Locations Guide

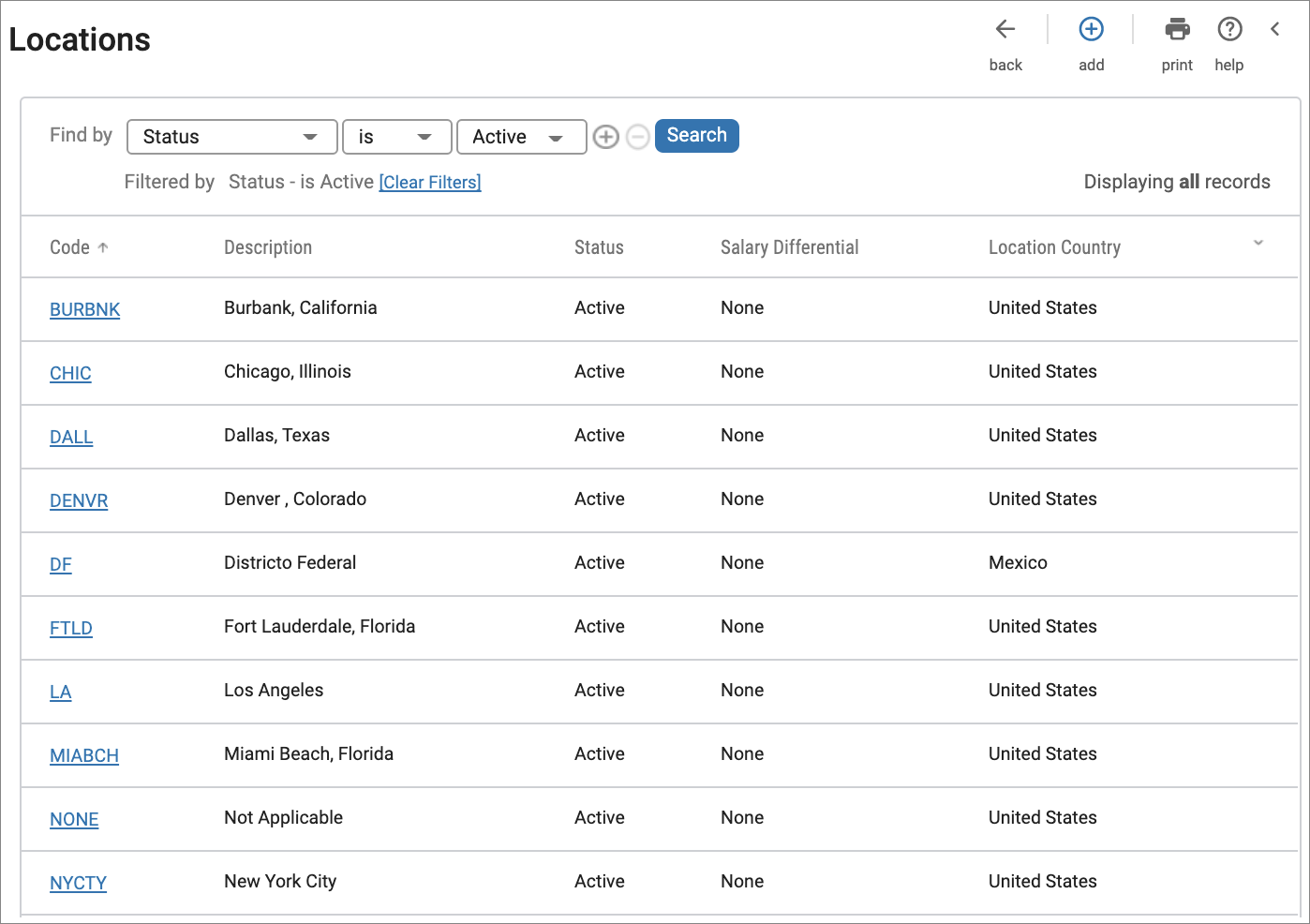

Locations

Location-Based Taxes

Your UKG Pro solution calculates taxes based on locations. With location-based taxes, a location is created and then associated with the applicable work-in state and local taxes based on that specific location.

When you assign the location code to an employee, those work-in state and local tax codes are automatically assigned to that employee. When you pay the employee for hours worked in that location, taxes are calculated based on the tax codes configured for that location.

Select Tax Locations , available in the UKG Video Gallery, for conceptual information about locations in UKG Pro Pay [View time 0:56 min:sec].

If the employee works in multiple locations in the same pay period, you can allocate the appropriate hours worked to each location. The employee's work-in state and local taxes are calculated separately for each location, based on the hours worked in each location.

Location-based taxes:

- Ensure that taxable wages accumulate by work-in jurisdiction.

- Ensure accurate taxation for your employees.

- Require that each location is assigned a state, county, resident, and non-resident tax, if applicable.

Jurisdictional Reciprocity

Many companies have employees who either work in multiple state or local tax jurisdictions or employees who work in one tax jurisdiction and reside in another.

Some tax jurisdictions have reciprocal agreements to avoid double taxation. Other tax jurisdictions require the full tax withholding from an employee’s resident jurisdiction regardless of whether taxes are withheld in another jurisdiction. Still other tax jurisdictions require the full tax withholding from the employee’s resident jurisdiction only if the work-in jurisdiction has no tax withholding requirements. Your UKG Pro solution correctly calculates the employee’s state and local taxable earnings and tax amounts based on applicable reciprocal agreements between the employee’s work-in and resident tax jurisdictions.

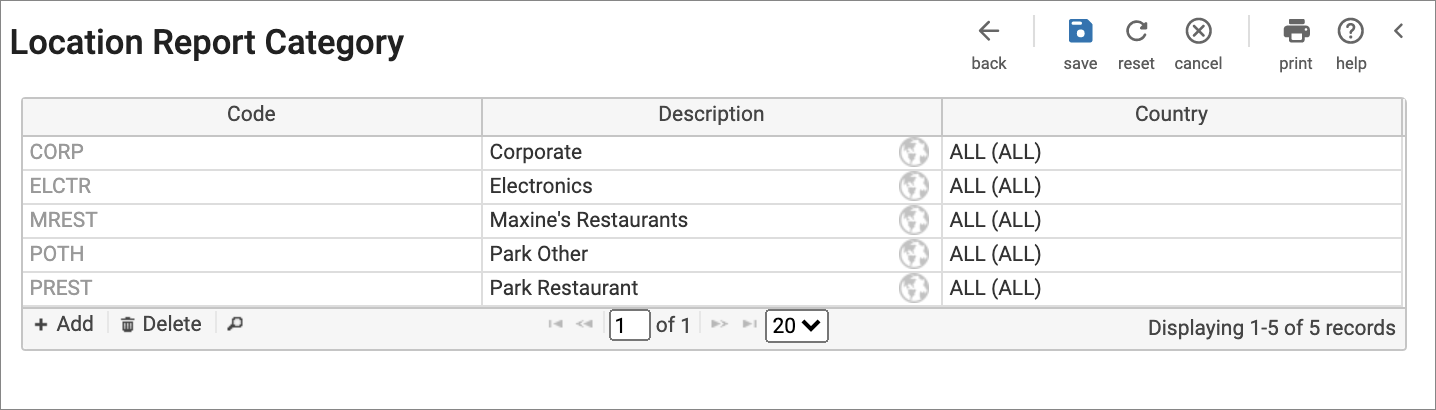

Location Report Category

Location Report Categories is an optional business rule that enables locations to be grouped for reporting purposes. Such groupings can be used to identify plants with different locations in the same city, or manufacturing versus distribution facilities.

Field Descriptions

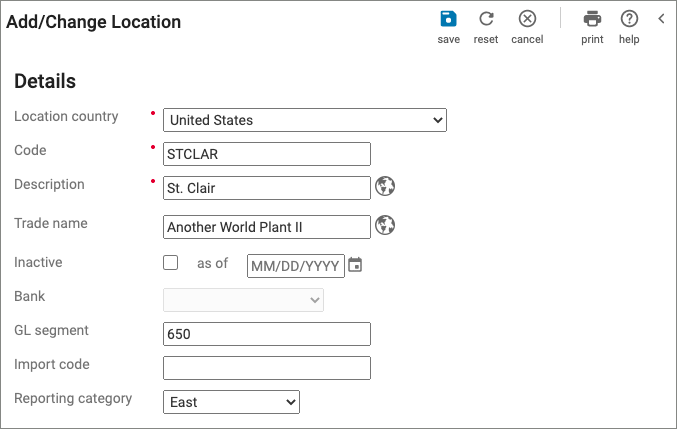

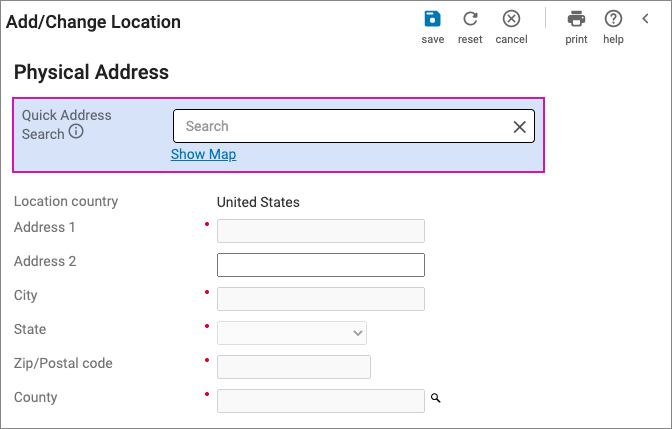

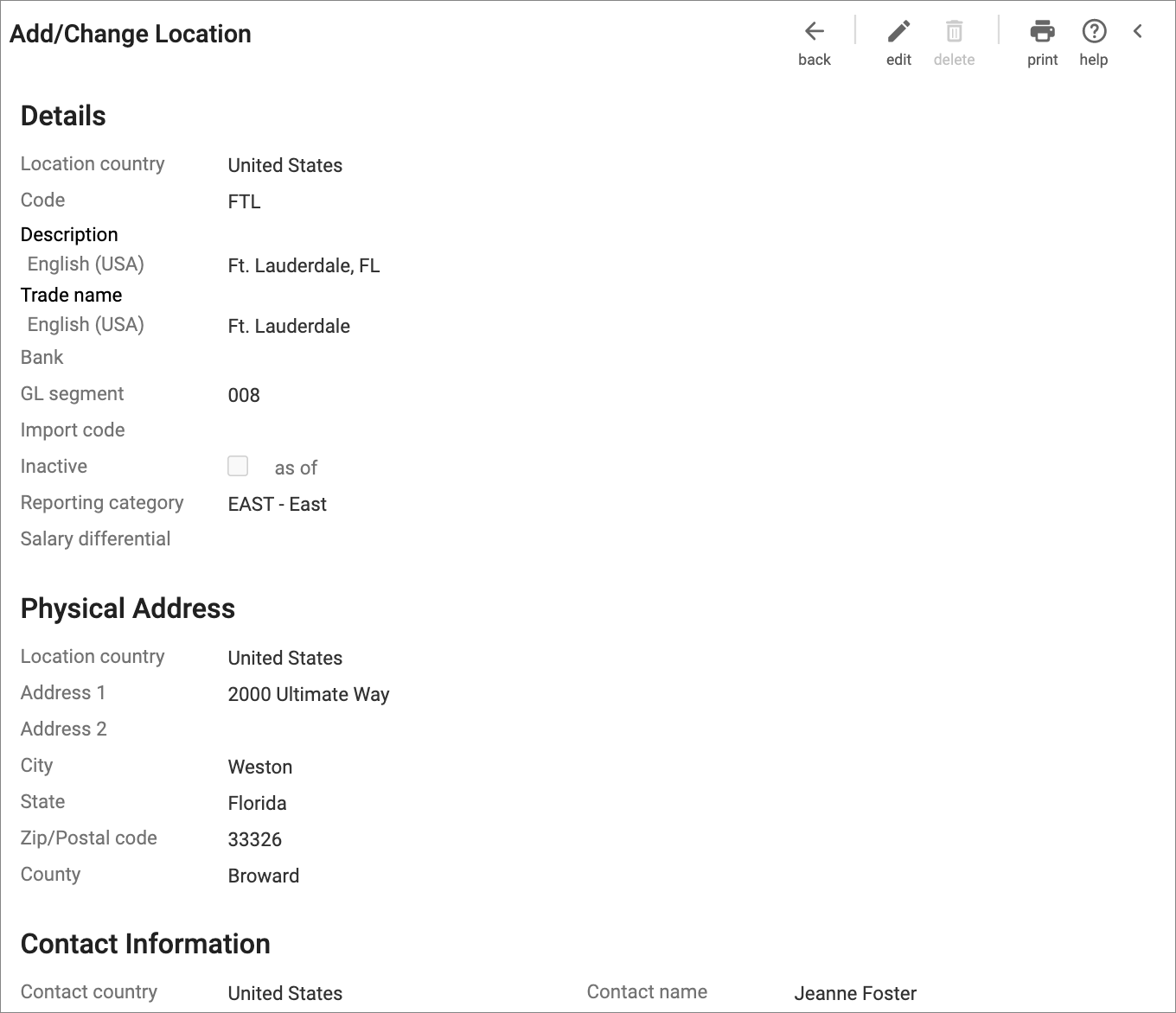

The Add/Change Locations page has several sections and fields to consider.

- Details

- Physical Address

- Contact Information

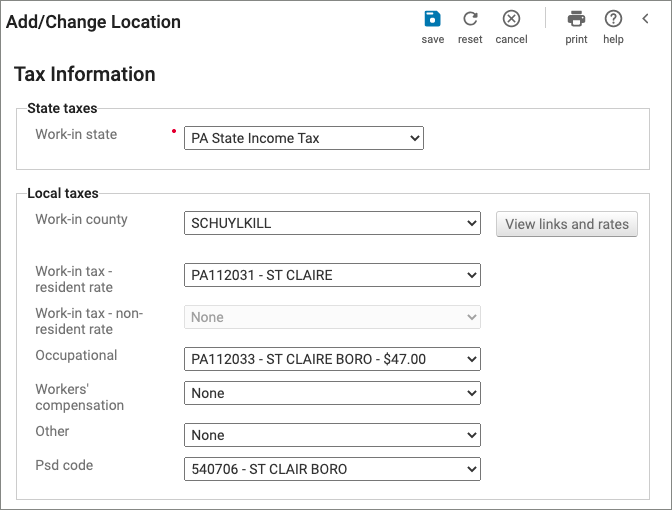

- Tax Information

- Reporting Information

The field names and descriptions used in the Locations business rule are listed in the following table:

| Field | Description |

|---|---|

| GL Segment | Used to designate the location as a general ledger cost center. This field defaults to the location code you entered in the Code field but can be modified. |

| Import Code | Used to specify a code you want to use when you import payroll information for this location. You can change the number by entering a new number over the existing value. |

| Reporting Category | Enables you to assign this location to a company location report category. |

| Worksite Reporting ID | Used if your company participates in the Multiple Worksite Report program. The program requires quarterly reporting of multiple worksite information. Multiple worksite reports are based on the worksite reporting identification number established for location codes. It is especially important for UKG Payment Services customers to enter the Worksite Reporting ID field. The worksite reporting ID is the Bureau of Labor Statistics (BLS) Reporting Unit Number (RUN) assigned to the worksite. For additional information about the Bureau of Labor Statistics (BLS), access the following website: U.S. Bureau of Labor Statistics - Multiple Worksite Report (MWR) Respondents |

| SUI Unit Code | Used if the company has two-character unit codes for special mailing of SUI claim information pre-approved through the state reporting agency. |

| Primary and Secondary Comment Code | This section is used for multi-worksite reporting. Two comment code fields, Primary and Secondary, are provided in the standardized file formats. Use the comments to explain any unusual changes in the economic data if they differ substantially from that previously reported, as instructed in the Electronic Data Reporting instructions provided by the Bureau of Labor Statistics (BLS). If you need to include comment codes, enter the codes in the Comment Code fields for the applicable location code prior to creating multiple worksite reports. For additional information about Electronic Data Reporting, access the following website: U.S. Bureau of Labor Statistics - Multiple Worksite Report (MWR) Respondents |

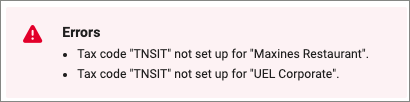

The Tax Information section is used to indicate the applicable state and local tax codes that are associated with the location. When the location is assigned to the employee, the employee inherits the tax codes for the location. An employee can be taxed for multiple locations, if needed.

If the Tax Information section does not appear for a specific location, then the location's state must be added as part of tax configuration or the location cannot be assigned in the Locations business rule.

Add a Location

To add a new location:

Assign Locations

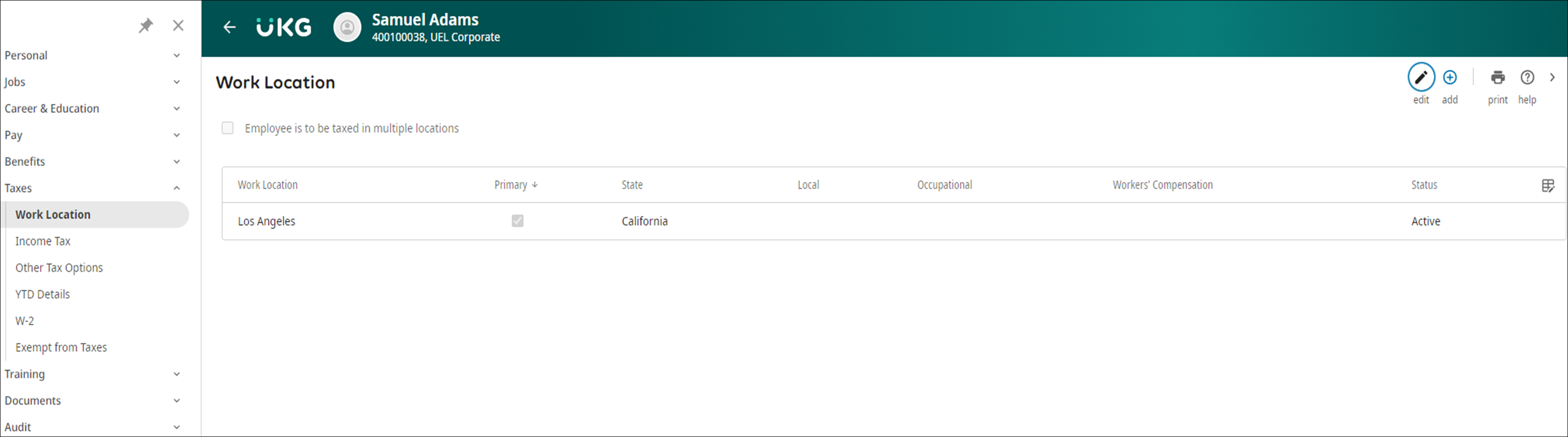

Once you configure a location from the Locations business rule, you can assign the location to an employee.

From the employee’s record, locations can be added from the Taxes > Work Location page.

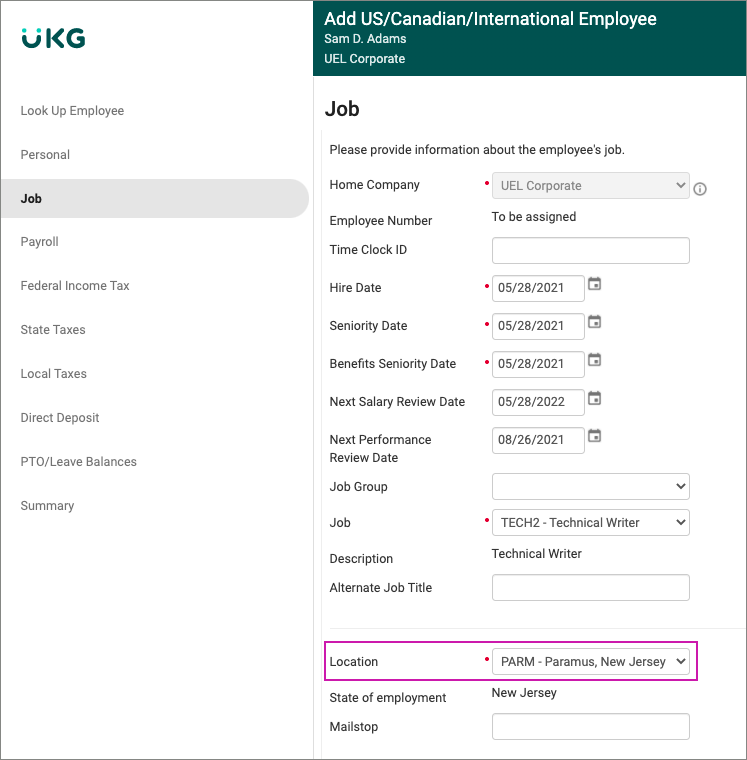

When hiring an employee, the location is added from the Jobs page.

© 2024 UKG Inc. All rights reserved. For a full list of UKG trademarks, visit https://www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners.

This document and all information contained herein are provided to you "AS IS" and UKG Inc. and its affiliates (collectively "UKG") make no representation or warranties with respect to the accuracy, reliability, or completeness of this document, and UKG specifically disclaims all warranties, including, but not limited to, implied warranties of merchantability and fitness for a particular purpose. The information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG. Nothing herein constitutes legal, tax, or other professional advice. All legal, tax, or other questions or concerns should be directed to your legal counsel, tax consultant, or other professional advisor. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.