Configure ACA - Eligible Earnings for Third-Party Payrolls

ACA-Eligible Earnings for Third-Party Payrolls

ACA-Eligible Earnings for Third-Party Payrolls - Overview

The ACA-Eligible Earnings for Third-Party Payrolls Guide is for employers who are undergoing mid-year UKG Pro activations, employers who need to load new employee payroll data due to a merger or acquisition, or employers who use the UKG Pro People Center solution with a third-party (external) payroll system.

In these cases, payroll data must be imported from a third-party system to include ACA-eligible hours before the ACA Manager can be used to auto-populate Forms 1094-C and 1095-C for ACA reporting.

- Submit a service request to import data from a third-party (external) payroll system to

the UKG Pro solution. As a reminder, the data that is imported must

include pay period information.Note Employers who use third-party payroll providers on an ongoing basis can enable the Third-Party Pay Service API. For more information, refer to the Third Party Pay Data Access in the UKG Pro Solution.

- Enable role access to Third Party Pay History data.

- View Third-Party Pay History data to confirm that the data has been imported.

- Enable role access rights to the ACA-Eligible Third-Party Payroll business rule.

- Configure Third-Party earnings codes for ACA-eligible hours of service.

- ACA Job #1 - tracks average hours worked for employees assigned to a health care measurement group.

- ACA Job #2 - tracks the hours worked for all employees for each month.Important Earnings must be configured for health care eligibility hours to be included in the ACA jobs. For more information, refer to the Designate Earnings for Inclusion in PPACA Calculation.

Enable Role Access to Third Party Pay History Data

To view third-party pay history information in the UKG Pro solution, you must grant the applicable roles access to the Third Party Pay History pages.

View Third-Party Pay History Data

After role access has been granted to the Third-Party Pay History pages, in order to view the history date, confirm that the data has been imported.

Enable Role Access to the ACA-Eligible Third-Party Payroll Business Rule

Before configuring third-party earnings, ensure that the ACA-Eligible Third-Party Payroll business rule access rights are enabled in role-based security for applicable user roles.

- From the Role Administration page, at the Find By field, locate and select the role.

- From the navigation pane, select Business Rules Access Rights.

- At the ACA-Eligible Third-Party Payroll business rule, select the View and Edit boxes to enable role access to the business rule.

- Select Save.

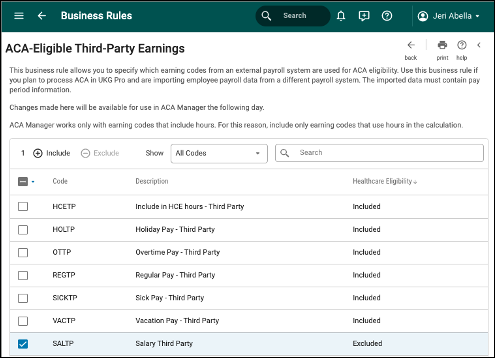

Configure Third-Party Earnings Codes for ACA-Eligible Hours

After your system administrator imports payroll data from an external payroll system, the third-party payroll tables are loaded with the earnings and appear on the business rule page. ACA administrators can select which third-party earnings codes to include in ACA-eligible hours of service calculation by configuring the business rule.

ACA Eligibility and Measurement Methods

To comply with the Affordable Care Act (ACA), employers can determine an employee’s full-time status by counting each employee’s hours of service using one of two measurement methods.

Full-time status is an average of 30 or more hours of service per week or 130 hours per month:

- Monthly Measurement Method

- Look-back Measurement Method

Employers may decide to designate additional employees as eligible for coverage or offer coverage on a wider basis than required to avoid an ACA pay or play penalty. For more information, refer to the frequently asked questions on the IRS website.

Note System administrators must configure third-party earnings using the ACA-Eligible Third-Party Payroll business rule to ensure eligible hours of service are included in the health care eligibility calculations.

Monthly Measurement Method

When using the Monthly Measurement method, the hours of an employee, who is not assigned to a health care measurement group, are analyzed on a monthly basis to determine full-time status for each calendar month.

- An employee’s earnings hours are tracked from both payroll histories (UKG Pro solution and Third-Party Pay). Assigned earnings codes that are

flagged as Health Care Eligible hours are tracked. TheUKG Pro solution

calculates hours worked in a month for all employees. Calculations occur nightly.

- Tracks only regular or supplemental payroll with pay period dates in the given month.

- Pro-rates hours for pay periods that are only partially included in the given month.

- The hours worked for each employee are updated on the paycheck date when the pay period

is processed and closed.

- If an employee works at least 130 hours a month or more, the employee is considered ACA full-time for the given month.

Monthly Measurement Method - Example

In this example, third-party payroll hours were imported for the employee during the launch process and added to the UKG Pro payroll hours, and then measured on a nightly basis. Both UKG Pro and Third-party Earnings were flagged as ACA-eligible hours. At the end of the monthly measurement period for June, a total of 150 hours had accumulated. Since the total hours are above the 130 hour per month threshold, the employee is considered full-time for ACA and their health care eligibility status in UKG Pro was set to Eligible for June.

| Go Live Date | Measurement Method | UKG Pro Pay History for June | Third-Party Pay History for June | Total Hours Worked in a Month | ACA Full or Part Time |

|---|---|---|---|---|---|

| June 23, 2021 | Monthly | 40 | 110 | 150 | Full Time |

Look-Back Measurement Method

When using the Look-back Measurement Method, an employer “looks back” to previous hours of service to determine full-time status of a future period for those employees who are assigned to a Health Care Measurement Group.

- An employee’s earnings hours are tracked from both payroll histories (UKG Pro solution and Third-Party Pay). Assigned earnings codes are

flagged as Health Care Eligible hours. TheUKG Pro solution calculates

hours worked in a month for all employees assigned to a Health Care Measurement Group, as

of the measurement date. Calculations occur nightly.

- Tracks only regular or supplemental payrolls with pay period dates in the given measurement period.

- Pro-rates the hours for pay periods that are only partially included in the given measurement period

- The average hours worked for each employee being measured is updated the day after the

paycheck date when a pay period is processed and closed.Note Managers and employee administrators can review the average hours worked to identify any employees who may be approaching the threshold of 30 hours per week or 130 hours per month (full-time under ACA). The average hours worked are calculated based on the Health Care Eligible Group configuration and duration of the measurement period.

- An Eligible status appears, which means the employee is eligible for an Offer of Coverage or a Form 1095-C.

Look-Back Measurement Method - Example

In this example, third-party payroll hours were imported for the employee during the launch process and added to the UKG Pro payroll hours, and then measured for a 12-month period. The Healthcare Measurement Group was configured to define employee eligibility by 30 hours per week. Both UKG Pro and Third-party Earnings were flagged as ACA-eligible hours. At the end of the measurement period (and a day after the final paycheck), a total of 2100 hours had accumulated, which averaged to ~40.27 hours per week (2100 multiplied by 7 divided by 365). Since the average hours are above the minimum 30-hour per week threshold, the employee is considered full-time for ACA and their health care eligibility status in UKG Pro was set to Eligible.

| Go Live Date | Measurement Method | Measurement Period | UKG Pro Pay History | Third-Party Pay History | Total Hours at the end of measurement period | Average Hours per Week | Eligibility Status |

|---|---|---|---|---|---|---|---|

| June 23, 2021 | Look-Back | 12 months (Jan. 2021 to Dec. 2021) | 900 | 1200 | 2100 | ~40.27 | Eligible |

Run ACA Services Delivered Reports

ACA Services Delivered reports enable employers to view ACA monthly hours and Health Care Measurement Group periods and average hours across both UKG Pro pay history and Third-Party pay history.

Navigation: Team content > UltiPro Sample Reports > Sample Reports > ACA Services Delivered Reports > Employee Total & Average Hours

© 2023 UKG Inc. All rights reserved. For a full list of UKG trademarks, visit https://www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners.

This document and all information contained herein are provided to you "AS IS" and UKG Inc. and its affiliates (collectively "UKG") make no representation or warranties with respect to the accuracy, reliability, or completeness of this document, and UKG specifically disclaims all warranties, including, but not limited to, implied warranties of merchantability and fitness for a particular purpose. The information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG. Nothing herein constitutes legal, tax, or other professional advice. All legal, tax, or other questions or concerns should be directed to your legal counsel, tax consultant, or other professional advisor. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.