Configure Blocked or Exempt Employee Tax Withholding

UKG Pro Tax Configuration Overview

Tax configuration is critical regarding how reports and forms reflect earnings and tax data. A common area of confusion is whether to set an employee’s taxes as withhold and report, exempt from withholding, or blocked. Tax implications of each are very different, especially during year-end, as these settings drive the amounts that populate on the employee’s Form W-2. In addition, identifying which local taxes are withheld and reported impacts tax liability for the employee.

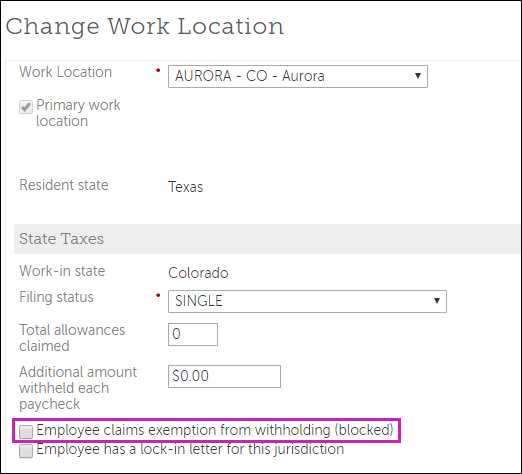

Exemption from Withholding - State Taxes

When the Employee Claims Exemption from Withholding box is checked, wages are accumulated and calculated. Information is included in tax filing reports and on the employee’s Form W-2, and taxes are not calculated or withheld. The Employee Claims Exemption from Withholding check box only applies to state income tax withholding.

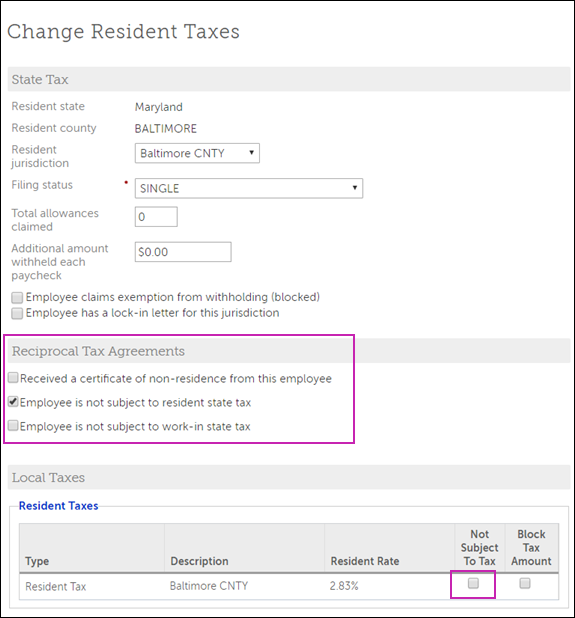

Not Subject to Work In or Resident State Taxes

On an employee's Resident Taxes page, the Reciprocal Tax Agreements section contains the following check boxes.

Not Subject to Work In State Tax

Select the Not Subject to Work in State Tax check box if the employee resides and works in different states, where the employee’s resident state has a reciprocal agreement with the state in which the employee works, and the employee is not subject to the work-in state tax.

Not Subject to Resident State Tax

Select the Not Subject to Resident State Tax check box if the employee resides and works in different states, where the employee’s resident state has a reciprocal agreement with the state in which the employee works, and the employee is not subject to the resident state tax.

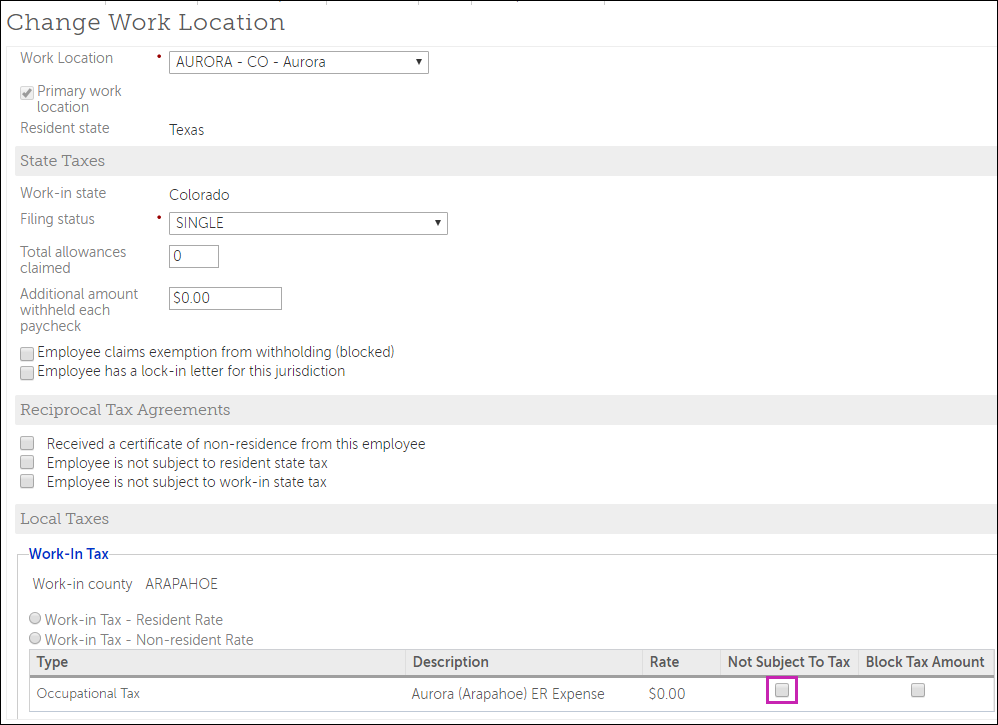

Not Subject to Tax- Local Taxes

When the Not Subject to Tax box is checked on the, the tax is not withheld from wages. The tax is NOT included in tax filing reports and on the employee’s Form W-2; however, taxes are blocked and not calculated or withheld. The Not Subject to Tax check box in the Local Taxes section only applies to local income tax withholding.

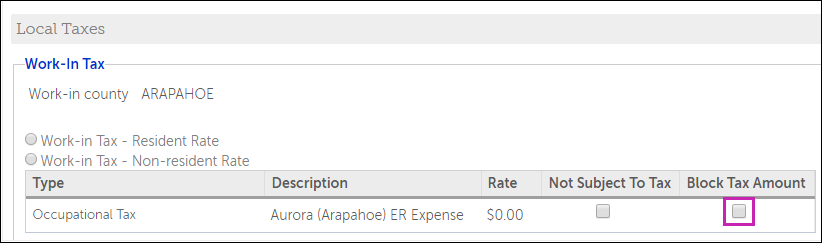

Block Tax Amount - Local Taxes

When the Block Tax Amount box is checked, wages are accumulated and calculated. Information is included in tax filing reports and on the employee’s Form W-2; however, taxes are blocked and not calculated or withheld. The Block Tax Amount check box in the Local Taxes section only applies to local income tax withholding.

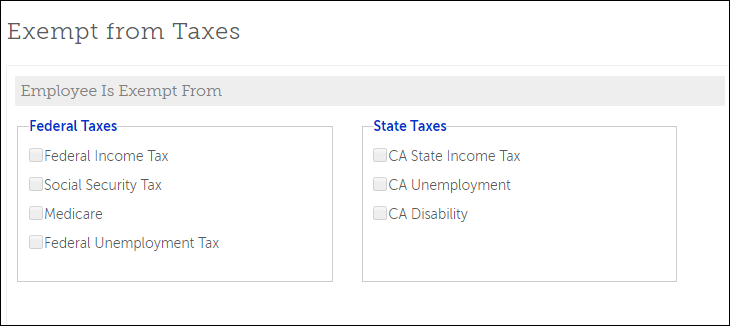

Exempt from Taxes

When the Employee Is Exempt From box is checked for federal, state, and/or local taxes on the Exempt from Taxes page, wages are not accumulated, calculated, or reported. In addition, no applicable taxes are withheld.

Exempt from Tax means the employee's wages are neither calculated nor reported and taxes are not withheld. This is different from Exempt from Withholding where the employee's earnings are both calculated and reported, but no tax is withheld.

© UKG Inc. All rights reserved. For a full list of UKG trademarks, visit www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG Inc. (“UKG”). Information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. Nothing herein constitutes legal advice, tax advice, or any other advice. All legal or tax questions or concerns should be directed to your legal counsel or tax consultant.

Liability/Disclaimer

UKG makes no representation or warranties with respect to the accuracy or completeness of the document or its content and specifically disclaims any responsibility or representation for other vendors’ software. The terms and conditions of your agreement with us regarding the software or services provided by us, which is the subject of the documentation contained herein, govern this document or content. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.

Links to Other Materials: The linked sites and embedded links are not under the control of UKG. We reserve the right to terminate any link or linking program at any time. UKG does not endorse companies or products to which it links. If you decide to access any of the third-party sites linked to the site, you do so entirely at your own risk.