UKG Pro Web Services API Guide

Employee New Hire Service

Introduction

With UKG’s UKG Pro Web Services, you can leverage your UKG Pro data for solving business application and integration needs.

This document is intended for individuals who are familiar with software development and web service technologies.

Employee New Hire Service API

The UKG Pro Employee New Hire Service Application Programming Interface (API) enables the user to programmatically hire an employee into a UKG Pro company based in the United States.

This document describes the methods of the service and provides examples for how to use the Employee New Hire web service for USA-based employees.

| Service Specifications | |

|---|---|

| Protocol | Simple Object Access Protocol (SOAP) 1.2 |

| SSL Support | Required |

| Signup and Licensing | |

|---|---|

| Account Required |

One of the following is required:

|

Using a UKG Pro Service Account is recommended. For information regarding establishing and maintaining a UKG Pro Service Account, refer to the Manage Service Accounts guide located in the UKG Pro Learning Center (Home > Content > System Management > Web Services).

Employee New Hire Object

The Employee New Hire object includes the following properties. In this table, some of the data is grouped as a data collection. The fields within each data collection should be used together.

For example:

- The DirectDeposits section is a collection of DirectDeposit elements.

- The PTOPlans section is a collection of EmployeeAccrual elements.

| Property | Required | Type | Description |

|---|---|---|---|

| AddressLine1 | Yes | String | Address line 1 |

| AddressLine2 | String | Address line 2 | |

| AlternateEmailAddress | String | Alternate email address | |

| AlternateTitle | String | Alternate job title | |

| BenefitSeniorityDate | Yes | Datetime | Benefit seniority date |

| BirthDate | Yes | Datetime | Birth date |

| City | Yes | String | Address city |

| CompanyIdentifier | Yes | Identifier | Identifier that represents an UKG Pro component company. Select Company Code, Federal ID or Import code and provide the value. |

| Country | Yes | Code | Currently only USA is supported with this service. Use the Global or Canadian new hire service for other countries. |

| County | String | Address county | |

| DeductionBenefitGroup | Yes | Code | Deduction / Benefit group code |

| Direct Deposits | Collection | Direct Deposit records | |

| AccountIsActive | Boolean | Account status. Default to 'True' | |

| AccountNumber | Only when direct deposit is provided | String | Account number |

| AccountType | Yes | Code | Account type

|

| AmountRule | Amount rule

| ||

| BankName | String | Bank name | |

| FlatOrPercentAmount | Required if AmountRule is Flat Amount or Percent Amount | Decimal | Flat or percent amount Must be a positive decimal less or equal to 1 when amount rule is percent amount ('P') |

| RoutingNumber | Only when direct deposit is provided | Int | Routing number |

| Direct Deposits | Collection | Direct Deposit records | |

| AccountIsActive | Boolean | Account status. Default to 'True' | |

| EarningsGroup | Yes | Code | Earnings group code |

| EmailAddress | String | Primary Email address | |

| EmployeeNumber | String | Employee number. If the company employee number method is set to SSN, Time clock number or automatic, this field will be ignored. | |

| EmployeeType | Yes | Code | Employee type code |

| EthnicOrigin | Code | Ethnic origin code | |

| FederalAdditionalAmountWithheld | Money | Additional amount withheld for Federal taxes. | |

| FederalDeductionAmount | No | Money | Deductions from Step 4b of the Federal W-4 |

| FederalDependentAmount | No | Money | Claim Dependents Total from Step 3 of the Federal W-4 |

| FederalEmployeeClaimsExempt | Boolean | If true, employee is exempt from federal taxes. | |

| FederalFilingStatus | Yes | Code | Federal filing status code |

| FederalOtherIncome | No | Money | Other Income from Step 4a of the Federal W-4 |

| FederalSubjectToBackupWithholding | Boolean | If true, employee is subject to federal backup tax withholding. | |

| FederalTotalAllowancesClaimed | Int | Total federal allowances claimed | |

| FederalW2Pension | Boolean | If true, enables the pension flag on the W2 | |

| FirstName | Yes | String | First name |

| FormerLastName | String | Former last name | |

| FullOrPartTime | Yes | Code | Employee status

|

| Gender | Yes | Code | Gender code.

|

| HireDate | Yes | Datetime | Date of hire |

| HireSource | Code | Hire source code | |

| HomePhone | String | Home phone number. Exclude dashes and parentheses. | |

| HourlyOrSalaried | Yes | Code | Employee’s pay type

|

| I9Verification | Yes | Code | I9 Verification code |

| JobCode | Yes | Code | Job code |

| JobGroup | Code | Job group code | |

| LastName | Yes | String | Last name |

| LocalWorkInTaxResidentStatus | Code | Determines whether the employee receives the local work in tax for being a resident or nonresident of the local municipality.

| |

| LocationCode | Yes | Code | Location code |

| MailStop | String | Mail stop | |

| MaritalStatus | Code | Marital Status code | |

| MiddleName | String | Middle name | |

| NextPerformanceReviewDate | Datetime | Date of next performance review | |

| NextSalaryReviewDate | Datetime | Date of next salary review | |

| OrgLevel1 | Code | Organizational 1 code | |

| OrgLevel2 | Code | Organizational 2 code | |

| OrgLevel3 | Code | Organizational 3 code | |

| OrgLevel4 | Code | Organizational 4 code | |

| OtherPhone | String | Other Phone Number | |

| OtherPhoneExtension | String | Extension for Other Phone Number | |

| OtherPhoneType | Only when OtherPhone provided | String | Code for the type of other phone number provided |

| OtherRate1 | Money | Requires Master Company to be configured to use other rates | |

| OtherRate2 | Money | Requires Master Company to be configured to use other rates | |

| OtherRate3 | Money | Requires Master Company to be configured to use other rates | |

| OtherRate4 | Money | Requires Master Company to be configured to use other rates | |

| PayAutomatically | Boolean | If true, selects the employee to be auto paid | |

| PayGroup | Yes | Code | Pay group code |

| PayRate | Yes | Decimal | Employee’s rate of pay. Set the PayRateType accordingly. |

| PayRateType | Yes | Code | Type of pay rate entered in the PayRate.

|

| PreferredFirstName | String | Preferred first name | |

| Prefix | Code | Prefix name code | |

| Project | Code | Project code | |

| ResidentStateAdoptedDependentExemptions | No | Numeric | Must be greater than zero |

| ResidentStateDeductionAmount | No | Money | Deductions from Step 4b of the W-4 for state withholding. Ignored for states that do not use the Federal W-4 as their state withholding form |

| ResidentStateDependentAmount | No | Money | Claim Dependents Total from Step 3 of the W-4 for state withholding. Ignored for states that do not use the Federal W-4 as their state withholding form |

| ResidentOtherIncome | No | Money | Other Income from Step 4a of the W-4 for state withholding. Ignored for states that do not use the Federal W-4 as their state withholding form |

| ResidentStateAdditionalAllowances | Int(4) | Additional resident state allowances claimed. Ignored for states that do not have additional values. | |

| ResidentStateAdditionalAmountWithheld | Money | Additional amount withheld for resident state taxes. | |

| ResidentStateEmployeeClaimsExempt | Boolean | If true, employee is exempt from resident state taxes. | |

| ResidentStateFilingStatus | Yes | Code | Resident state filing status code |

| ResidentStateTotalAllowancesClaimed | Int | Total resident state allowances claimed. | |

| ResidentStateTotalAllowancesClaimedCurrencyAmount | Optional. Only to be used if the employee lives in Iowa and wants to specify Total Allowances Claimed for the corresponding location. Other states are not supported. | Int | 10-digit maximum. Whole dollar amounts only. Decimals are not supported. |

| ScheduledHours | Yes | Decimal | Scheduled hours |

| SeniorityDate | Yes | Datetime | Date of seniority |

| ShiftCode | Code | Shift code | |

| ShiftGroup | Code | Shift group code | |

| SSN | Yes | String | Social Security Number |

| StateGeographicCode | Code | State geographic code. Only required for the state of Alaska. | |

| StateOccupationalCode | Required for

Other states are not supported. | Code | State Occupational code. |

| StateOrProvince | Yes | Code | State or Province code. |

| Suffix | Code | Suffix name code | |

| Supervisor | Identifier | ID that represents a person that is the supervisor | |

| TimeClock | String | Time clock code. Required if the employee number method is set to time clock. | |

| WorkStateAdoptedDependentExemptions | No | Numeric | Must be greater than zero. |

| WorkStateDeductionAmount | No | Money | Deductions from Step 4b of the W-4 for state withholding. Ignored for states that do not use the Federal W-4 as their state withholding form |

| WorkStateDependentAmount | No | Money | Claim Dependents Total from Step 3 of the W-4 for state withholding. Ignored for states that do not use the Federal W-4 as their state withholding form |

| WorkExtension | String | Work phone extension | |

| WorkOtherIncome | No | Money | Other Income from Step 4a of the W-4 for state withholding. Ignored for states that do not use the Federal W-4 as their state withholding form |

| WorkPhone | String | Work phone. Exclude dashes and parentheses. | |

| WorkStateAdditionalAllowances | Int | Additional work state allowances claimed. Ignored for states that do not have additional values. | |

| WorkStateAdditionalAmountWithheld | Money | Additional amount withheld for work state taxes. | |

| WorkStateDisabilityPlanType | Required for: CA, CO, CT, DC, MA, NJ, NY, OR, PR, WA | Code | State disability plan type code for the work state. Required for states that have disability. |

| WorkStateEmployeeClaimsExempt | Boolean | If true, employee is exempt from work state taxes. | |

| WorkStateFilingStatus | Yes | Code | Work state filing status code |

| WorkStatePlan | Code | State plan code. Required for California. | |

| WorkStateTotalAllowancesClaimed | Int | Total work state allowances claimed. | |

| WorkStateTotalAllowancesClaimedCurrencyAmount | Optional. Only to be used if the employee works in Iowa and wants to specify Total Allowances Claimed for the corresponding location. Other states are not supported. | Int | 10-digit maximum. Whole dollar amounts only. Decimals are not supported. |

| ZipOrPostalCode | Yes | String | Zip / Postal code |

| DistributionCenterCode | Code | Distribution Center | |

| ResidentCounty | Required for PA. Other states are currently not supported. | String | Resident county code |

| ResidentJurisdiction | Required for PA. Other states are currently not supported. | String | Resident Jurisdiction |

| PTOPlans | Collection (Employee Accrual) | Paid time off plan | |

| Available | Decimal | Current PTO balance available | |

| Default to: 0.0000 | |||

| EarnedThroughDate | Date | Earned through date | |

| Default to seniority date | |||

| Plan | Code | PTO plan code | |

| Reset Date | Date | Reset date. Based on plan's reset option: If option is reset on a specific date, or on service anniversary, PTO Reset is defaulted to seniority date. | |

| PayScaleCode | String | Required if UsePayScale=”Y” | |

| StepNo | Required if UsePayScale=”Y” | ||

| UnionLocal | Code | Local Union code | |

| UnionNational | Code | National Union code | |

| OverrideCompanyLevelRate | No | Boolean | Boolean flag to check if it is allowed to override the company level rate. |

| VTChildCareContributionEmployeeTaxRate | No | Decimal | Vermont Child Care Contribution Rate to override company level rate. |

Quick Start

This section provides steps for creating a sample application in your development environment to hire an employee in a USA-based company.

Prerequisites

In order to use the service, you will need the following items:

- A UKG Pro Service Account username and password or a UKG Pro Web User username and password

- The Customer API key from the UKG Pro Web Service administrative page

-

If you use a

UKG Pro

Service Account:

- You will need the User API key from the Service Account administrative page.

- You must have appropriate permissions granted to the Service Account for the Development Opportunity service on the Service Account administrative page.

- If you use a UKG Pro Web User account, you will need the User API key from the Web Service administrative page.

Methods

This section introduces the API methods for the Employee New Hire Web Service.

NewHireUsa

This method provides a way to hire an employee to a US based company in UKG Pro. You must provide the minimum required fields listed in the new hire object in order to successfully hire an employee.

C# Example

Generate the Service Reference

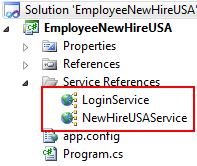

Once you have a user and API keys, you need to create a service reference to the Login Service and the New Hire Service. In your development environment, add the service references.

In Visual Studio, select the Add Service Reference menu item from the Project menu. Once you enter the service information you should have the references display in the solution explorer.

Example Code

The following code is an example of adding a new employee in a console application. Copy the entire contents to a C# console application and update the following values to build an operable application.

UserName = "YOUR SERVICE ACCOUNT OR WEB USER NAME ",

Password = "YOUR PASSWORD",

UserAPIkey = "YOUR USER API KEY",

CustomerAPIkey = "YOUR CUSTOMER API KEY"

namespace NewHireTest

{

using System;

using System.ServiceModel;

using System.ServiceModel.Channels;

using NewHireTest.EmployeeNewHireService;

using NewHireTest.LoginService;

publicclassProgram

{

internalstaticvoid Main(string[] args)

{

// Setup your user credentials:

conststring UserName = "";

conststring Password = "";

conststring CustomerApiKey = "";

conststring UserApiKey = "";

// Create a proxy to the login service:

var loginClient = newLoginServiceClient("WSHttpBinding_ILoginService");

try

{

// Submit the login request to authenticate the user:

string message;

string authenticationToken;

AuthenticationStatus loginRequest =

loginClient

.Authenticate(

CustomerApiKey,

Password,

UserApiKey,

UserName,

out message,

out authenticationToken);

if (loginRequest == AuthenticationStatus.Ok)

{

// User is authenticated and the authentication token is provided.

Console.WriteLine("User authentication successful.");

// Hire employee:

HireEmployee(CustomerApiKey, authenticationToken);

}

else

{

// User authentication has failed. Review the message for details.

Console.WriteLine("User authentication failed: " + message);

}

loginClient.Close();

Console.WriteLine("Press a key to exit...");

Console.ReadKey(true);

}

catch (Exception ex)

{

Console.WriteLine("Exception: " + ex);

loginClient.Abort();

throw;

}

}

privatestaticvoid HireEmployee(string customerApi, string token)

{

conststring UltiProTokenNamespace =

"http://www.ultimatesoftware.com/foundation/authentication/ultiprotoken";

conststring ClientAccessKeyNamespace =

"http://www.ultimatesoftware.com/foundation/authentication/clientaccesskey";

// Create a proxy to the employee new hire service:

var employeeNewHireClient = newEmployeeNewHireClient("WSHttpBinding_IEmployeeNewHire");

try

{

// Add the headers for the customer API key and authentication token:

using (newOperationContextScope(employeeNewHireClient.InnerChannel))

{

OperationContext.Current.OutgoingMessageHeaders.Add(

MessageHeader.CreateHeader("UltiProToken", UltiProTokenNamespace, token));

OperationContext.Current.OutgoingMessageHeaders.Add(

MessageHeader.CreateHeader("ClientAccessKey", ClientAccessKeyNamespace, customerApi));

// Create an employee and set the values:

var employee =

newEmployee

{

AddressLine1 = "123 Main St",

AddressLine2 = String.Empty,

AlternateEmailAddress = String.Empty,

AlternateTitle = "Sales Rep",

BenefitSeniorityDate = newDateTime(2016, 4, 1),

BirthDate = newDateTime(1970, 1, 1),

City = "Sydney",

CompanyIdentifier =

newCompanyCodeIdentifier

{

CompanyCode = "PRU"

},

Country = "USA",

County = String.Empty,

DeductionBenefitGroup = "SAL",

DistributionCenterCode = String.Empty,

DirectDeposits = new[]{

newDirectDeposit

{

AccountIsActive = true,

AccountNumber = "854954546",

AccountType = "C",

AmountRule = "P",

BankName = "Wells Fargo",

FlatOrPercentAmount = Decimal.Parse("0.50"),

RoutingNumber = "122100024"

}

},

EarningsGroup = "SAL",

EmailAddress = "jsmith@ausco.com",

EmployeeNumber = "689479",

EmployeeType = "REG",

EthnicOrigin = "1",

FederalAdditionalAmountWithheld = 0,

FederalEmployeeClaimsExempt = false,

FederalFilingStatus = "M",

FederalSubjectToBackupWithholding = false,

FederalTotalAllowancesClaimed = 1,

FederalW2Pension = false,

FirstName = "Jacob",

FormerLastName = String.Empty,

FullOrPartTime = "F",

Gender = "M",

HireDate = newDateTime(2012, 4, 1),

HireSource = "EEREF",

HomePhone = "7405551212",

HourlyOrSalaried = "S",

I9Verification = "P",

JobCode = "SALES",

JobGroup = "WEBSA",

LastName = "Smith",

LocalWorkInTaxResidentStatus = "R",

LocationCode = "OH",

MailStop = String.Empty,

MaritalStatus = "M",

MiddleName = "R",

NextPerformanceReviewDate = newDateTime(2012, 10, 1),

NextSalaryReviewDate = newDateTime(2012, 10, 1),

OtherPhone = String.Empty,

OtherPhoneExtension = String.Empty,

OtherPhoneType = String.Empty,

OtherRate1 = 1.5m,

OtherRate2 = null,

OtherRate3 = null,

OtherRate4 = null,

OrgLevel1 = "SE",

OrgLevel2 = String.Empty,

OrgLevel3 = String.Empty,

OrgLevel4 = String.Empty,

PayAutomatically = false,

PayGroup = "UPC",

PayRate = 30500.00m,

PayRateType = "Y",

PayScaleCode = null,

PreferredFirstName = "Jay",

Prefix = String.Empty,

Project = String.Empty,

PTOPlans = new[]

{

newEmployeeAccrual

{

Available = Decimal.Zero,

EarnedThroughDate = DateTime.Now.AddDays(100),

Plan = "IKANOR",

ResetDate = DateTime.Now.AddDays(100)

}

},

ResidentCounty = null,

ResidentJurisdiction = null,

ResidentStateAdditionalAllowances = 0,

ResidentStateAdditionalAmountWithheld = 0,

ResidentStateEmployeeClaimsExempt = false,

ResidentStateFilingStatus = "M",

ResidentStateTotalAllowancesClaimed = 0,

ScheduledHours = 40m,

SeniorityDate = newDateTime(2012, 4, 1),

ShiftCode = String.Empty,

ShiftGroup = String.Empty,

SSN = "299001934",

StateGeographicCode = String.Empty,

StateOccupationalCode = String.Empty,

StateOrProvince = "OH",

StepNo = null,

Suffix = String.Empty,

Supervisor =

newEmployeeNumberIdentifier

{

EmployeeNumber = "046546546"

},

TimeClock = String.Empty,

UnionLocal = String.Empty,

UnionNational = String.Empty,

WorkExtension = "289",

WorkPhone = "9543317000",

WorkStateAdditionalAllowances = 0,

WorkStateAdditionalAmountWithheld = 0,

WorkStateDisabilityPlanType = String.Empty,

WorkStateEmployeeClaimsExempt = false,

WorkStateFilingStatus = "M",

WorkStatePlan = String.Empty,

WorkStateTotalAllowancesClaimed = 1,

ZipOrPostalCode = "43135"

};

// Hire the employee:

CreateResponse createResponse =

employeeNewHireClient.NewHireUsa(new[] { employee });

// Check the results of the hire to see if there are any errors:

if (createResponse.OperationResult.HasErrors)

{

// Review each error:

foreach (OperationMessage message in

createResponse.OperationResult.Messages)

{

Console.WriteLine("Error message: " + message.Message);

}

}

// Check the response results for any errors:

if (createResponse.HasErrors)

{

foreach (Result result in createResponse.Results)

{

Console.WriteLine("HasErrors: {0}", result.HasErrors);

Console.WriteLine("HasWarnings: {0}", result.HasWarnings);

Console.WriteLine("Success: {0}", result.Success);

foreach (var message in result.Messages)

{

Console.WriteLine("\tCode: {0}", message.Code);

Console.WriteLine("\tMessage: {0}", message.Message);

Console.WriteLine("\tPropertyName: {0}", message.PropertyName);

Console.WriteLine("\tSeverity: {0}\n", message.Severity);

}

}

}

else

{

Console.WriteLine("New hire success.");

}

}

employeeNewHireClient.Close();

}

catch (Exception ex)

{

Console.WriteLine("Exception: " + ex);

employeeNewHireClient.Abort();

}

}

}

}XML Examples

XML Example

The Authentication Service (http://<address>/services/LoginService) is required to get the Token needed for all Core Web Service Calls. Please refer to the UKG Pro Login Service API Guide for further information.

NewHire

<s:Envelopexmlns:s="http://www.w3.org/2003/05/soap-envelope"xmlns:a="http://www.w3.org/2005/08/addressing">

<s:Header>

<a:Actions:mustUnderstand="1">http://www.ultipro.com/services/employeenewhire/IEmployeeNewHire/NewHireUsa </a:Action>

<UltiProTokenxmlns="http://www.ultimatesoftware.com/foundation/authentication/ultiprotoken">d91e98fe-560a-4e30-b00e-85117a3629c1 </UltiProToken>

<ClientAccessKeyxmlns="http://www.ultimatesoftware.com/foundation/authentication/clientaccesskey">

0QMDG

</ClientAccessKey>

<a:MessageID>urn:uuid:3d6bc06c-b4c1-4469-ba70-0909e80da211</a:MessageID>

<a:ReplyTo>

<a:Address>http://www.w3.org/2005/08/addressing/anonymous</a:Address>

</a:ReplyTo>

<a:Tos:mustUnderstand="1">http://tuna4hx/services/EmployeeNewHire</a:To>

</s:Header>

<s:Body>

<NewHireUsaxmlns="http://www.ultipro.com/services/employeenewhire">

<entitiesxmlns:b="http://www.ultipro.com/contracts"xmlns:i="http://www.w3.org/2001/XMLSchema-instance">

<b:Employee>

<b:AddressLine1>123 Maple Ln.</b:AddressLine1>

<b:AddressLine2/>

<b:AlternateEmailAddress/>

<b:AlternateTitle/>

<b:BenefitSeniorityDate>2015-09-16T00:00:00</b:BenefitSeniorityDate>

<b:BirthDate>2001-01-01T00:00:00</b:BirthDate>

<b:City>Piermont</b:City>

<b:CompanyIdentifieri:type="b:CompanyCodeIdentifier">

<b:CompanyCode>C0013</b:CompanyCode>

</b:CompanyIdentifier>

<b:Country>USA</b:Country>

<b:County/>

<b:DeductionBenefitGroup>AUTO</b:DeductionBenefitGroup>

<b:DirectDeposits>

<b:DirectDeposit>

<b:AccountIsActive>1</b:AccountIsActive>

<b:AccountNumber>999999999</b:AccountNumber>

<b:AccountType>C</b:AccountType>

<b:AmountRule>P</b:AmountRule>

<b:BankName>Wells Fargo</b:BankName>

<b:FlatOrPercentAmount>0.50</b:FlatOrPercentAmount>

<b:RoutingNumber>122100024</b:RoutingNumber>

</b:DirectDeposit>

</b:DirectDeposits>

<b:DistributionCenterCode/>

<b:EarningsGroup>EXEC</b:EarningsGroup>

<b:EmailAddress/>

<b:EmployeeNumber>asdfar343</b:EmployeeNumber>

<b:EmployeeType>reg</b:EmployeeType>

<b:EthnicOrigin>1</b:EthnicOrigin>

<b:FederalAdditionalAmountWithheld>0</b:FederalAdditionalAmountWithheld>

<b:FederalEmployeeClaimsExempt>false</b:FederalEmployeeClaimsExempt>

<b:FederalFilingStatus>m</b:FederalFilingStatus>

<b:FederalSubjectToBackupWithholding>false</b:FederalSubjectToBackupWithholding>

<b:FederalTotalAllowancesClaimed>0</b:FederalTotalAllowancesClaimed>

<b:FederalW2Pension>false</b:FederalW2Pension>

<b:FirstName>Joe</b:FirstName>

<b:FormerLastName/>

<b:FullOrPartTime>f</b:FullOrPartTime>

<b:Gender>f</b:Gender>

<b:HireDate>2015-09-15T00:00:00</b:HireDate>

<b:HireSource/>

<b:HomePhone/>

<b:HourlyOrSalaried>h</b:HourlyOrSalaried>

<b:I9Verification/>

<b:JobCode>ACCTG</b:JobCode>

<b:JobGroup/>

<b:LastName>Tester</b:LastName>

<b:LocalWorkInTaxResidentStatus/>

<b:LocationCode>FL</b:LocationCode>

<b:MailStop/>

<b:MaritalStatus/>

<b:MiddleName/>

<b:NextPerformanceReviewDate>0001-01-01T00:00:00</b:NextPerformanceReviewDate>

<b:NextSalaryReviewDate>0001-01-01T00:00:00</b:NextSalaryReviewDate>

<b:OrgLevel1/>

<b:OrgLevel2/>

<b:OrgLevel3/>

<b:OrgLevel4/>

<b:OtherPhone/>

<b:OtherPhoneExtension/>

<b:OtherPhoneType/>

<b:OtherRate1i:nil="true"/>

<b:OtherRate2i:nil="true"/>

<b:OtherRate3i:nil="true"/>

<b:OtherRate4i:nil="true"/>

<b:PTOPlans>

<b:EmployeeAccrual>

<b:Available>0.0000</b:Available>

<b:EarnedThroughDate>2020-05-05T12:00:00</b:EarnedThroughDate>

<b:Plan>IKANOR</b:Plan>

<b:ResetDate>2020-05-05T12:00:00</b:ResetDate>

</b:EmployeeAccrual>

</b:PTOPlans>

<b:PayAutomatically>false</b:PayAutomatically>

<b:PayGroup>WEBPRB</b:PayGroup>

<b:PayRate>0</b:PayRate>

<b:PayRateType>H</b:PayRateType>

<b:PayScaleCode/>

<b:PreferredFirstName/>

<b:Prefix/>

<b:Project/>

<b:ResidentCounty/>

<b:ResidentJurisdiction/>

<b:ResidentStateAdditionalAllowances>0</b:ResidentStateAdditionalAllowances>

<b:ResidentStateAdditionalAmountWithheld>0</b:ResidentStateAdditionalAmountWithheld>

<b:ResidentStateEmployeeClaimsExempt>false</b:ResidentStateEmployeeClaimsExempt>

<b:ResidentStateFilingStatus>M</b:ResidentStateFilingStatus>

<b:ResidentStateTotalAllowancesClaimed>0</b:ResidentStateTotalAllowancesClaimed>

<b:ResidentStateTotalAllowancesClaimedCurrencyAmount>0

</b:ResidentStateTotalAllowancesClaimedCurrencyAmount>

<b:SSN>123458771</b:SSN>

<b:ScheduledHours>0</b:ScheduledHours>

<b:SelfServicePropertiesxmlns:c="http://schemas.microsoft.com/2003/10/Serialization/Arrays">

<c:KeyValueOfstringstring>

<c:Key/>

<c:Value/>

</c:KeyValueOfstringstring>

</b:SelfServiceProperties>

<b:SeniorityDate>2015-09-16T00:00:00</b:SeniorityDate>

<b:ShiftCode/>

<b:ShiftGroup/>

<b:StateGeographicCode/>

<b:StateOccupationalCode>11-2021</b:StateOccupationalCode>

<b:StateOrProvince>LA</b:StateOrProvince>

<b:StepNoi:nil="true"/>

<b:Suffix/>

<b:Supervisori:type="b:SsnIdentifier">

<b:CompanyCode>C0013</b:CompanyCode>

<b:Ssn>373299087</b:Ssn>

</b:Supervisor>

<b:TimeClock/>

<b:UnionLocal/>

<b:UnionNational/>

<b:WorkExtension/>

<b:WorkPhone/>

<b:WorkStateAdditionalAllowances>0</b:WorkStateAdditionalAllowances>

<b:WorkStateAdditionalAmountWithheld>0</b:WorkStateAdditionalAmountWithheld>

<b:WorkStateDisabilityPlanType/>

<b:WorkStateEmployeeClaimsExempt>false</b:WorkStateEmployeeClaimsExempt>

<b:WorkStateFilingStatus>M</b:WorkStateFilingStatus>

<b:WorkStatePlan/>

<b:WorkStateTotalAllowancesClaimed>0</b:WorkStateTotalAllowancesClaimed>

<b:WorkStateTotalAllowancesClaimedCurrencyAmount>0

</b:WorkStateTotalAllowancesClaimedCurrencyAmount>

<b:ZipOrPostalCode>33172</b:ZipOrPostalCode>

</b:Employee>

</entities>

</NewHireUsa>

</s:Body>

</s:Envelope>© 2024 UKG Inc. All rights reserved. For a full list of UKG trademarks, visit https://www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners.

This document and all information contained herein are provided to you "AS IS" and UKG Inc. and its affiliates (collectively "UKG") make no representation or warranties with respect to the accuracy, reliability, or completeness of this document, and UKG specifically disclaims all warranties, including, but not limited to, implied warranties of merchantability and fitness for a particular purpose. The information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG. Nothing herein constitutes legal, tax, or other professional advice. All legal, tax, or other questions or concerns should be directed to your legal counsel, tax consultant, or other professional advisor. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.