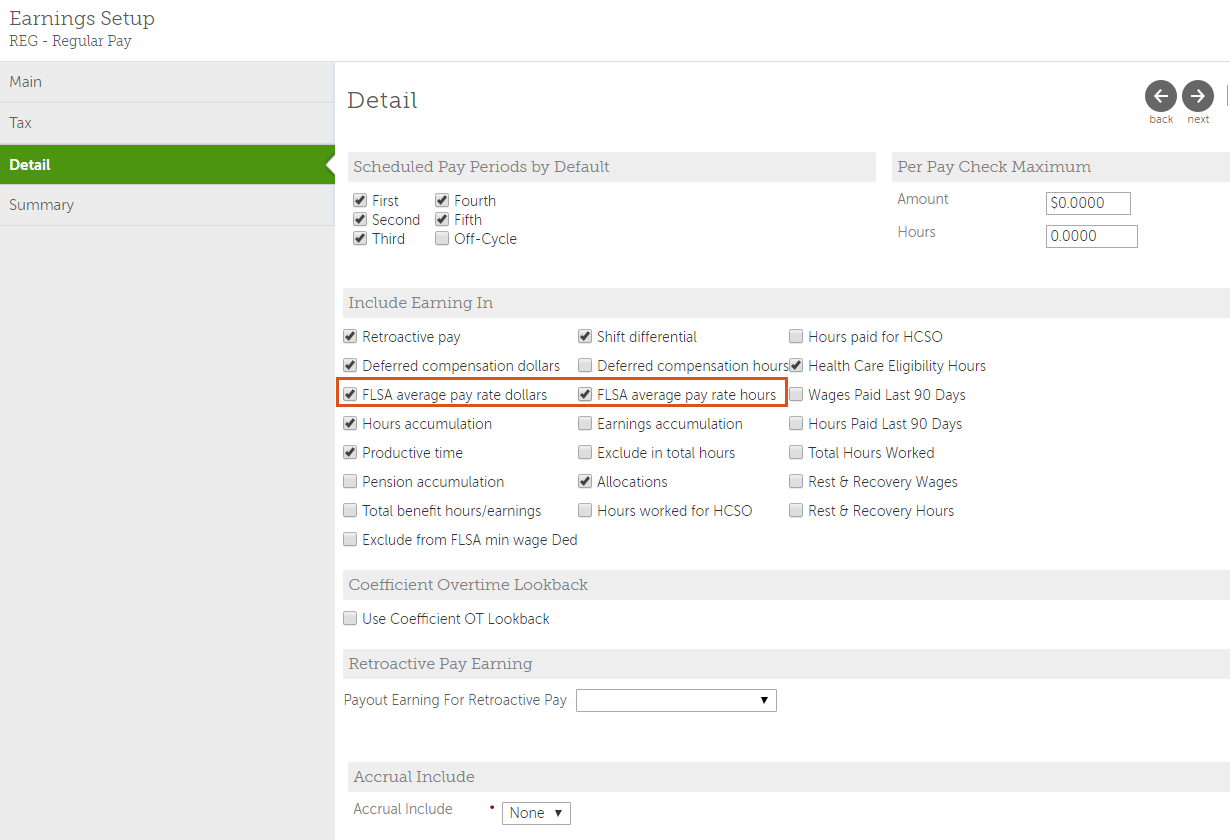

- From the Business Rules page, select Earnings and then select the appropriate earnings code.

- From the Earnings Setup page, select Next.

- From the Tax page, select Next.

-

From the Detail page, in Include Earning In, check the following boxes:

- FLSA Average Pay Rate Dollars

- FLSA Average Pay Rate Hours

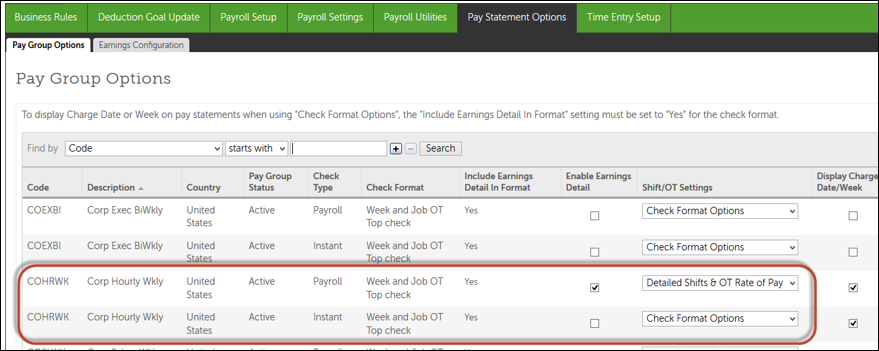

Configure Detailed Overtime and Shifts on Pay Statements

Overtime earnings and corresponding shifts can appear on employee pay statements in an easy-to-read format.

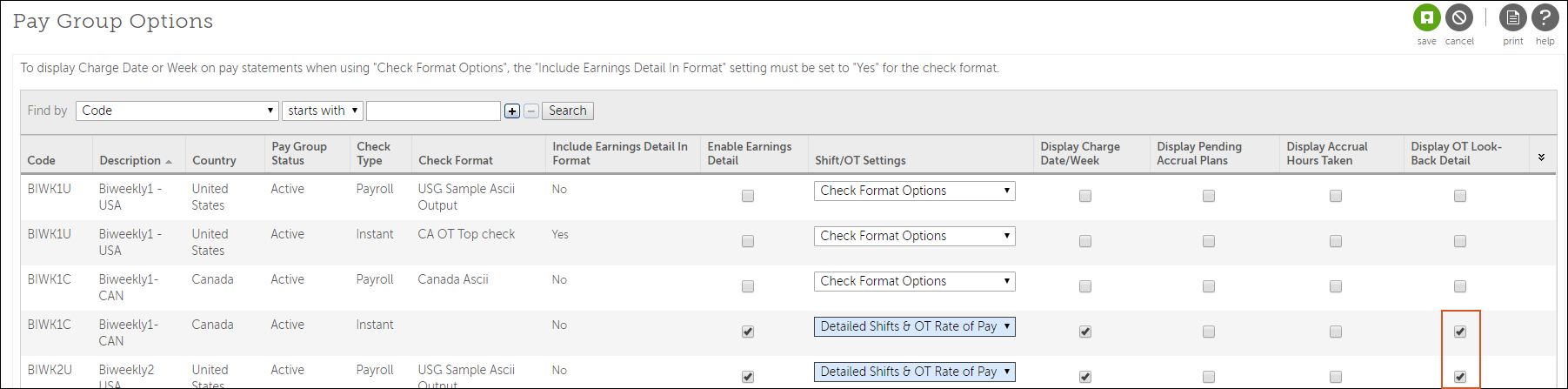

Configure Shift/OT Settings from the Pay Group Options page. Assign Shift/OT Settings according to pay group and check type. The shift and corresponding overtime earnings must have the same Charge Date, Job, and Shift. When the Detailed Shifts & OT Rate of Pay option is assigned:

- Shifts appear below the overtime earnings

- Overtime hours are subtracted from the regular earnings hours when the overtime earnings

is configured with the Overtime indicator enabled.Note If the Overtime indicator is not selected in the Earnings setup, the earnings will not be reduced from the regular hours.

- Overtime pay rate appears as a combined time and a half rate (or other rate)

When the Detailed Shifts option is assigned and overtime pay is applied, but no shifts are paid, the overtime pay displays without a corresponding shift.

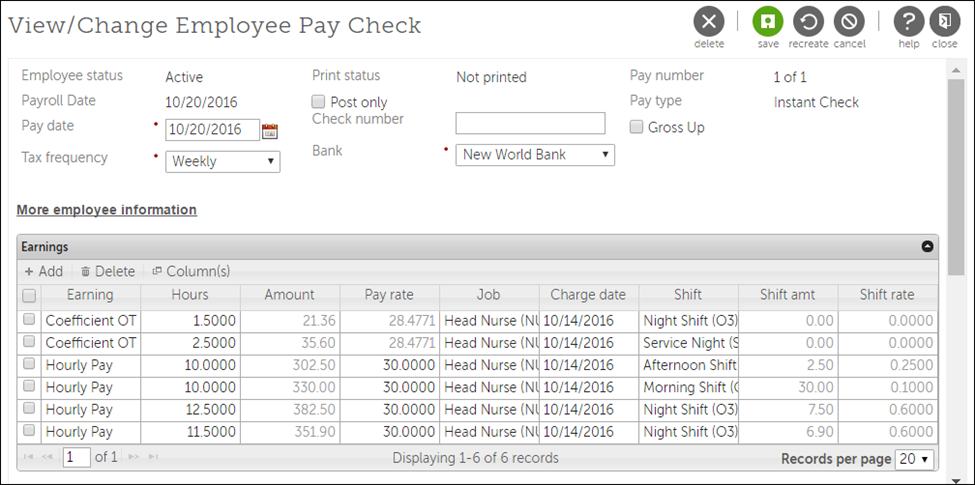

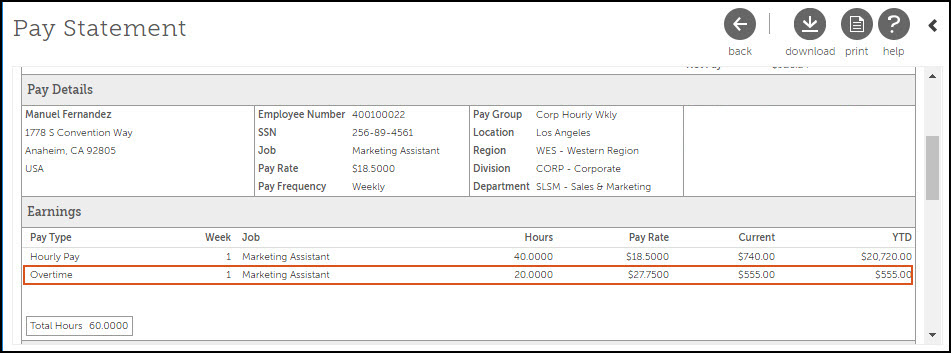

Pay Statement Examples with Configured Overtime

The following examples show possible pay statements for a full-time employee who works 45 hours in a week (which includes 5 hours of overtime). Each pay statement example is a different configuration of the same scenario.

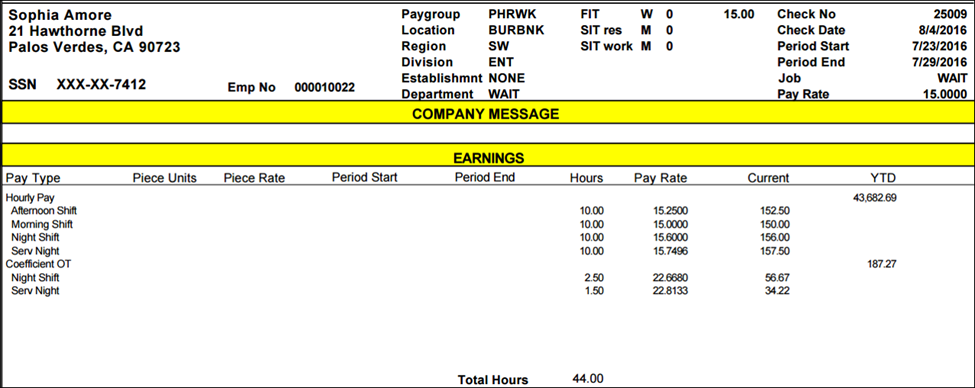

Example Pay Statement with Two Configured Earnings and Detailed Shifts & OT Rate of Pay Option Enabled

The following example shows a pay statement with two earnings configured, regular pay and coefficient overtime.

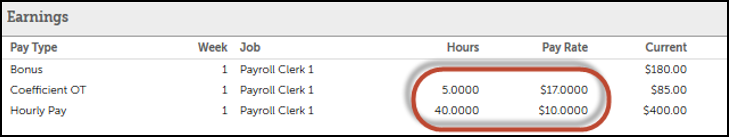

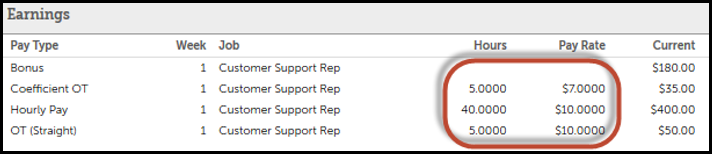

Example Pay Statement with Three Configured Earnings and Detailed Shifts & OT Rate of Pay Option Disabled

- Regular Earnings – Typically, 40 hours.

- Overtime (Straight) Earnings - Shows the number of hours worked at the overtime rate.

- Coefficient Overtime - Shows the premium overtime earnings rate and amount.

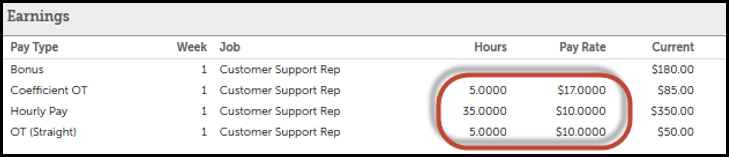

Example Pay Statement with Three Configured Earnings and Detailed Shifts & OT Rate of Pay Option Enabled

The following example shows an example of a pay statement with three earnings configured:

- Regular Earnings – Typically, 40 hours, but the number of hours for Coefficient Overtime is subtracted from the regular earnings total.

- Overtime (Straight) Earnings - Show the number of hours worked at the overtime rate.

- Coefficient Overtime - Shows the employee’s pay rate and the premium overtime earnings amount.

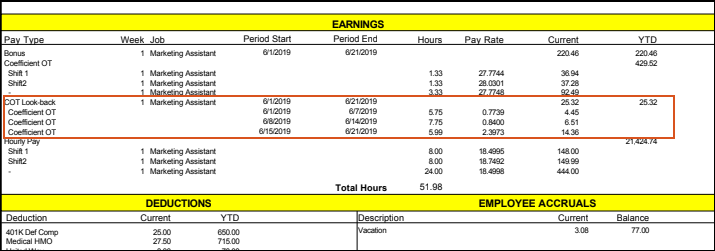

Configure the Detailed Overtime Look-Back Calculation on Pay Statements

A payroll administrator can configure pay statements to display overtime look-back details

on pay statements.

When non-discretionary bonus earnings are configured with coefficient overtime look-back, the pay statement displays the adjusted earnings start and end dates separate from the bonus period. The coefficient overtime look-back details are displayed on printed and online pay statements.

© UKG Inc. All rights reserved. For a full list of UKG trademarks, visit www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG Inc. (“UKG”). Information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. Nothing herein constitutes legal advice, tax advice, or any other advice. All legal or tax questions or concerns should be directed to your legal counsel or tax consultant.

Liability/Disclaimer

UKG makes no representation or warranties with respect to the accuracy or completeness of the document or its content and specifically disclaims any responsibility or representation for other vendors’ software. The terms and conditions of your agreement with us regarding the software or services provided by us, which is the subject of the documentation contained herein, govern this document or content. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.

Links to Other Materials: The linked sites and embedded links are not under the control of UKG. We reserve the right to terminate any link or linking program at any time. UKG does not endorse companies or products to which it links. If you decide to access any of the third-party sites linked to the site, you do so entirely at your own risk.