Print Forms 1095-C using Self-Printing

Print Forms 1095-C using Self-Printing Overview

The Patient Protection and Affordable Care Act (PPACA) reporting processes in the UKG Pro solution provides employers with a method to distribute and download electronic copies of Form 1095-C.

A single PDF file, viewable with Adobe Reader, is created for each applicable large employer (ALE) member. The resulting multi-page PDF contains the front side of Form 1095-C for each employee associated with the ALE. Employers can view electronic copies in PDF format and print paper copies. Employers can also provide employees with access to view and print copies of Form 1095-C for their records.

Before You Print Forms 1095-C

Before you approve your organization’s PPACA forms per applicable large employer (ALE) for printing, you must designate the PPACA Administrator role type for your organization to an existing role or new role.

Assign the PPACA Administrator role type to a user role and enable web access rights to the File Transfers and PPACA features from the Reporting section to allow assigned users access to employees’ final, approved Forms 1095-C in PDF format to view or print Forms 1095-C.

- Assign the PPACA Administrator role type to a user role (System Configuration > Security > Role Administration > select existing role or select Add to create new role > Description/Role Types > select PPACA Administrator role type).

- Enable web access rights to the PPACA feature from Reporting (System Configuration > Security > Role Administration > select role > Web Access Rights > Reporting > PPACA).

-

Enable web access rights to the File Transfers feature from Reporting (System

Configuration > Security > Role Administration > select role > Web Access Rights >

Reporting > File Transfers).

If a role does not have the PPACA Administrator role type assigned, an information message appears.

Forms 1095-C and 1094-C for the ALE member must be finalized prior to printing Forms 1095-C. Each of the twelve months of the reporting year must contain a valid coverage code for Form 1095-C. A final edit, review, and e-signing of Form 1094-C completes the finalization process. Starting on January 1, employers can self-print the employee copies of Form 1095-C, provided forms have been finalized for the prior reporting year.Note The employer copy of Form 1094-C is not available for self-printing.

Enable Furnish Paper Copy of Form 1095-C to Terminated Employees

To ensure terminated employees receive a paper copy of Form 1095-C even if they have consented for the electronic copy, enable the setting.

Navigate to the System Settings tab (System Configuration > System Settings). Check the Furnish Paper Copy of Form 1095-C to Terminated Employees box on the PPACA Reporting Settings page

Enable Masking of the Social Security Number on Printed Forms 1095-C

Starting with the 2016 reporting year, ACA administrators can enable the Mask setting to hide the social security number (SSN) of employees on the printed copies of Forms 1095-C.

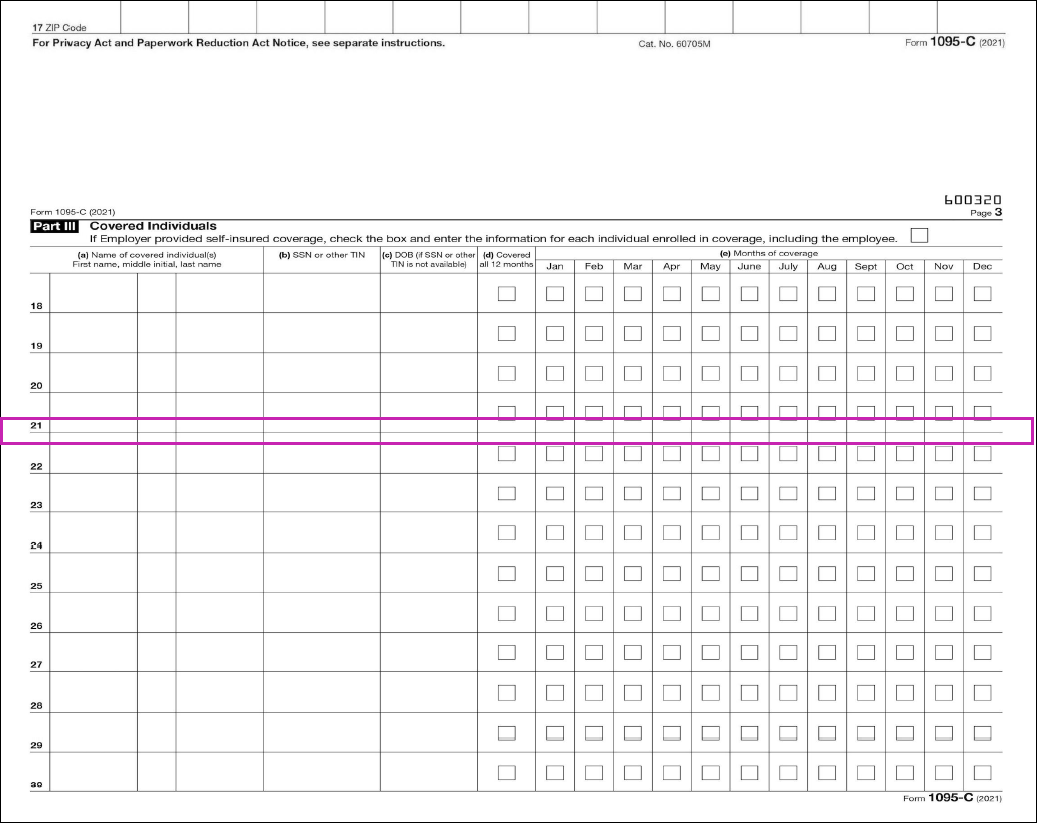

When enabled, all SSN digits on the printed form, except for the last four, are masked in Part I (employee information) and Part III (employee and dependent information). All SSN digits remain visible on the electronic PDF version of Forms 1095-C when individual employees view their own electronic copy on the portal.

From the Patient Protection and Affordable Care Act (PPACA) Reporting Settings page, select the Mask 1095-C Social Security Number (SSN) setting for All Individuals on Printed Forms 1095-Cs setting.

Paper Stock and Paper Size

The electronic Standard 1095-C PDF file prints the front side only, including lines and boxes, on letter-size 8.5" x 11" paper. For 2020 and future reporting years, the Foldable 7171-1 PDF prints on legal-size 8.5" x 14" paper and the Pressure-Sealed PDF prints on legal-size 8.5" x 14" pressure-sealed paper. Print the IRS instructions on the back side or order paper stock with pre-printed instructions on the back side to produce final forms on your laser printer. Paper stock and companion envelopes can be purchased from the Forms Division by sending an email to forms.division@ukg.com.

Types of PDF Files for Print

PPACA administrators must select the type of PDF file for print (standard, foldable, or pressure seal format) and indicate if they want a full or partial set of forms. A full set contains all employees, including those who consented to receive Forms 1095-C electronically; a partial set excludes employees who consented to receive electronic forms. Refer to the table for a description of PDF file download options:

| PDF File for Print | Forms 1095-C Per ALE: Partial/Full Set of Employee Copies | Print Image: Full (Standard) or Reduced (Foldable) |

|---|---|---|

| Standard 1095-C PDF | Partial Set | Full-size image of Form 1095-C |

| Full Set (includes employees who opted for electronic copy) |

|

|

| Foldable 7171-1 PDF | Partial Set | Reduced-size image of Form 1095-C Note For 2020 and future

reporting years, the Foldable 7171-1 PDF prints on 8.5" x 14" legal-size

paper. |

| Full Set (includes employees who opted for electronic copy) | Prints a reduced-size image on the front side of the page only.

|

|

| Pressure-Sealed PDF | Partial Set | Reduced-size image of Form 1095-C Note For 2020 and future

reporting years, the Pressure-Sealed PDF prints on 8.5" x 14" legal-size,

pressure-sealed paper. |

| Full Set (includes employees who opted for electronic copy) | Prints a reduced-size image on the top half and the continuation on the bottom

half of the pressure-sealed PDF.

|

Download Printable Copies

Follow these steps to download printable copies of the Form 1095-C for employer self-printing.

- From the Distribute and Download Forms page, select the Download Forms button.

- From the Download Forms dialog box, select the PDFs for Print option from the drop-down list.

- Check the Include Employees Who Opted In for an Electronic Copy Only box, if needed, and

select OK.Note Once the Forms 1095-C are loaded for your employees, you are ready to print all of your employee copies.

Print employee copies of Form 1095-C for distribution

- From the File Transfers page (Reporting > File Transfers), select the PDF file to print.

- Scroll to the bottom of the document; an Adobe toolbar displays.

- Select the Printer icon.

- Before you print your forms, scroll down to the Size Options and select Actual size. The forms have been aligned based on this setting.

Fold Form 1095-C for 7171-1 Envelope

After printing the foldable 7171-1 PDF version of Form 1095-C on 8.5" x 14" legal-size paper, you must fold the form to fit the envelope and to display the employee's mailing address in the address window.

Printable Employee Copies of Form 1095-C for Employee Self-Printing

Employers must provide a Form 1095-C to each of their full-time employees on paper, unless employees consent to receive the form in an electronic format.

Employees can access a PDF file to view and print a paper copy of the form for their records using Adobe Acrobat. This PDF file contains both the front and back of Form 1095-C for employee self-printing.

PPACA administrators must select Enable Online Access from the Distribute and Download Forms page to provide access to the PDF file (Reporting > PPACA > Generate and Finalize > Distribute and Download Forms). When enabled, an electronic copy is distributed to all employees to access via Employee Self-Service. Employees who consented to receive the electronic form may not receive a paper copy from their employer. In these cases, employees can self-print a copy to report as part of their income tax submission for the tax year, if needed.

Print Employee Copies of Form 1095-C Using Employee Self-Printing

- Employee: Select Myself > Benefits > 1095-C > select the PDF file

- Employee Administrator: Select Employee Admin > My Employees > select an employee >

Benefits > 1095-CNote When the masking option is enabled, the social security number remains visible on the electronic PDF version of Forms 1095-C when individual employees view their own electronic copy on the portal.

© UKG Inc. All rights reserved. For a full list of UKG trademarks, visit www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG Inc. (“UKG”). Information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. Nothing herein constitutes legal advice, tax advice, or any other advice. All legal or tax questions or concerns should be directed to your legal counsel or tax consultant.

Liability/Disclaimer

UKG makes no representation or warranties with respect to the accuracy or completeness of the document or its content and specifically disclaims any responsibility or representation for other vendors’ software. The terms and conditions of your agreement with us regarding the software or services provided by us, which is the subject of the documentation contained herein, govern this document or content. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.

Links to Other Materials: The linked sites and embedded links are not under the control of UKG. We reserve the right to terminate any link or linking program at any time. UKG does not endorse companies or products to which it links. If you decide to access any of the third-party sites linked to the site, you do so entirely at your own risk.