Withholding Expatriate Hypothetical Tax

Withholding Expatriate Hypothetical Tax

A hypothetical tax is often used for tax equalization of foreign employees. Tax equalization is designed to neutralize taxes when determining expatriate employees' compensation package.

When an employer moves an employee to another country for a work assignment, the native country and the host country may require income tax withholding. Even if expatriate employees' taxes have increased, employees only report taxes they would have withheld in their native country.

To neutralize the taxes, use a hypothetical tax. A hypothetical tax is the tax amount employees would have hypothetically paid if the assignment had not occurred. When withholding a hypothetical tax from an employee, the employer is responsible to pay the actual tax liability for the employee.

To collect the hypothetical tax from your expatriate employees, use a negative earnings on the employee's check.

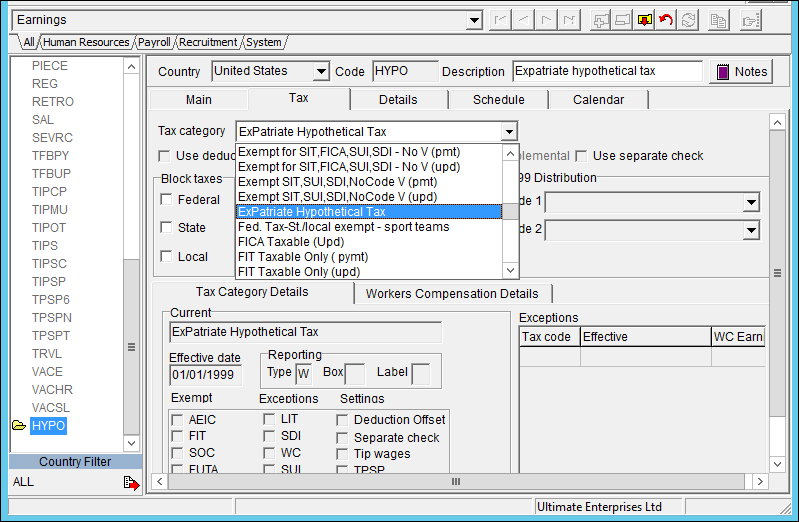

UKG Pro provides the ExPatriate Hypothetical Tax (HYPOC) earnings tax category for Canada companies and the ExPatriate Hypothetical Tax (HYPOT) earnings tax category for U.S. companies. With these tax categories, expatriates continue to incur a tax burden equal to what would incur if they were living and working in their native country. The tax burden incurs regardless of the actual foreign tax liability.

There are two ways to withhold expatriate hypothetical taxes:

- Manually enter negative earnings amounts through pay data entry

- Automatically populate negative earnings amounts through an earnings expression

Earnings in Pay Data Entry (PDE)

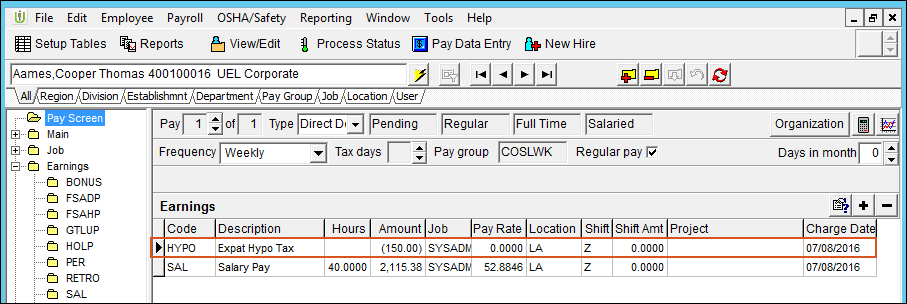

You can manage expatriate hypothetical taxes individually during payroll. Manually enter the earnings amount directly to employees each time you process a payroll.

When editing earnings for expatriate employees, use these guidelines:

- Configure the earnings code with a Flat Amount calculation rule

- Enter the earnings as a negative amount

The employee's check must contain regular earnings to avoid receiving the check calculation error: Insufficient Earnings.

Configure Expression to Automatically Populate

You can manage expatriate hypothetical taxes automatically through an earnings expression.

If you configure an amount to populate automatically, perform these steps:

- Configure a user-defined field

- Configure an earnings code, expression, and assign to earnings groups

- Add earnings code and user-defined field to expatriate employees

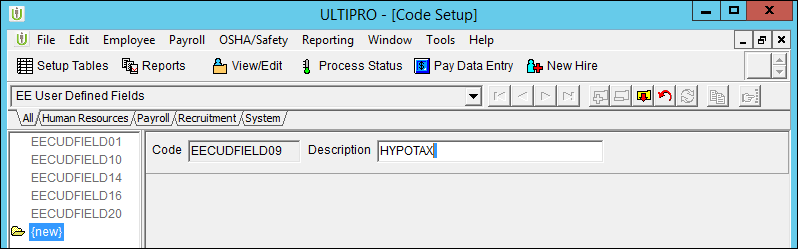

Configure Expatriate User-Defined Field

Add a user-defined field for the expatriate earnings calculation.

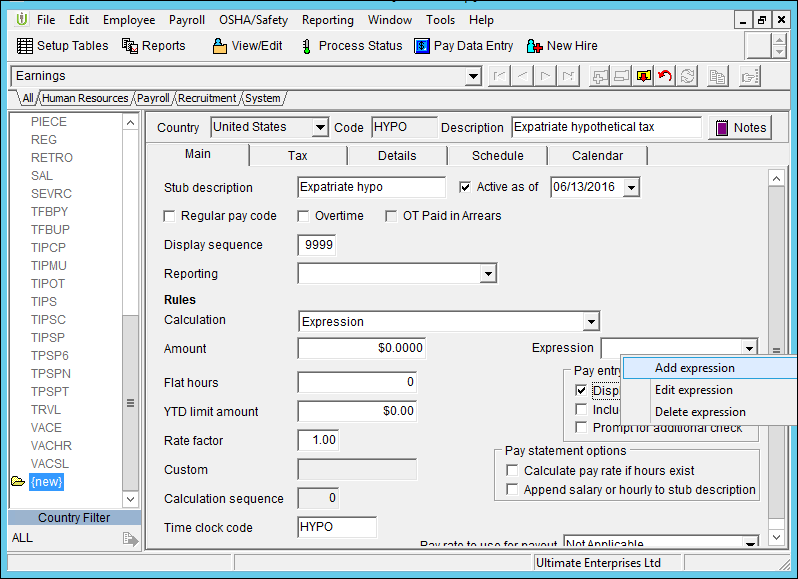

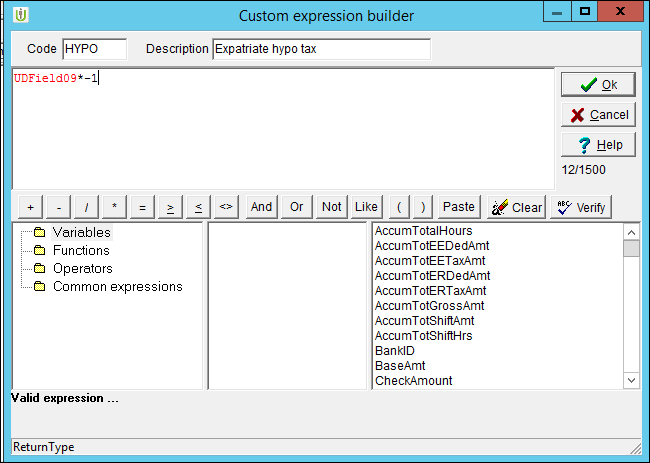

Configure Earnings and Expression

After adding the appropriate user-defined field, configure the earnings code and expression. Once you have completed configuring the earnings code, add the earnings to all applicable earnings groups.

Add the Earnings Code and User-Defined Amount to Employees

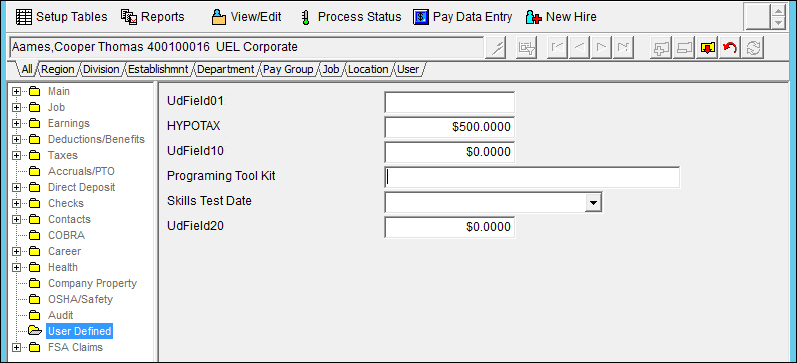

For each expatriate employee, add the Expatriate Hypothetical Tax earnings. Add the user-defined field for Expatriate Hypothetical Tax amount.

© UKG Inc. All rights reserved. For a full list of UKG trademarks, visit www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG Inc. (“UKG”). Information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. Nothing herein constitutes legal advice, tax advice, or any other advice. All legal or tax questions or concerns should be directed to your legal counsel or tax consultant.

Liability/Disclaimer

UKG makes no representation or warranties with respect to the accuracy or completeness of the document or its content and specifically disclaims any responsibility or representation for other vendors’ software. The terms and conditions of your agreement with us regarding the software or services provided by us, which is the subject of the documentation contained herein, govern this document or content. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.

Links to Other Materials: The linked sites and embedded links are not under the control of UKG. We reserve the right to terminate any link or linking program at any time. UKG does not endorse companies or products to which it links. If you decide to access any of the third-party sites linked to the site, you do so entirely at your own risk.