Monitor eFiling Status for ACA Employer Services

Monitor eFiling Status

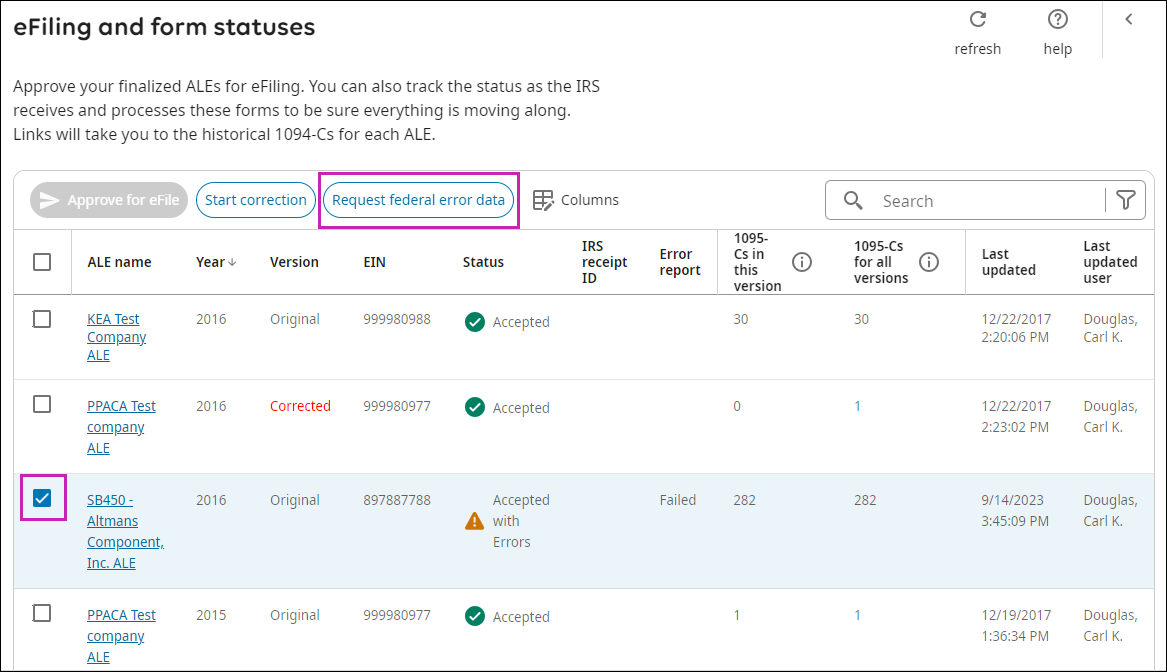

ACA Employer Services customers can monitor the eFiling status of applicable large employer (ALE) members from the eFiling and Form Statuses page.

As the file is processed, the status is updated on the page. Since there is no automatic alert or notification sent when a status change occurs, it is recommended that you review this page to monitor the different status types and take action, as follows:

| Status Types | Description | Action/Result |

|---|---|---|

| Ready to File | After the ALE is finalized, this status confirms that the ALE is ready to file to the IRS. | Select the Approve for eFile button. |

| Pending | After the Approve for eFile button is selected, this status confirms that the file is starting to queue for submission. | Monitor this page periodically for a status update. |

| Submitted for eFiling | After the Approve for eFile button is selected, this status confirms that the file has been successfully queued for submission. | Monitor this page periodically for a status update. |

| Processing by IRS | Confirms that the IRS has received the ALE file and is determining acceptability. | Monitor this page periodically for status to update. A receipt ID is provided in the applicable column. |

| Accepted | IRS has determined ALE files have been accepted without errors. | Filing process is complete. A receipt ID is provided in the applicable column. |

| Accepted with Errors | IRS has determined ALE files have been accepted but contain errors. | Select the Request Federal Error Data button to download and review the IRS error report. A receipt ID is provided in the applicable column. |

| Replacement Required | ALE file contains errors and is unable to be accepted. | Submit a case with your ACA Benefits Specialist to receive follow-up instructions. |

| Failed | IRS was not able to receive ALE files. | Submit a case with your ACA Benefits Specialist to receive follow-up instructions. |

It is important to monitor the eFiling status to ensure the appropriate action is taken, when needed.

- From the eFiling and Form Statuses page, check the box next to the desired ALE name in Ready to File status.

- Select Approve for eFile. The status initially updates to Pending, and then to Submitted for eFiling once it has been successfully queued for submission.

- Continue to monitor this page for status updates and take appropriate action, as needed.

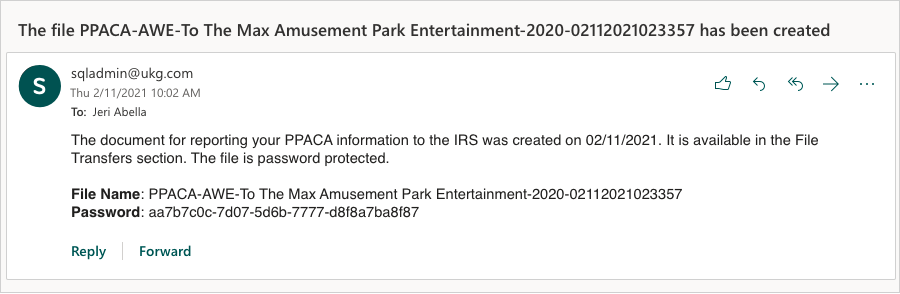

Request Federal Error Data

To download and review your Accepted with Errors information from the IRS:

© 2023 UKG Inc. All rights reserved. For a full list of UKG trademarks, visit https://www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners.

This document and all information contained herein are provided to you "AS IS" and UKG Inc. and its affiliates (collectively "UKG") make no representation or warranties with respect to the accuracy, reliability, or completeness of this document, and UKG specifically disclaims all warranties, including, but not limited to, implied warranties of merchantability and fitness for a particular purpose. The information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG. Nothing herein constitutes legal, tax, or other professional advice. All legal, tax, or other questions or concerns should be directed to your legal counsel, tax consultant, or other professional advisor. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.