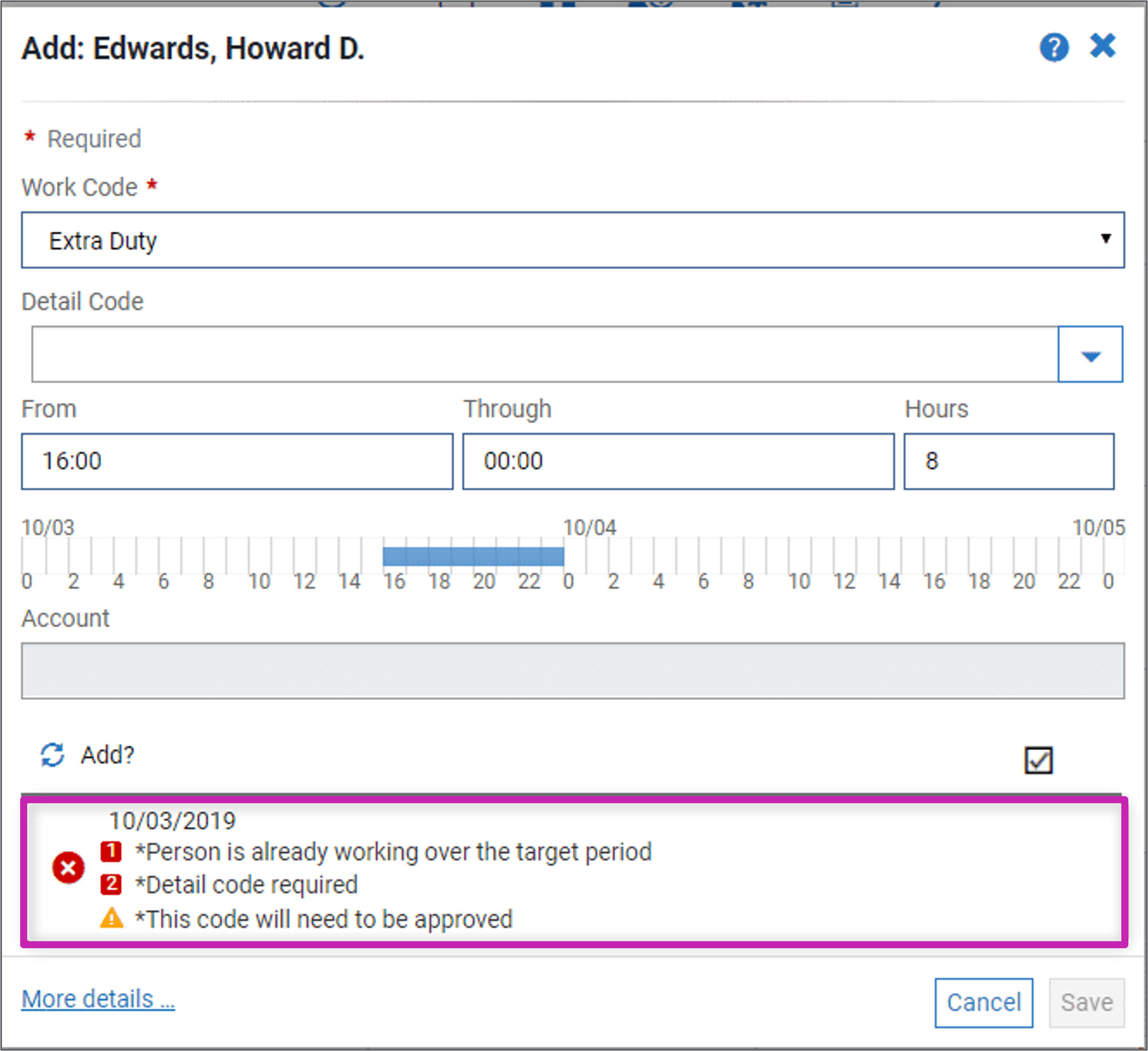

Issues Table

Work Code Issues

When adding a work code in the UKG TeleStaff solution, you may be presented with warnings before submitting. You may even be prohibited from adding the work code. This is due to Issues.

The ability to add work codes is determined by your organization's business rules. Dynamic and static issues prevent users from adding work codes that fail a business rule or system rule.

Issues Override

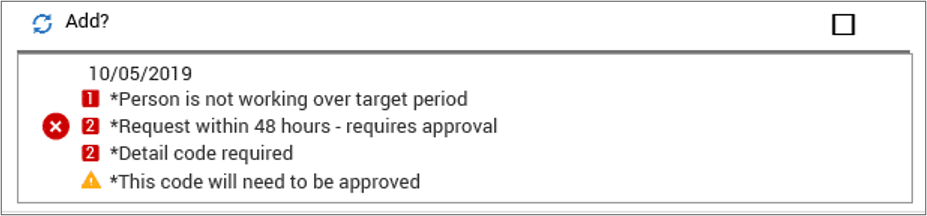

When issues are listed in the UKG TeleStaff solution, there may be a number one or two in a box, indicating an approval hierarchy based on configuration.

Different users within the solution may have different permissions when it comes to managing work codes. For example, a mid-level scheduler may be able to override all level two issues but stopped by a level one issue, while managers have the override capability for both level one and two issues. The ability to grant superior override authority allows organizations to grant hierarchy over overriding both system and department issues and policies.

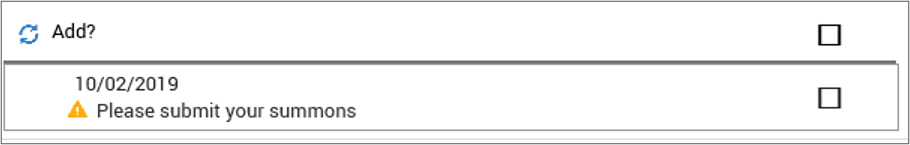

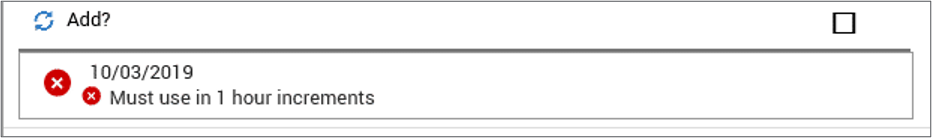

Multiple symbols may appear to indicate the type of issue being presented.

Circle with a Checkmark

Triangle with an Exclamation Point

Red Circle with Numbered Boxes

Two Red Circles with X

Yellow Circle with X

Indicates there is an issue associated with the record but the record may still be submitted if the employee has the correct authorities; namely the authority the employee is logged in as. This means the logged in employee has the override authority of the number listed in the red box.

© 2024 UKG Inc. All rights reserved. For a full list of UKG trademarks, visit https://www.ukg.com/trademarks. All other trademarks, if any, are the property of their respective owners.

This document and all information contained herein are provided to you "AS IS" and UKG Inc. and its affiliates (collectively "UKG") make no representation or warranties with respect to the accuracy, reliability, or completeness of this document, and UKG specifically disclaims all warranties, including, but not limited to, implied warranties of merchantability and fitness for a particular purpose. The information in this document is subject to change without notice. The document and its content are confidential information of UKG and may not be disseminated to any third party. No part of this document or its content may be reproduced in any form or by any means or stored in a database or retrieval system without the prior written authorization of UKG. Nothing herein constitutes legal, tax, or other professional advice. All legal, tax, or other questions or concerns should be directed to your legal counsel, tax consultant, or other professional advisor. All company, organization, person, and event references are fictional. Any resemblance to actual companies, organizations, persons, and events is entirely coincidental.