Download the ACA Form Data Files (XML)

Download the ACA Form Data Files (XML)

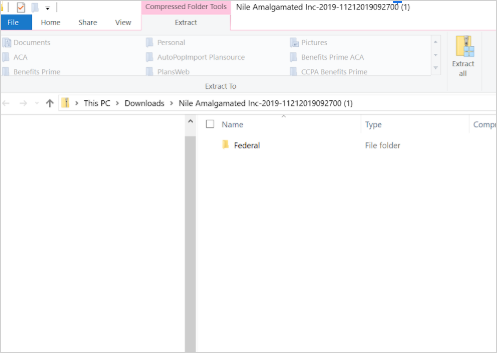

Your company's data is extracted and made available as a downloadable Export File (ZIP). The Export File contains the Form Data Files (XML), which are prepared in accordance with ACA reporting requirements as stipulated by the IRS.

The IRS rejects Form Data Files larger than 100MB. UltiPro creates multiple Form Data Files (each smaller than 100MB) to meet this requirement, when needed.

The IRS requires all employees on record as of December 31 of the reporting year to be included in the ACA Form Data File. To avoid omissions and possible penalties, your UKG Pro™ solution prevents the generation of Form Data Files until after the last day of the reporting year.

This job aid, Download the ACA Form Data File (XML), includes a description of the export file generated by your UKG Pro solution. Refer to your organization's legal and tax advisors as well as the IRS website, www.irs.gov, to ensure the Form Data File (XML) complies with the latest IRS file requirements.

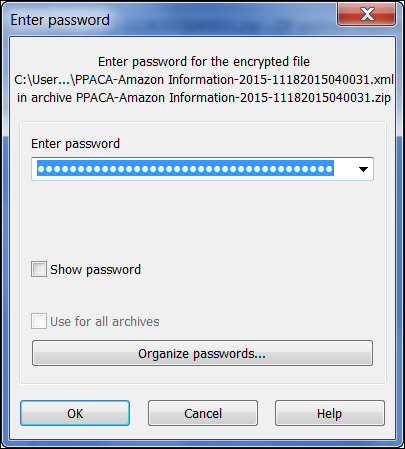

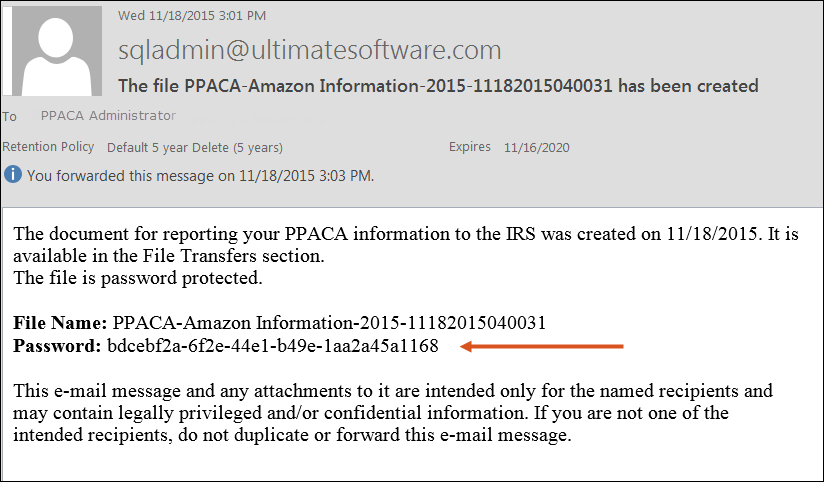

For security purposes, each ACA Form Data File (XML) downloaded is encrypted and password protected. Upon download, an email with a password is sent to qualified users, as shown. Only those users who have been assigned to roles with the PPACA Administrator role type receive the email with the password. Ensure the PPACA Administrator role type has been assigned to applicable roles in your organization prior to downloading the Form Data File (XML).

© 2021 UKG Inc. All rights reserved. For a full list of UKG trademarks, visit www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG Inc. (“UKG”). Information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. Nothing herein constitutes legal advice, tax advice, or any other advice. All legal or tax questions or concerns should be directed to your legal counsel or tax consultant.

Liability/Disclaimer

UKG makes no representation or warranties with respect to the accuracy or completeness of the document or its content and specifically disclaims any responsibility or representation for other vendors’ software. The terms and conditions of your agreement with us regarding the software or services provided by us, which is the subject of the documentation contained herein, govern this document or content. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.

Links to Other Materials: The linked sites and embedded links are not under the control of UKG. We reserve the right to terminate any link or linking program at any time. UKG does not endorse companies or products to which it links. If you decide to access any of the third-party sites linked to the site, you do so entirely at your own risk.