Monitor Forms 1095C Data and Penalties Using the ACA Manager Dashboard

Monitor Forms 1095-C Data and Penalties

The ACA Manager Dashboard provides a series of graphics and charts that tracks health care coverage your organization offered to employees.

Use the dashboard to monitor data associated with each applicable large employer (ALE) and view potential exposure to penalties.

If an ACA administrator makes any of the following employee data changes, the Potential Monthly Penalties that display on the dashboard are recalculated to reflect the data changes the next time the ALE is generated.

ACA Full-Time override - marks an employee as full time for ACA reporting

Form 1095-C codes - changes codes for one or more employees

Suppressed Form 1095-C - selects the option: "This employee should not receive a 1095-C"

ACA Manager Dashboard Overview

The Dashboard leverages Form 1095-C generated data to provide a quick visual reference to determine whether coverage was offered to eligible employees, if it was affordable, and potential penalties if coverage was not offered to eligible employees.

- Monthly and year-to-date estimated Affordability penalties

- Monthly and year-to-date estimated Offered Coverage penalties

- Up to date 1095-C recipient information

- Deadline countdowns displaying information Internal Revenue Service (IRS) dates you do not want to miss, such as print distribution and filing deadlines

ACA Manager Dashboard Sections

The PPACA Dashboard provides at-a-glance views of the latest generated Forms 1095-C data and estimated penalties.

By selecting an ALE in the Dashboard Settings section, UKG Pro populates the following five sections with data:

- Potential Monthly Penalties

- Affordable Coverage

- Offered Coverage

- Upcoming Deadlines

- 1095-C Recipients

Only employees who are Full Time for ACA purposes are included in the applicable Dashboard penalty calculations for each month. UKG Pro determines ACA Full Time status in the following ways:

ACA Full Time Override: Employees who have been overridden to ACA Full Time for the given month.

Look-back Measurement Method: Employees who have not been overridden but are in a Health Care Eligibility period with an eligibility status of "Yes" for the given month.

Monthly Measurement Method: Employee who have not been overridden and are not in a Health Care Eligibility period for the given month, but who have at least 130 or more ACA hours of service in the month.

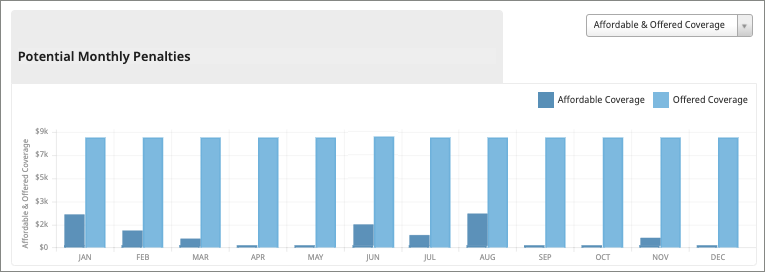

Potential Monthly Penalties Review using the ACA Dashboard

Employers can review the Potential Monthly Penalties graph on the ACA Dashboard to help resolve issues and avoid possible penalties. Based on the latest generated Form 1095-C data, the Potential Monthly Penalties section displays your company’s estimated monthly penalties for not offering affordable coverage or for not offering coverage to eligible employees by month.

You can modify graph information to view the potential monthly penalties by Affordability penalties, Offer of Coverage penalties, or combined Affordability and Offer of Coverage penalties. When you hover over a penalty bar, you can view estimated penalty dollar amounts.You can also select the Download Data link to review which employees have code combinations that are causing potential penalties.

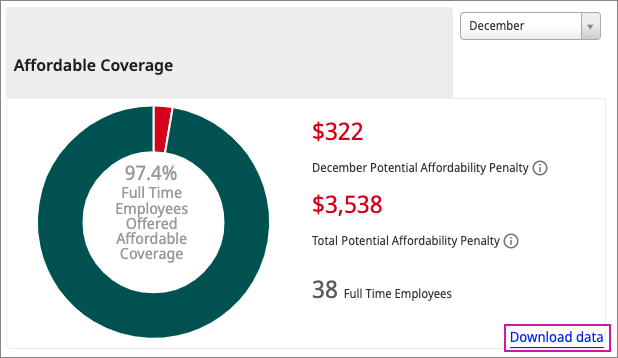

Affordable Coverage

The Affordable Coverage section displays the percentage of full-time employees who have been offered affordable coverage for the month.

Hover over each section of the graph to see exact amounts. The Affordable Coverage section also displays estimated affordability penalties for the current month and year.

To calculate the estimated monthly affordability penalty, UKG Pro multiplies the number of full-time employees who are not offered affordable coverage for the month by the IRS monthly penalty amount for the given year.

- Line 14 has one of these offer of coverage codes:

1F - offer did not provide minimum value or

1R - ICHRA offer was unaffordable

- Line 16 safe harbor code is blank, and Line 14 does not have one of these offer of coverage codes:

1A, 1G, 1H, 1S

To generate a report that indicates which employees have Form 1095-C code combinations that are causing potential penalties, select the Download Data link in the Affordable Coverage section.

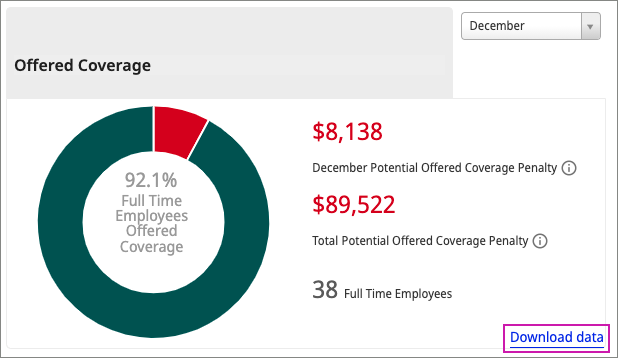

Offered Coverage

The Offered Coverage section displays the percentage of full-time employees who have been offered health care coverage for the month. Hover over each section of the graph to see exact amounts.

The Offered Coverage section also displays estimated offer of coverage penalties for the current month and year.

To calculate offered coverage penalties for the month, UKG Pro determines if at least 95% of the month’s full-time employees have been offered coverage. (UKG Pro divides the number of full-time employees for the month by the number of full-time employees offered coverage for the month.)

If the percentage offered is above 95%, no penalty is calculated for the month. If the percentage offered is below 95%, UKG Pro multiplies the month’s total number of full-time employees by the IRS monthly penalty amount for the given reporting year.

The following code combinations may cause penalties to appear in the Potential Monthly Penalties for Offered Coverage.

- Line 14 does not have one of these offer of coverage codes:

1A, 1C, 1E, 1F, 1K, 1M, 1N, 1P, 1Q or 1R (the minimum essential coverage (MEC) was not offered to the employee and their dependent children for the month)

AND

- Line 16 does not have one of these safe harbor codes:

2D safe harbor code (employee is not in a limited non-assessment period for the month); and

2E (employee was not offerent coverage through a multi-employer plan)

AND

The employee does not have a 1H/2B code combination together in the given month, which means the employee was not terminated before the end of the month with coverage ending on their termination date.

To generate a report that indicates which employees are causing potential penalties, select the Download Data link in the Offered Coverage section.

For example, if the IRS penalty amount is $240 per month and the ALE had 1,000 full-time employees for a given month and less than 95% of those were offered coverage for the month, then UKG Pro calculates the monthly penalty as follows: 1000*$240.00 = $240,000 monthly penalty. The sum of all monthly offered coverage penalties for the year provides the Total Potential Offered Coverage Penalty.

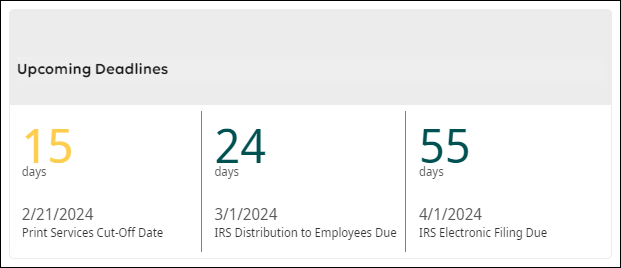

Upcoming Deadlines

The Upcoming Deadlines section displays IRS PPACA deadlines and associated countdowns.

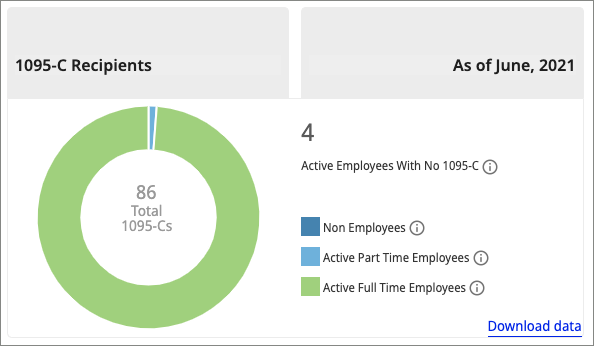

1095-C Recipients

The 1095-C Recipients section displays a color-coded breakdown of employees who are receiving Forms 1095-C to date.

Hover over each section of the graph to see totals. The 1095-C Recipients section also displays the number of active employees who do not have a generated Form 1095-C. These employees average less than 30 hours a week and are not enrolled in self-insured plan.

© 2024 UKG Inc. All rights reserved. For a full list of UKG trademarks, visit https://www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners.

This document and all information contained herein are provided to you "AS IS" and UKG Inc. and its affiliates (collectively "UKG") make no representation or warranties with respect to the accuracy, reliability, or completeness of this document, and UKG specifically disclaims all warranties, including, but not limited to, implied warranties of merchantability and fitness for a particular purpose. The information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG. Nothing herein constitutes legal, tax, or other professional advice. All legal, tax, or other questions or concerns should be directed to your legal counsel, tax consultant, or other professional advisor. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.