Configure and Manage Health Care Measurement Groups

Configure and Manage Health Care Measurement Groups

Health Care Measurement Group Overview

A Health Care Measurement Group calculates average hours worked for individual employees using a look-back measurement period. By measuring hours, employers can more easily determine if workers with part-time employment statuses (for example, part-time, part-time variable, or part-time seasonal) qualify as full-time under the Affordable Care Act (ACA) and are eligible for health care benefits.

The definition of full-time eligibility can sometimes leave employers in a situation where employees are considered part-time by company standards, but full-time under the ACA. To determine which employees qualify as full-time under the ACA, employers can use one of two measurement methods:

- Look-back method - Optional - Employers configure the Health Care Measurement Groups tool with specific measurement periods and then assign employees to these groups to determine benefit qualification (this is an optional tool), or

- Month-to-month method - Default - Employers use the default UKG Pro system method to determine health care eligibility on a month-to-month basis.

The Affordable Care Act (ACA) specifies that large employers (employers who employ at least 50 full-time equivalent employees) must provide full-time employees the option to enroll in employer-sponsored benefits. An option to enroll in benefits must also be extended to an employee’s dependent children, age 26 or younger.

What is full-time eligibility?

The ACA defines a full-time employee differently than federal and state laws. Full-time is defined as an employee who works an average of at least 30 hours a week or more for the employer; 130 service hours in a calendar month are treated as the monthly equivalent of at least 30 hours per week.

Salaried employees are usually considered full-time employees and become eligible for benefits. Hourly employees become eligible for benefits if the number of hours worked meets or exceeds full-time work.

Some employees, such as variable hour and seasonal, may also be considered full-time employees based on ACA hours of service. Employers use a measurement period (look-back period) to determine whether a project-based or variable hour employee works 30 hours per week or 130 hours for the month. If the employee is not classified as full-time, the ACA does not apply.

Based on the ACA full-time employee definition, employees can be considered part-time by company standards, but full-time according to the ACA.

Health Care Measurement Periods and Full-Time Eligibility

The Health Care Eligibility feature provides the ability to define certain measurement periods and evaluate employees for health care eligibility.

The following eligibility periods are available to employers:

- Measurement Period – period of time (not less than 3 months and not more than 12 months) used to determine average service hours.

- Administrative Period – period of time (not more than 90 days) used by an employer to enroll eligible employees in the appropriate benefit groups.

- Stability Period – subsequent period following the measurement period where the employee is "benefit eligible." It cannot be less in duration than the measurement period (and in no case less than six months). The stability period either immediately follows the measurement period or follows the administrative period.

Configure the Health Care Measurement tool to track multiple measurement groups based on ACA requirements to determine if employees meet full-time eligibility requirements. Measurement periods must be between 3-12 months. If the employee is full-time, the minimum stability period must be 6 months. Non-variable hourly employees generally do not need a measurement. Part-time employees include a stability period that cannot exceed the length of the measurement period.

After the Health Care Measurement tool is enabled and configured for your company, you can:

- View a list of available measurement groups.

- Mass or individually assign or remove employees to or from measurement groups.

- View up-to-date eligibility for all employees assigned to measurement groups.

- Reassign an employee from their current measurement groups to another measurement group.

- Manually change an employee's eligibility status after their measurement period has been completed and calculated in the UKG Pro solution.

- Automatically create future standard measurement periods using the auto-extend option.

Earnings assigned to employees must be flagged as Health Care Eligibility Hours to track hours. A monthly average of hours is also tracked. On a nightly basis, average hours worked for all employees assigned to a given Health Care Measurement Group are calculated, as of the measurement date. When a pay period is processed and closed, the average hours worked for each employee being measured is updated. Average hour processing enables you to identify any employees who may be approaching the threshold of 30 hours per week or 130 hours per month.

If an employee works more than 30 hours a week or 130 hours a month, based on the Health Care Eligible Group configuration and duration of the measurement period, the employee is considered full-time. An Eligible status appears after the final payroll with the measurement period is paid and closed, which means the employee is eligible for an Offer of Coverage or a Form 1095-C.

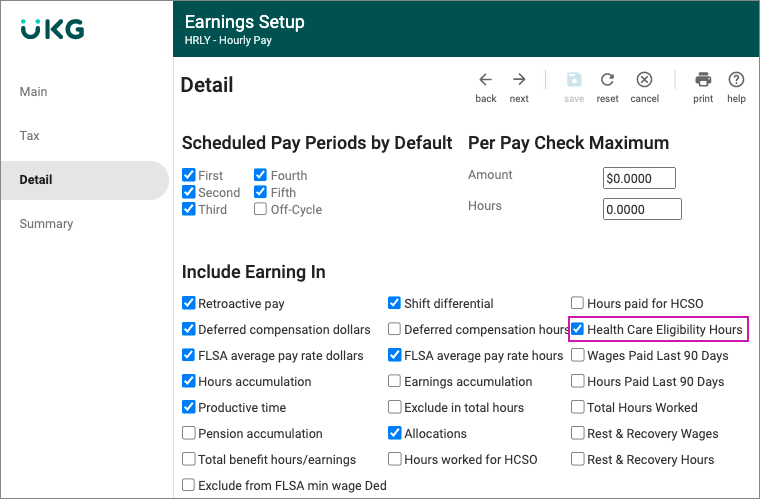

Designate Earnings for Inclusion in ACA Calculation for Accurate Measurement of Hours to Determine Health Care Eligibility

Payroll history and earnings codes are used to calculate average hours worked.

Ensure earnings code(s) are configured for applicable hours of service, each hour an employee is paid, or entitled to payment. In cases where a Flat Amount or Pay Period calculation rule is configured for earnings, the health care measurement tool cannot calculate eligibility and auto-population cannot generate offer of coverage codes.

The earning calculation rule on the Earnings Setup page must include hours for the system to calculate hours of eligibility.

Configure Earnings for ACA Eligibility Calculation

To configure earnings for inclusion in the ACA eligibility calculation:

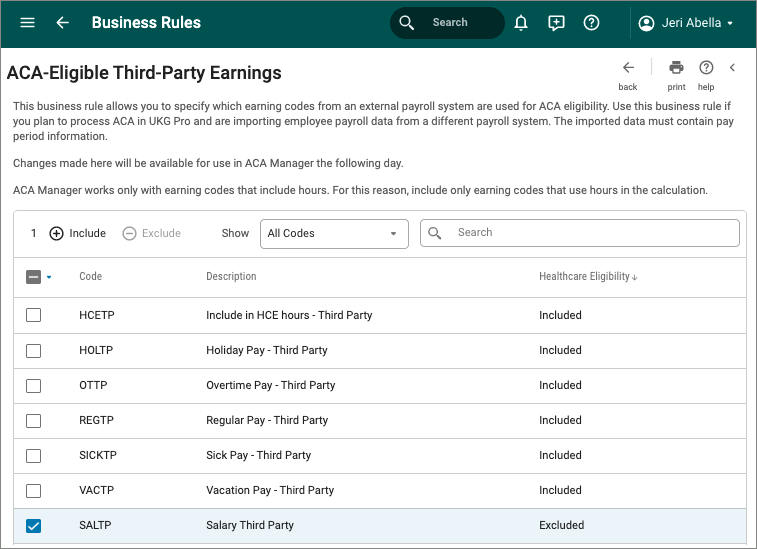

Configure Third-Party Earnings for ACA Eligibility Calculation

After you imported employee payroll data from an external payroll system using the API, you can use the ACA-Eligible Third-Party Earnings business rule to specify which third-party earnings to include in health care eligibility hours and ACA calculations.

Enable Settings for Accurate Measurement of Hours to Determine Eligibility

Payroll history and earnings codes are used to calculate average hours worked to determine full-time eligibility.

- Navigate to the Earnings business rule (Menu > System Configuration > Business Rules > Earnings > select earnings code).

- From the Detail Page in the Include Earnings In section, check the Health Care Eligibility Hours box.

For third-party earnings, select which earnings codes to include (Menu > System Configuration > Business Rules > ACA-Eligible Third-Party Earnings).

Best Practices for Tracking Employee Hours in Health Care Measurement Groups

Review the best practices prior to tracking employee hours to prevent unintended measurement results. Follow guidance from your compliance advisor when working with health care measurement groups.

| Tracking Employee Hours using Measurement Groups | Best Practices | Why? |

|---|---|---|

| Do employees classified as part-time need to be tracked? | Use the health care measurement groups to track individual employees who are classified as part-time, including part-time variable, project-based, or other part-time designation. | Including part-time employees enables employers to measure the full-time

eligibility requirement under ACA. Note Every employee who is added to a health care

measurement group, regardless of employment status, is automatically assigned a

part-time status during the measurement period. |

| Do employees classified as full-time need to be tracked? | Avoid using health care measurement groups to track traditional full-time employees. | Including full-time employees may result in their misclassification as a part-time when auto-population of Form 1095-C is enabled. It may also negatively impact UKG Pro Benefits Open Enrollment and Life Events sessions where ACA reporting plans are configured for eligible full-time employees. |

| When should I use the Health Care Measurement Group tool in UKG Pro solution to track employee hours? Is it an optional tool? | Employers can determine full-time status by counting each employee’s hours of service using one of two measurement methods: monthly or look-back. The health care measurement tool uses the look-back method which tracks hours over a set period to calculate the average number of hours worked over that period. The other method is the monthly method. Employers can choose the method that works best for their organization and the use of the tool is optional. | To help support your organization's efforts to identify full-time eligibility under the ACA for your employee population; and, to facilitate the generation of data for Forms 1095-C and 1094-C reporting. |

| Is the Health Care Measurement tool a compliance tool? | Avoid using the Health Care Measurement tool as a compliance tool. | The Health Care Measurement tool was not designed to be a compliance tool. Consult with your employer's compliance advisor to ensure your organization is meeting ACA reporting requirements. |

Enable Web Access Rights to Health Care Eligibility and Measurement Groups

System administrators must enable web access rights to health care eligibility and measurement groups in role administration for each role. Depending on the role, access can be assigned to view, edit, add, or delete eligibility periods and measurement groups. Access to add and delete groups of employees from health care measurement groups can only be assigned to the employee administrator role.

Enable Web Access Rights to the Health Care Measurement Groups Business Rule

Prior to configuring health care measurement groups, system administrators must enable web access rights to View and Edit the Health Care Measurement Groups business rule.

- From the Business Rules Access Rights page, locate the Health Care Measurement Groups business rule.

- From the Health Care Measurement Groups section, select the boxes in the View and Edit columns.

- Select Save.

Configure Health Care Measurement Groups

Health Care Measurement Groups are configured in the UKG Pro solution and use built-in ACA features to help employers identify employees that meet full-time eligibility requirements. Measurement groups track all service hours for assigned employees. It is important to properly configure the solution and maintain employee data so it is current to obtain accurate hours of service measurements.

After health care measurement groups are configured, managers and administrators can assign employees to the applicable group and view their health care eligibility.

Create health care measurement groups that use different period durations or different start and end dates, if needed. For eligibility measurement, include variable-hour, part-time and seasonal employees and consider including them in the following example categories:

- Part-time/variable salaried employees

- Part-time/variable hourly employees

- Employees located in different states

- Collectively bargained or non-collectively bargained employees (unions)

- Collectively bargained employees covered by separate contracts (unions)

Keep in mind that for each measurement group, new hire and ongoing employees are measured differently. Once your health care measurement groups are configured, they can be assigned to employees.

Change Health Care Measurement Groups

You have the option to change the health care measurement group for an employee.

Add Employees to Health Care Measurement Groups

Assign employees to a health care measurement group using the Add Employees page. Administrators can mass assign employees by employee type, including terminated employees.

Once assigned, a nightly job runs to calculate average hours worked for all employees assigned to health care measurement groups, as of the measurement date. Payroll must be completely processed for employees when added to the measurement group. Payroll history records are referenced as part of the calculation. If this condition is not met, average hours are not processed. When a measurement period (standard or new hire) completes, eligibility is determined and displayed for assigned employees.

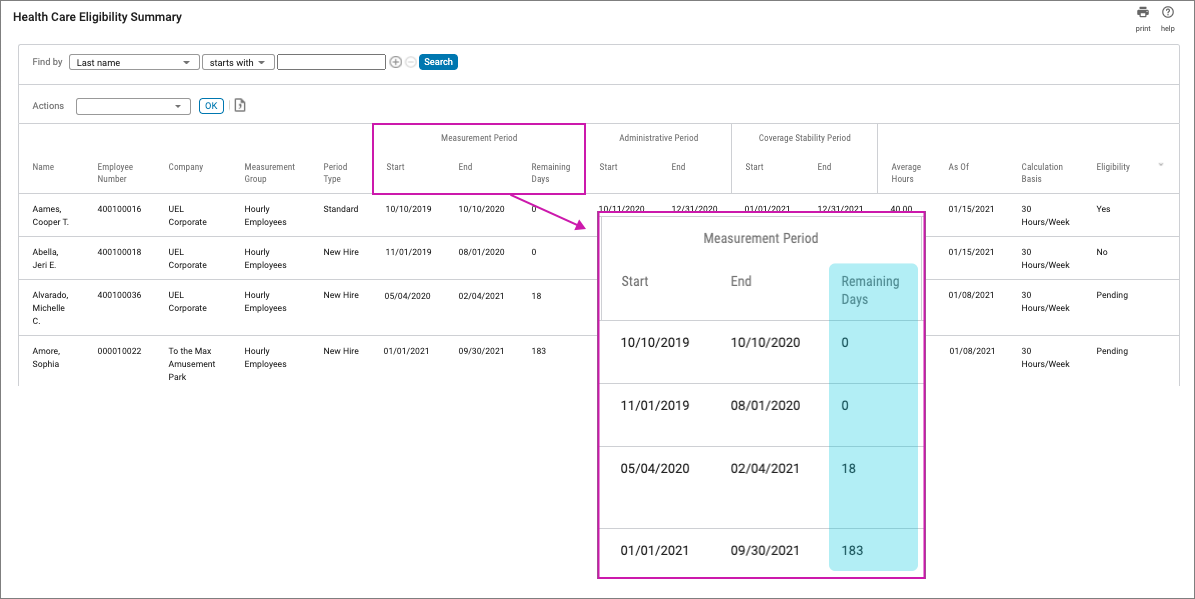

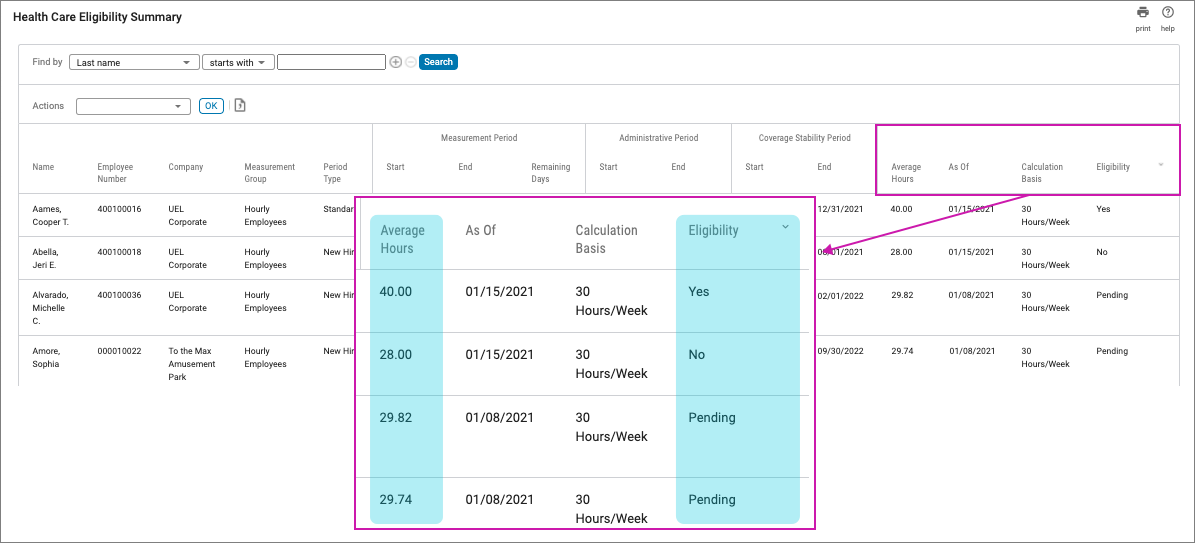

Health Care Eligibility Summary

The Affordable Care Act (ACA) specifies that employers must provide full-time employees the option to enroll in employer-sponsored benefits. The Health Care Measurement Group tool can help employers decide which employees should be offered health coverage at the end of their measurement period. We also recommend that employers use additional tools to assist in making these decisions for their organizations.

View health care eligibility information for employees on the Health Care Eligibility Summary page, which includes the following features:

- Enables managers and employee administrators a way to easily track the average hours worked by their part-time or seasonal employees, in real-time.

- Provides benefits administrators a quick view of all employees that are trending as eligible for health care coverage.

- Provides access to a summary of the different eligibility periods (including stability periods) in a downloadable file (CSV) with sort and filter options to find groups or individual employees.

Use the Health Care Eligibility Summary page (also called dashboard) to view up-to-date average hours worked for each employee. Employees whose measurement period is near completion appear on the top of the dashboard. The information on this page enables you to identify those employees who need to be addressed sooner than others.

Sort and filter on average hours and eligibility status for more defined information.

A separate full-time status analysis through the look-back method is completed for new employees versus ongoing employees. The measurement period that an employer chooses to apply for new employees is referred to as the "new hire" measurement period; the measurement period for ongoing employees is referred to as the “standard” measurement period. Ongoing employees are those employees who have worked for the employer through at least one measurement period.

The Internal Revenue Service (IRS) requires new hires to complete the full initial measurement period before they can be eligible in a standard stability period. Employees hired soon after the standard measurement period has begun may be assigned to both an initial measurement period and a standard measurement period simultaneously, which may cause an overlap in stability periods. If this overlap occurs, the health care measurement tool prioritizes the initial stability period over the standard stability period when determining health care eligibility, OE/LE eligibility, and ACA reporting of the 1095-C codes.

Employers can download the current view of the Health Care Eligibility Summary page in an Excel file (CSV) by selecting the "Export to CSV" from the Actions drop-down menu. Select OK and the file immediately downloads to the computer.

- In cases where employees are ineligible during the initial stability period but eligible during the standard stability period, priority is updated to reflect the standard stability period.

- When employees have a gap between the initial stability period and the standard stability period, the treatment as a full-time employee or not full-time employee that applies during the initial stability period continues to apply until the beginning of the standard stability period. The health care measurement tool automatically extends the initial stability period end date to meet the standard stability start date.

Remove a Health Care Measurement Group Assignment

Remove an employee from a health care measurement group assignment on the Assigned Employees page.

- From the Health Care Measurement Groups page, select the Assigned Employees link for the applicable measurement group.

- The Assigned Employees page for that measurement group appears. From the Assigned Employees page, select the applicable employees. The Remove button becomes enabled.

- Select the Remove button. A delete confirmation pop-up window appears.

- Select OK. The employee is no longer assigned to the health care measurement group.

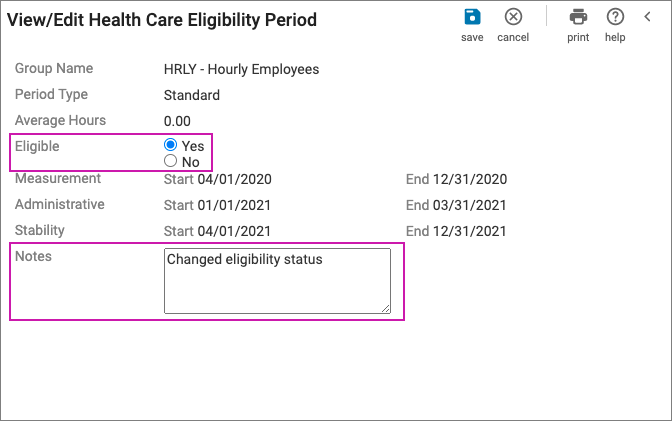

Change Employee Health Care Eligibility Period

Change health care eligibility period information for employees using the View/Edit Health Care Eligibility Period page.

When eligibility is Yes or No (and not Pending), you can override eligibility status from Yes to No or No to Yes.

Retro-Calculate Health Care Measurement Groups with Closed Measurement Periods

When active or terminated employees are added to a closed health care measurement group, use the retro-calculate tool to determine health care eligibility.

Since payroll history records are referenced as part of the calculation, payroll processing must be completed for employees before submitting a retro-calc request. Terminated employees must have a job history to be added to a closed measurement period. After a retro-calc request is submitted, a nightly job runs to retro-calculate average hours worked for all newly added employees based on the dates defined by the closed measurement period. An updated health care eligibility status is provided the next day.

Assign Employees to Health Care Measurement Groups during Hire, Rehire, or Transfer

Assign employees to a health care measurement group using the Jobs/Payroll page available from the hire, rehire, or transfer work event.

The field is optional, by default; however, by using the Platform Configuration feature, administrators can make this field required or hidden, if needed.

- From the Jobs/Payroll page, select the Health Care Measurement Group drop-down menu.

- Select the Health Care Measurement Group.

Run the Employee Total and Average Hours Report to Monitor Health Care Eligibility

The Employee Total and Average Hours report provides detailed employee-level data for employees in all United States-based component companies to assist with monitoring monthly hours, health care measurement group assignments, and historical health care measurement group data.

- At the Employee Monthly Hours and Health Care Measurement Group Data prompt page, enter the four-digit PPACA reporting year you want to review.

- Select Finish at the bottom of the page to run the report.

© 2022 UKG Inc. All rights reserved.

For a full list of UKG trademarks, visit www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG Inc. (“UKG”). Information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. Nothing herein constitutes legal advice, tax advice, or any other advice. All legal or tax questions or concerns should be directed to your legal counsel or tax consultant.

Liability/Disclaimer

UKG makes no representation or warranties with respect to the accuracy or completeness of the document or its content and specifically disclaims any responsibility or representation for other vendors’ software. The terms and conditions of your agreement with us regarding the software or services provided by us, which is the subject of the documentation contained herein, govern this document or content. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.

Links to Other Materials: The linked sites and embedded links are not under the control of UKG. We reserve the right to terminate any link or linking program at any time. UKG does not endorse companies or products to which it links. If you decide to access any of the third-party sites linked to the site, you do so entirely at your own risk.