Complete Employee Maintenance and Pre-Payroll Audits

Employee Maintenance

Before you open your payroll, there are several administrative tasks to perform and audit reports to review to ensure a smooth payroll process.

Complete Employee Maintenance

Before starting the payroll process, ensure that all employee maintenance is up-to-date, including:

- Hire new employees

- Submit job changes

- Submit terminations

- Submit employee company transfers

- Submit deduction/benefit changes

- Submit direct deposit changes

- Submit tax changes

- Submit pending items

- Submit pre-payroll imports

- Submit workflow approvals

- Submit updates to PTO plans

Update employee records and ensure that all permanent changes are completed before creating batches.

Submit all updates requiring workflow approval. If workflows with effective dates within the pay period are not approved before creating batches, the workflow request is not reflected in the payroll.

Complete Pre-Payroll Audits

Before beginning your payroll process, complete a payroll audit and verify your payroll and employee information.

The Payroll Gateway page provides an overview of your pay groups, pay calendar, and payroll reports. The gateway also provides direct access to complete payroll functions from the Actions buttons and the More actions links at the top of the screen.

From the Process Pay section, validate your pay group information, including:

- Frequency

- Type

- Start, End, Pay Date

- Payroll Status

- Payroll Model

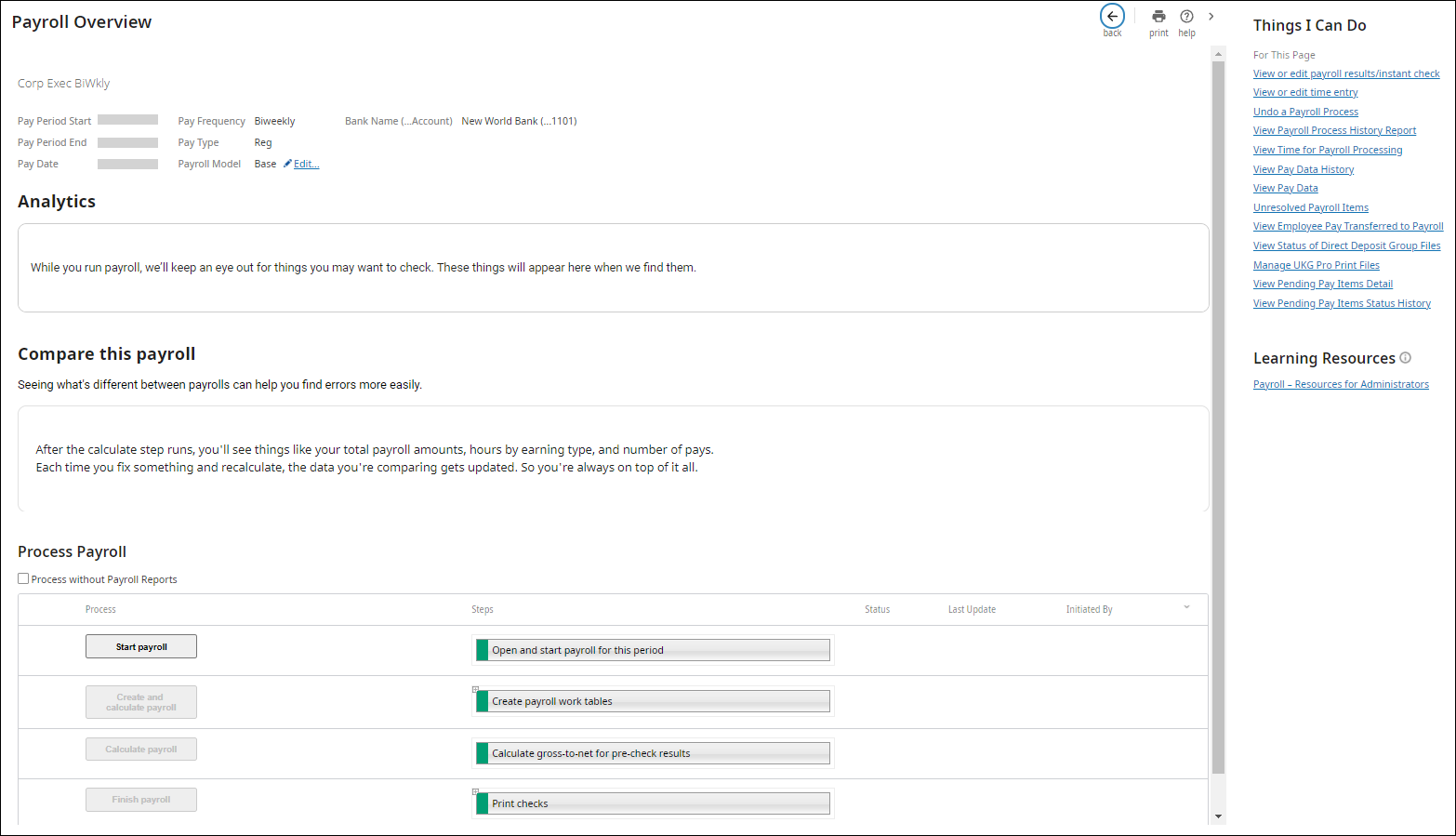

Select the pay group to view the Payroll Overview page. You can complete the following:

- Edit the payroll model (the selected payroll model remains the payroll model for the pay group until it is changed again)

- Review the payroll steps and reports generated for each step (select the step’s Plus icon)

- Review the processing dates

- Review the bank assigned to this pay group

- Process payroll without generating payroll reports, if needed

Generate People Analytics reports to audit your human resource and payroll information. There are several audit reports available in People Analytics (Open Menu > Content > Team Content > UltiPro BI Content > UltiPro BI for Core HR and Payroll > _UltiPro Delivered Reports > _Workplace Custom Reports).

You may have customized reports that were created for your company. Edit this area to include company-specific reports to generate in People Analytics (Open Menu > Content > Team Content > zzzCompany Folders > (your company name) > UltiPro).

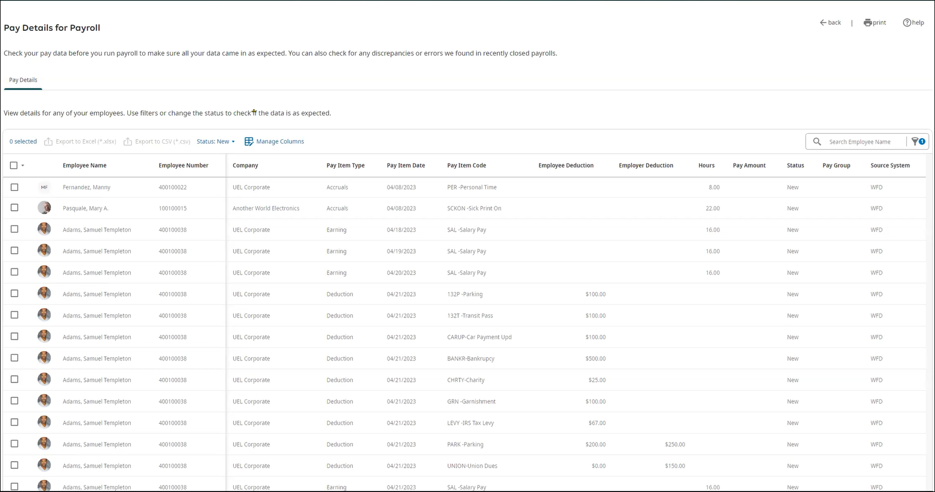

View the Pay Details for Payroll

Check your pay data before you run payroll to ensure the data appears as expected. From this page, you can also check for any discrepancies or errors found in recently close payrolls.

© 2024 UKG Inc. All rights reserved. For a full list of UKG trademarks, visit https://www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners.

This document and all information contained herein are provided to you "AS IS" and UKG Inc. and its affiliates (collectively "UKG") make no representation or warranties with respect to the accuracy, reliability, or completeness of this document, and UKG specifically disclaims all warranties, including, but not limited to, implied warranties of merchantability and fitness for a particular purpose. The information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG. Nothing herein constitutes legal, tax, or other professional advice. All legal, tax, or other questions or concerns should be directed to your legal counsel, tax consultant, or other professional advisor. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.