Form 1095-C Auto-Population Flow Diagram

Form 1095-C Auto-Population Process Flow

The UKG ProACA Manager solution offers employers the ability to automatically populate an employee's Form 1095-C using the data stored in the system. Once configured to do so, the system updates the Offer and Coverage page on the employee record automatically.

Auto-Population of Form 1095-C aggregates hours across all companies associated to an Applicable Large Employer (ALE). An Applicable Large Employer is any company or organization that has an average of at least 50 full-time employees or "full-time equivalents" or "FTE." For the purposes of the Affordable Care Act, a full-time employee is someone who works at least 30 hours a week.

For purposes of the reporting requirements under section 6056, an ALE member is any person that is an applicable large employer or a member of an aggregated group (determined under section 414(b), 414(c), 414(m) or 414(o)) that is determined to be an applicable large employer. An Aggregated Applicable Large Employer (AALE) refers to a group of affiliated entities that are under common control, for example: parent and subsidiary.

For employees who have worked for multiple component companies within the same ALE member, the following employee details are aggregated at an ALE level:

- ACA eligible Hours (Only applies when using the Monthly Measurement determination.)

- Employee Status

- Offers of Coverage (The best offer of coverage across the ALE is reported.)

- Employee Share of Lowest Cost (The lowest share of employee cost across the ALE is reported.)

- Wages or Salary (Aggregate W-2 wages and hourly or annual salaries across an ALE are reported.)

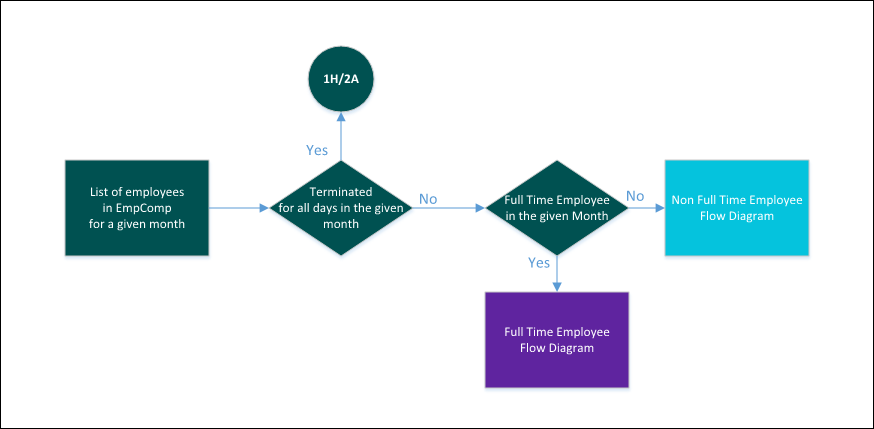

To automatically populate an employee's Form 1095-C, the ACA Manager tool must first determine if the employee is active or terminated as of the last day of the month. Employees terminated for all days of the given month are automatically assigned a code of 1H. All other employees, both active and on leave of absence, are evaluated to determine full time eligibility. Depending on whether the employee is full time or not, the ACA Manager tool processes system data using a logical series of questions to arrive at the appropriate codes for the completion of Form 1095-C.

How UKG Pro ACA Manager Determines Full Time Health Care Eligibility Status for Employees

UKG Pro ACA Manager calculates full time health care eligibility status for your employees under the ACA legislative requirement. This calculation is completed for each month of the calendar year based on the available system data.

ACA Manager provides three methods to determine full time status:

- Administrator Override

The solution enables administrators to designate an employee as full-time for ACA reporting.

- Aggregated Hours based on Payroll Earnings

The solution uses payroll history and earnings codes to calculate average hours worked.

(For more information, refer to the Designate Earnings for Inclusion in PPACA Calculation job aid)

- Status of Eligible based on Health Care Eligibility Tool

The solution uses the stability period status for employees assigned to a measurement group.

Use Aggregated Hours to Determine Full Time Eligibility

UKG Pro ACA Manager calculates average hours worked based on payroll history and earnings codes to determine full time eligibility. ACA Manager references all earnings for each pay period in a given month.

Earnings marked for inclusion in Health Care Eligibility are aggregated into the total hours per month. Employee hours are aggregated across all companies associated to an Applicable Large Employer (ALE). This method is used for employees that are not assigned to a measurement group.

- Employee is full time when aggregated hours are greater than or equal to 130 hours per month.

- Employee is not full time when aggregated hours are less than 130 hours per month.

Ensure earnings code(s) are configured for applicable hours of service, each hour an employee is paid, or entitled to payment (vacation, holiday, illness, jury duty, etc.). For a complete description and additional information on which types of earnings should be included, refer to the Identification of Full-Time Employees section on the IRS website.

Offer of Coverage codes and amounts are calculated on a monthly basis. To ensure the most accurate determination, it is best to generate the data after the pay date of the pay period that includes the last day of the previous month. For example, if an employee's pay period that includes December 31st runs from December 24th – January 6th with a paycheck date of January 13th, then it is best to generate on or after January 13th to see accurate codes for the month of December.

When a pay period overlaps two months, the system prorates the percentage of the pay period that is in the month. For example, an employee who works 35 hours in a pay period that begins on March 25th and ends April 8th, would have 6 of the 14 days in the pay period count toward March. The system calculates 42.9% of the 35 hours in the pay period and applies 15 hours to the total hours for March. The remaining 20 hours are included in the total hours for April.

If you are using a calculation rule for your earnings that equals Flat Amount or Pay Period, the solution will NOT have a record of the hours in order to determine full time eligibility. This affects your ability to use the auto-population feature. You can still generate Form 1095-C, but you will have to import your data.

Use Health Care Measurement Tool to Determine Full Time Eligibility

Employees assigned to a measurement group are evaluated based on the stability period status for the given month. This status determines whether the employee meets the legislative definition.

- Employee assigned to a measurement group is full time when the stability period status for the given month is "Eligible".

- Employee assigned to a measurement group is not full time when the stability period status for the given month is "Ineligible" or "Pending".

Employees must be in a stability period with an Eligible status to be considered full time for health care eligibility. Employees who are in an initial measurement or administration period are automatically placed in a Pending status with a non-full time status.

Determine Full Time Status

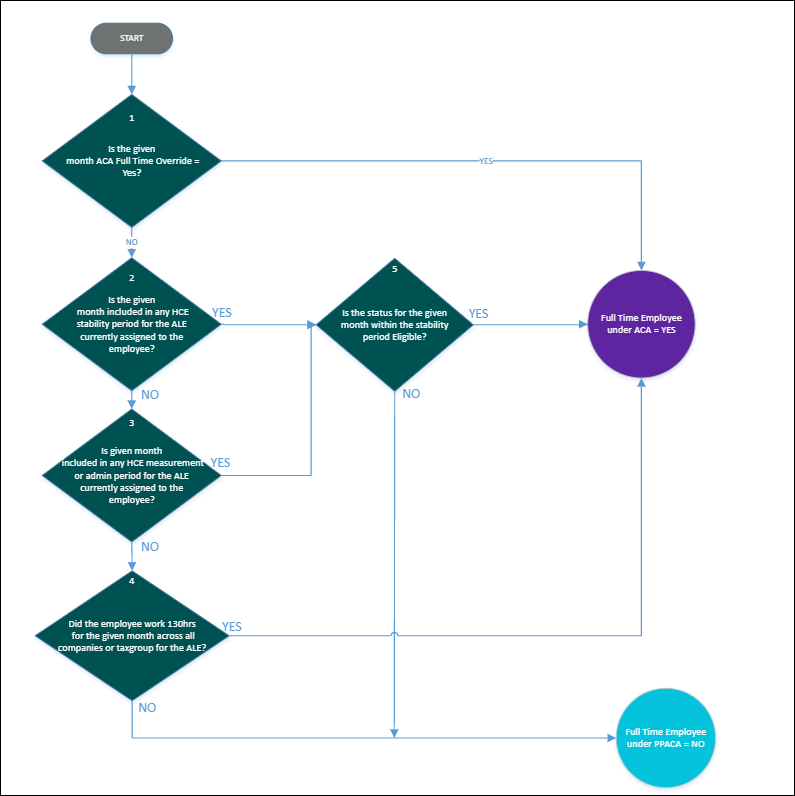

When determining full time eligibility, for each month during the reporting year, ACA Manager processes system data using a logical series of questions and answers (Yes or No) as shown in the diagram. Benefits Administrators can override the system logic within ACA Manager.

| Process Step/Decision Point | Information Used to Make Determination | Applicable Safe Harbor Code |

|---|---|---|

| 1. Is the given month ACA Full Time Override set to Yes? | Administrator has manually set the ACA Full Time override to Yes for the given month for the employee. | If No, continue with #2 in flow for determination. If Yes, employee is full time. |

| 2. Is the given month included in any HCE stability period currently assigned to the employee? | Employee is assigned to a health care measurement group. Given month falls within the coverage stability start and end dates for the employee's health care measurement group. From employee record > Benefits > Health Care Eligibility |

If No, continue with #3 in flow for determination. If Yes, continue with #5 in flow for determination |

| 3. Is given month included in any HCE measurement or administrative period currently assigned to the employee? | Given month falls within the initial measurement or administrative period start and end dates for the employee's health care measurement group. | If No, continue with #4 in flow for determination. If Yes, employee is not considered full time under ACA. |

| 4. Did the employee work 130 hours for the given month? | Aggregated hours for the given month. ACA Manager looks at all earnings for each pay period in a given month. Earnings marked for inclusion in Health Care Eligibility (HCE) are aggregated into the total hours per month. |

If No, employee is not considered full time under

ACA. If Yes, employee is full time under ACA. |

| 5. Is the status for the given month within the stability period ELIGIBLE? | Stability period status for the given month. | If No, employee is not considered full time under

ACA. If Yes, employee is full time under ACA. |

Once the Full Time or not Full Time determination is made, other data is evaluated to arrive at the appropriate codes for populating the employee's Form 1095-C.

Determine Offer and Coverage Code - Full-Time Employee

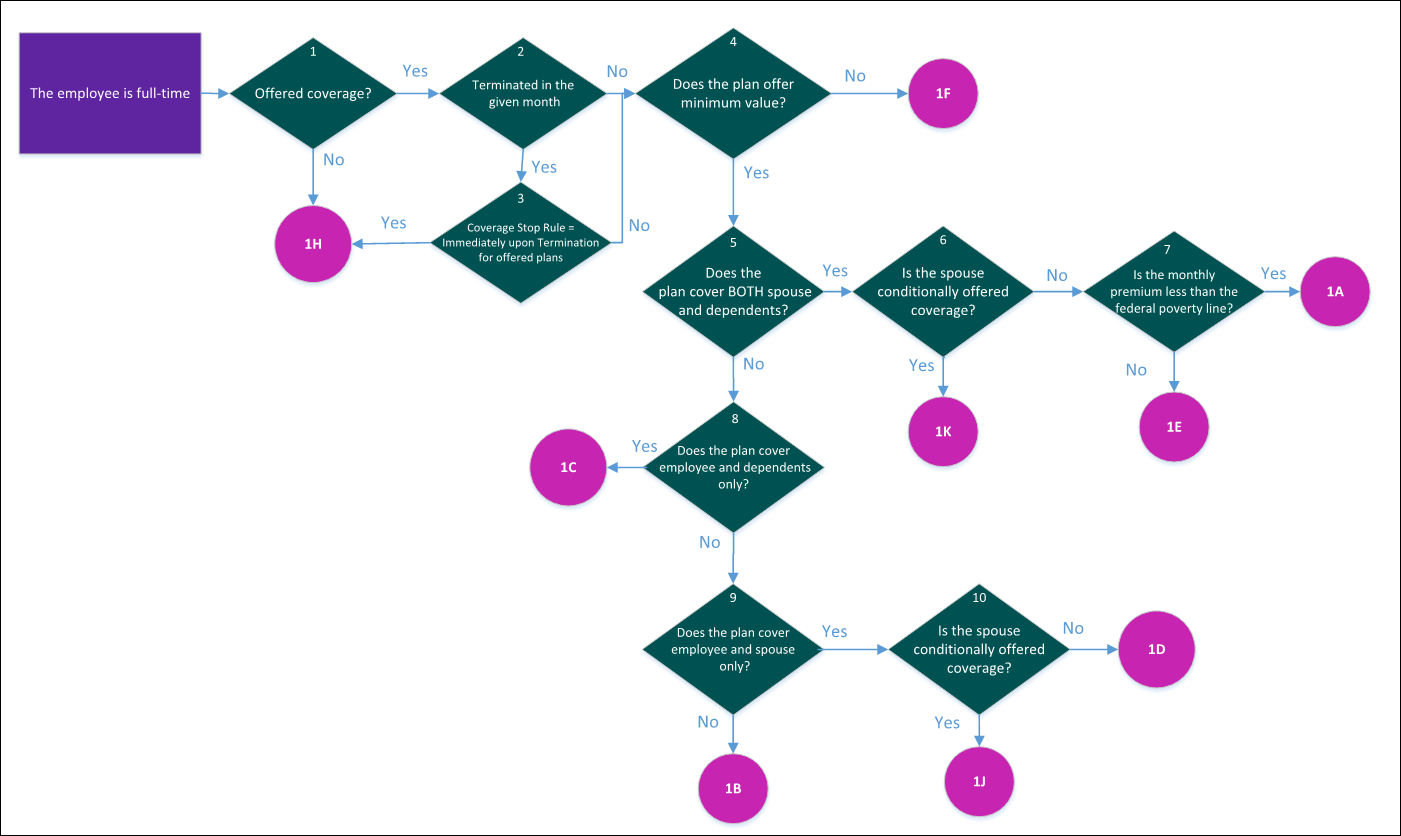

When determining which code to populate in the Offer and Coverage section, Line 14, for each month during the reporting year, the UKG ProACA Manager tool processes system data using a logical series of questions and answers (Yes or No) as shown in the diagram.

| Process Step/Decision Point | Information Used to Make Determination | Applicable Offer and Coverage Code |

|---|---|---|

| 1. Was coverage offered? | Employee is assigned to a deduction/benefit group as of the last day of the month which has been configured with at least one ACA reportable plan. | If No, code is 1H. If Yes, continue with flow for determination. |

| 2. Was the employee terminated in the given month? | Employment status is changed to "Terminated" during the given month. Employee

termination date is prior, or equal, to the last day of the month. For multi-company employees, status is Terminated in all companies. |

If No, skip to #4 to continue with flow for determination. If Yes, continue with #3 in flow for determination. |

| 3. Is the Coverage Stop Rule equal to Immediately Upon Termination for offered plans? | Coverage stop rule configured for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, continue with flow for determination. If Yes, code is 1H. |

| 4. Does the plan offer minimum value? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, code is 1F. If Yes, continue with flow for determination. |

| 5. Does the plan cover BOTH spouse and dependents? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, skip to #8 in flow for determination. If Yes, continue with #6 in flow for determination. |

| 6. Is the spouse conditionally offered coverage? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, continue with #7 in flow for determination. If Yes, code is 1K. |

| 7. Is the monthly premium less than the federal poverty line? | Employee-only level contribution for the offered plan. If the amount is lower than or equal to 1/12 of the healthcare affordability index* applied to the US published single federal poverty level, then the plan is considered affordable. | If No, code is 1E. If Yes, code is 1A. |

| 8. Does the plan cover employee and dependents only? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, continue with flow for determination. If Yes, code is 1C. |

| 9. Does the plan cover employee and spouse only? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, code is 1B. If Yes, continue with flow for determination. |

| 10. Is the spouse conditionally offered coverage? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, code is 1D. If Yes, code is 1J. |

*Healthcare affordability index is a percentage used to calculate the affordability safe harbor codes for Form 1095-C. The index is applied to one of the following safe harbors to determine whether or not offered healthcare coverage was affordable for the employee: (1) Federal poverty line; (2) employee's rate of pay; or (3) employee's Form W2, Box 1 Wages. The healthcare affordability index is determined by the IRS and indexed to inflation.

Determine Offer and Coverage Code - Not Full-Time Employee

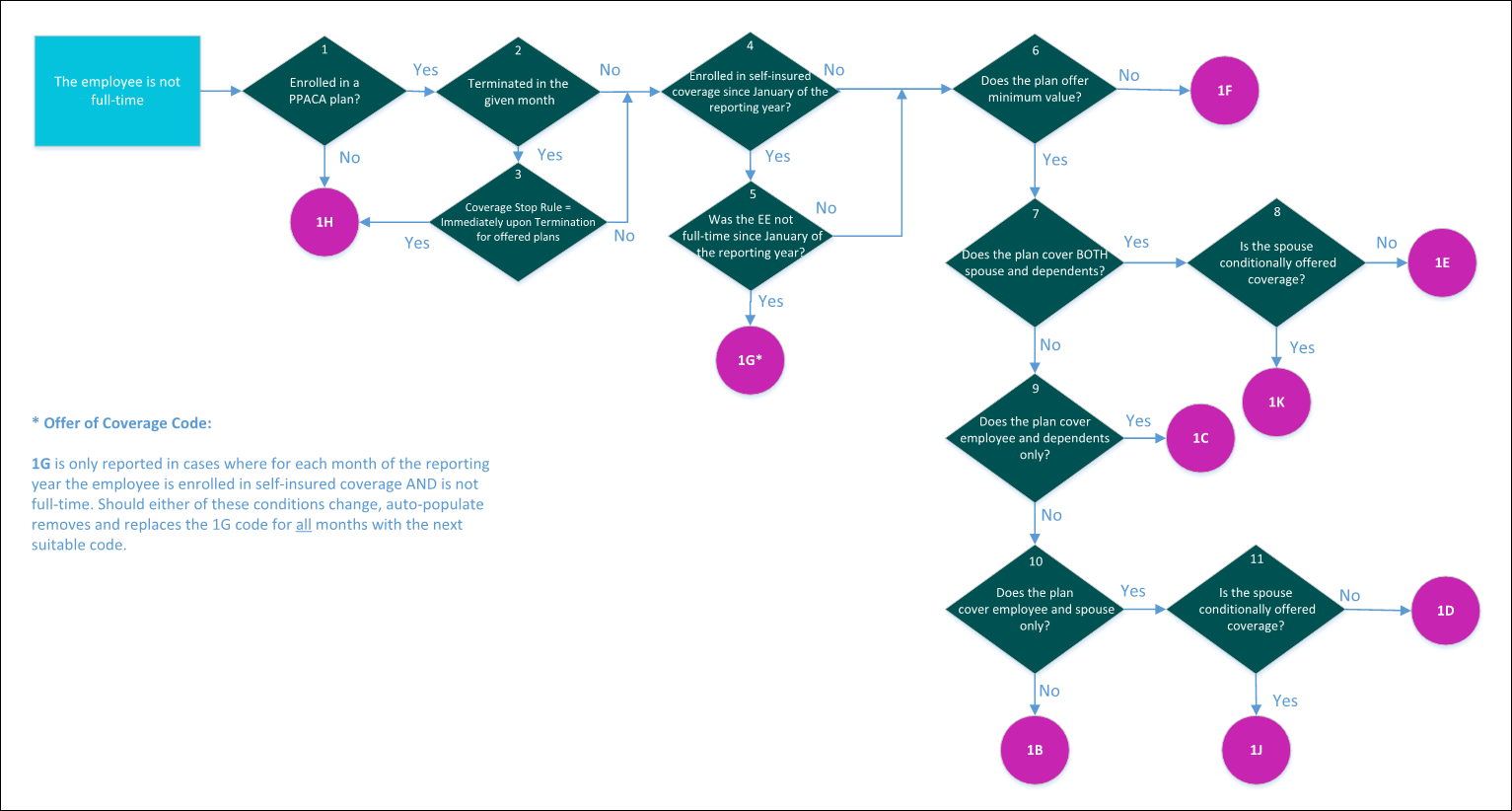

When determining which code to populate in the Offer and Coverage section, Line 14, for each month during the reporting year, the UKG ProACA Manager tool processes system data using a logical series of questions and answers (Yes or No) as shown in the diagram.

| Process Step/Decision Point | Information Used to Make Determination | Applicable Offer and Coverage Code |

|---|---|---|

| 1. Was coverage offered? | Employee is assigned to a deduction/benefit group as of the last day of the month which has been configured with at least one ACA reportable plan. | If No, code is 1H. If Yes, continue with flow for determination. |

| 2. Was the employee terminated in the given month? | Employment status is changed to "Terminated" during the given month. Employee

termination date is prior, or equal, to the last day of the month. For multi-company employees, status is Terminated in all companies. |

If No, skip to #4 to continue with flow for determination. If Yes, continue #3 in flow for determination. |

| 3. Is the Coverage Stop Rule equal to Immediately Upon Termination for offered plans? | Coverage stop rule configured for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, continue with flow for determination. If Yes, code is 1H. |

| 4. Was the employee enrolled in self-insured coverage since January of the reporting year? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, skip to #6 in flow for determination. If Yes, continue with #5 in flow for determination. |

| 5. Was the employee not full-time since January of the reporting year? | Employee is assigned to a measurement group and the stability period status is Ineligible in the given year; Or Employee is not assigned to a measurement group and their aggregated hours are less than 130 hours for any month in the given year. |

If No, continue with flow for determination. If Yes, code is 1G. |

| 6. Does the plan offer minimum value? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, code is 1F. If Yes, continue with flow for determination. |

| 7. Does the plan cover BOTH spouse and dependents? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, skip to #9 in flow for determination. If Yes, continue with #8 in flow for determination. |

| 8. Is the spouse conditionally offered coverage? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, code is 1E. If Yes, code is 1K. |

| 9. Does the plan cover employee and dependents only? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, continue with flow for determination. If Yes, code is 1C. |

| 10. Does the plan cover employee and spouse only? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, code is 1B. If Yes, continue with flow for determination. |

| 11. Is the spouse conditionally offered coverage? | PPACA Reporting configuration setting for the deduction/benefit plan. (Menu > System Configuration > Business Rules > Deduction/Benefit Plan) |

If No, code is 1D. If Yes, code is 1J. |

Offer and Coverage Codes

Depending on conditions that apply to offer of coverage codes, certain action may be required.

There are different conditions that apply to these offer of coverage codes, as follows:

| Code | Description | Required Action |

|---|---|---|

| 1G | This code is available through auto-population. It is only reported in cases where for each month of the reporting year the employee is enrolled in self-insured coverage AND is not full-time. Should either of these conditions change, auto-populate removes and replaces the 1G code for all months with the next suitable code. | Employer to be aware that this code may change should conditions no longer apply. |

| 1J and 1K | This code is available through auto-population for the 2016 reporting year. | Employer can monitor and review this code for conditional offers of coverage, when applicable. |

Multiple ACA Reportable Plans and Auto-Populated Codes

Employees who are full-time and non full-time may be assigned to a Deduction/Benefit Group that contains multiple ACA reportable plans.

In cases where employees have a choice of ACA plans for a given month, auto-population compares all offered plans and ranks the offer of coverage codes across plans. The code that ranks the highest is auto-populated. This code is derived from the best offered plan in the Deduction/Benefit Group to which employees are assigned, regardless of plans that employees elect. Refer to the table for the rank order of auto-populated codes for Line 14.

| Rank Order | Full-time Employee | Non Full-time Employee |

|---|---|---|

| 1 | 1A | 1G |

| 2 | 1E | 1E |

| 3 | 1K | 1K |

| 4 | 1C | 1C |

| 5 | 1F | 1F |

| 6 | 1D | 1D |

| 7 | 1J | 1J |

| 8 | 1B | 1B |

| 9 | 1H | 1H |

ACA Administrators must validate auto-populated codes prior to finalizing final Forms 1095-C.

Determine Employee Required Contribution

An amount representing the Employee Required Contribution must be reported for each month on Line 15 when the Offer and Coverage code is either 1B, 1C, 1D, 1E, 1J, or 1K.

UKG Pro ACA Manager compares the offered plans in the employee's deduction/benefit group and reports the lowest amount. The amount populated may or may not represent the employee's actual contribution.

Example: A full time employee is offered two ACA qualifying medical plans and enrolls in the Employee + Spouse option for Medical Plan B. Based on the employee's enrollment, the monthly premium contribution is $100.00. The solution compares the amount entered in the Employee share of self-only monthly premium field within the PPACA Reporting section of the Deduction/Benefit plan and reports $40.00 on Form 1095-C, which represents the lowest value among the plans offered in the Deduction/Benefit group.

| Option | Medical Plan A | Medical Plan B |

|---|---|---|

| Employee Only | $40.00 | $50.00 |

| Employee + Spouse | $80.00 | $100.00 |

| Employee + Family | $100.00 | $120.00 |

For multi-company employees, the ACA Manager tool reviews all of the ACA-related deduction/benefit plans assigned to the employee as of the last day of the month across all active companies within the employee-ALE combination, and reports the Employee's share of Lowest Cost for an ALE.

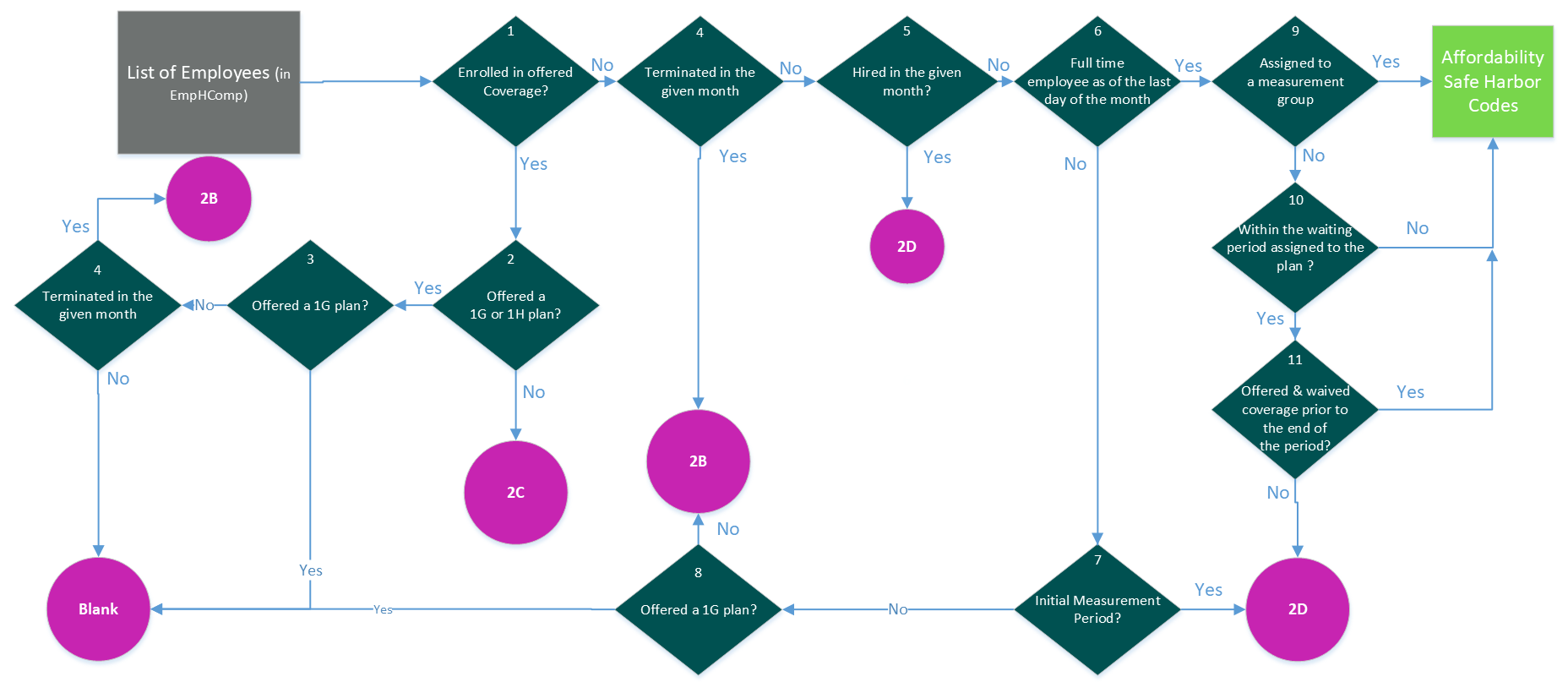

Determine Safe Harbor Codes not related to Affordability

When determining which code to populate in the Safe Harbor Codes (not related to Affordability) section, Line 16, for each month during the reporting year, the UKG ProACA Manager solution processes system data using a logical series of questions and answers (Yes or No) as shown in the diagram.

When an employee's employment status is terminated for all days of the month with the ALE, the ACA Manager tool automatically populates 1H/2A.

| Process Step/Decision Point | Information Used to Make Determination | Applicable Safe Harbor Code |

|---|---|---|

| 1. Enrolled in offered coverage? | Employee's benefits enrollment status is Active in a ACA reportable plan for each day of the given month with the ALE. | If No, skip to #4 in flow for determination. If Yes, continue with #2 in flow for determination. |

| 2. Offered a 1G or 1H plan? | Code determined to populate Line 14. | If No, code is 2C. If Yes, continue with flow for determination. |

| 3. Offered a 1G plan? | Code determined to populate Line 14. | If No, continue to 4. If Yes, code is left blank. |

| 4. Was the employee terminated in the given month? | Employment status is changed to "Terminated" during the given month. Employee

termination date is prior, or equal to the last day of the month. For multi-company employees, status is Terminated in all companies. | If No, field is left blank. If Yes, code is 2B. |

| 5. Was the employee terminated in the given month (and not enrolled in offered coverage)? | Employment status is changed to "Terminated" during the given month. Employee

termination date is prior, or equal to the last day of the month. For multi-company employees, status is Terminated in all companies. | If No, continue with flow for determination. If Yes, code is 2B. |

| 6. Was the employee hired in the given month? | Employment hire date is between the first and last day of the month. Not applicable for multi-company employees hired within the same ALE. | If No, continue with flow for determination. If yes, code is 2D. |

| 7. Full Time Employee as of the last day of the month? | Employment status is Active on the last day of the given month, and

| If No, continue with flow for determination. If Yes, skip to #8 in flow for determination. |

| 8. Initial Measurement Period? | When using the Health Care Eligibility (HCE) Measurement tool, the given month is within the employee's initial measurement period. | If No, code is 2B. If Yes, code is 2D. |

| 9. Offered a 1G plan? | Code determined to populate Line 14. | If No, code is 2B. If Yes, code is left blank. |

| 10. Assigned to a measurement group? | Employee is assigned to a HCE measurement group. | If No, continue with flow for determination. If Yes, continue with process flow for Affordability Safe Harbor Codes. |

| 11. Within the waiting period assigned to the plan? | Given month is within the waiting period assigned to the plan. | If No, continue with process flow for Affordability Safe Harbor Codes. If Yes, continue with flow for determination. |

| 12. Offered and waived coverage prior to the end of the period? | Employee's benefits enrollment status is Waived in an ACA reportable plan for each day of the given month with the ALE. | If No, code is 2D. If Yes, continue with process flow for Affordability Safe Harbor Codes. |

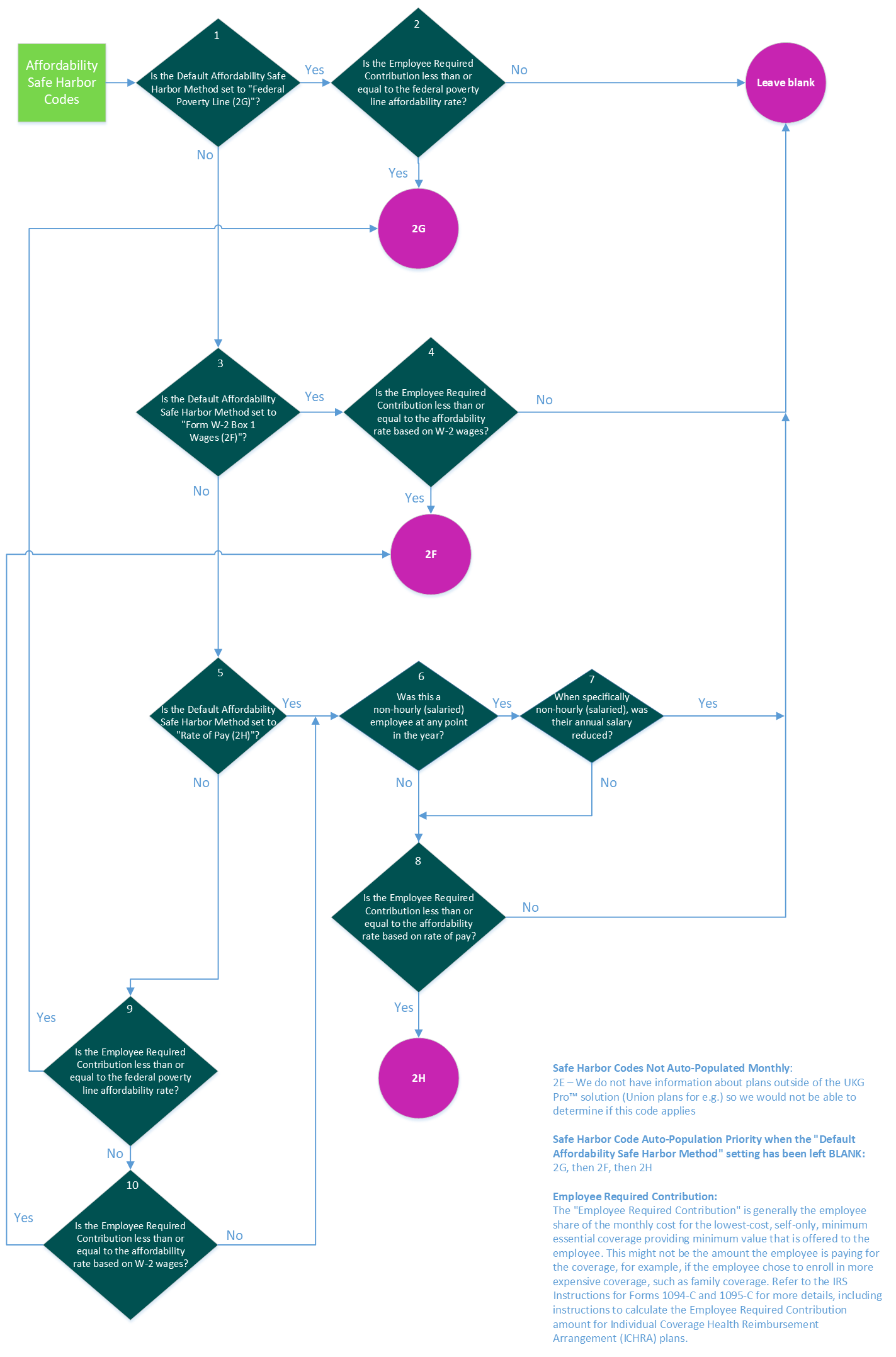

Determine Affordability Safe Harbor Codes

When determining which code to populate in the Safe Harbor Codes (related to Affordability) section, Line 16, for each month during the reporting year, the UKG ProACA Manager solution processes system data using a logical series of questions and answers (Yes or No) as shown in the diagram. If desired, customers can leverage the optional "Default Affordability Safe Harbor Method" system setting in UKG Pro (Menu > System Configuration > System Settings > PPACA Reporting Settings) to ensure that only their selected Affordability Safe Harbor Code can be populated.

| Process Step/Decision Point | Information Used to Make Determination | Applicable Safe Harbor Code |

|---|---|---|

| 1. Is the Default Affordability Safe Harbor Method set to "Federal Poverty Line (2G)"? | Optional "Default Affordability Safe Harbor Method" setting (Menu > System Configuration > System Settings > PPACA Reporting Settings) | If No, skip to number 3 in the flow for determination. If Yes, continue with flow for determination. |

| 2. Is the Employee Required Contribution less than or equal to the federal poverty line affordability rate? | Lowest "Employee share of self-only monthly premium" amount across all plans offered to the employee. This amount is compared to 1/12 of the healthcare affordability index* applied to the US published single federal poverty level. | If No, leave blank. If Yes, code is 2G. |

| 3. Is the Default Affordability Safe Harbor Method set to "Form W-2 Box 1 Wages (2F)"? | Optional "Default Affordability Safe Harbor Method" setting (Menu > System Configuration > System Settings > PPACA Reporting Settings) | If No, skip to number 5 in the flow for determination. If Yes, continue with the flow for determination. |

| 4. Is the Employee Required Contribution less than or equal to the affordability rate based on W-2 wages? | Lowest "Employee share of self-only monthly premium" amount across all plans offered to the employee. This amount is compared to 1/12 of the healthcare affordability index* applied to the employee's W-2 Box 1 wages. For multi-company employees, the ACA Manager tool applies the total W-2 Box 1 wages. | If No, leave blank. If Yes, code is 2F. |

| 5. Is the Default Affordability Safe Harbor Method set to "Rate of Pay (2H)"? | Optional "Default Affordability Safe Harbor Method" setting (Menu > System Configuration > System Settings > PPACA Reporting Settings) | If No, skip to number 9 in the flow for determination. If Yes, continue with the flow for determination. |

| 6. Was this a non-hourly (salaried) employee at any point in the year? | Employee's job history indicates salaried compensation during the year. | If No, skip to number 8 in the flow for determination. If Yes, continue with the flow for determination. |

| 7. When specifically non-hourly (salaried), was their annual salary reduced? | Salary effective as of the start of the plan year is compared to the salary throughout the employee's job history during the year. | If No, continue with the flow for determination. If Yes, leave blank. |

| 8. Is the Employee Required Contribution less than or equal to the affordability rate based on rate of pay? | Lowest "Employee share of self-only monthly premium" amount across all plans offered to the employee. This amount is compared to 1/12 of the healthcare affordability index* applied to the employee's rate of pay. For multi-company employees, the ACA Manager tool applies the lowest rate of wages across the ALE Member. | If No, field is left blank. If Yes, code is 2H. |

| 9. Is the Employee Required Contribution less than or equal to the federal poverty line affordability rate? | Lowest "Employee share of self-only monthly premium" amount across all plans offered to the employee. This amount is compared to 1/12 of the healthcare affordability index* applied to the US published single federal poverty level. | If No, continue with the flow for determination. If Yes, code is 2G. |

| 10. Is the Employee Required Contribution less than or equal to the affordability rate based on W-2 wages? | Lowest "Employee share of self-only monthly premium" amount across all plans offered to the employee. This amount is compared to 1/12 of the healthcare affordability index* applied to the employee's W-2 Box 1 wages. For multi-company employees, the ACA Manager tool applies the total W-2 Box 1 wages. | If No, skip to #6 in the flow for determination. If Yes, code is 2F. |

*Healthcare affordability index is a percentage used to calculate the affordability safe harbor codes for Form 1095-C. The healthcare affordability index is determined by the IRS and indexed to inflation.

Offer and Coverage Codes not Automatically Populated

UKG Pro™ ACA Manager does not automatically populate Offer and Coverage codes for Individual Coverage Health Reimbursement Arrangements (HRA). The employer must make the determination and make changes on the employee’s Offer of Coverage page.

| Code | Description |

|---|---|

| 1L | Individual coverage HRA offered to employee only with affordability determined by using employee's primary residence location ZIP code. |

| 1M | Individual coverage HRA offered to employee and dependent(s) (not spouse) with affordability determined by using employee's primary residence location ZIP code. |

| 1N | Individual coverage HRA offered to employee, spouse, and dependent(s) with affordability determined by using employee's primary residence location Zip code. |

| 1O | Individual coverage HRA offered to employees only using the employee's primary employment site ZIP code affordability safe harbor. |

| 1P | Individual coverage HRA offered to employee and dependent(s) (not spouse) using the employee's primary employment site ZIP code affordability safe harbor. |

| 1Q | Individual coverage HRA offered to employee, spouse, and dependent(s) using employee’s primary employment site ZIP code affordability safe harbor. |

| 1R | Individual coverage HRA that is NOT affordable offered to employee; employee and spouse, or dependent(s); or employee, spouse and dependents. |

| 1S | Individual coverage HRA offered to an individual who was not a full-time employee. |

| 1T | Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee's primary residence location ZIP code. |

| 1U | Individual coverage HRA offered to employee and spouse (no dependents) using employee's primary employment site ZIP code affordability safe harbor. |

UKG Pro ACA Manager does not automatically populate two safe harbor codes: 2E and 2I.

| Code | Description | Required Action |

|---|---|---|

| 2E | Multiemployer interim rule relief. Enter code 2E for any month for which the multiemployer interim guidance applies for that employee. This relief is described under Offer of Health Coverage in the Definitions section of the IRS instructions. | Employer must make this determination for data not stored in the UKG Pro solution. If applicable, make change on employee Offer of Coverage page. |

| 2I | Reserved for future use. | None. |

© 2023 UKG Inc. All rights reserved. For a full list of UKG trademarks, visit https://www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners.

This document and all information contained herein are provided to you "AS IS" and UKG Inc. and its affiliates (collectively "UKG") make no representation or warranties with respect to the accuracy, reliability, or completeness of this document, and UKG specifically disclaims all warranties, including, but not limited to, implied warranties of merchantability and fitness for a particular purpose. The information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG. Nothing herein constitutes legal, tax, or other professional advice. All legal, tax, or other questions or concerns should be directed to your legal counsel, tax consultant, or other professional advisor. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.