The focus of this chapter is to show you how to establish and maintain deduction codes for garnishments and levies at the company level.

The main topics covered in this chapter include:

A garnishment is a court action, initiated by a creditor in effect to obtain a part of the employee’s earnings, prior to the earnings being turned over to the employee. With garnishments, the employer is required to withhold from an employee’s pay that portion which is being garnished and pay it directly to the creditor. The employee garnishment function allows you to establish a number of garnishments to an employee. The system will specify and track an employee’s garnishments as necessary.

With garnishments the system requires you to:

Determine the proper controlling jurisdiction and rules for tax levies.

Determine the "excluded earnings," and "allowed deductions" components of disposable income.

Enter data into a table that has both company and employee level information.

Establish a separate deduction for fees and determine the amount and frequency.

The system automatically:

Calculates disposable income (take home pay), earnings exempt from garnishments and maximum amount subject to garnishments.

Calculates flat amounts and percentage of disposable income garnishment deductions and stores the federal yearly exemption tables for Federal Tax Levies.

Includes necessary calculations for child support.

Note: Calculations for multiple child support garnishments respect the rules for maximum percentage allowed for deduction. Multiple child or spousal support wage attachments should be marked for allocation in order for UltiPro to calculate the correct amount when the employee does not have enough disposable income to satisfy all garnishments in payroll.

The software is delivered with a number of system-level tables. It is the information stored in these tables along with the data and preferences you establish on the company level that validates the information you enter on the employee level.

Note: System-level tables are termed just that because the values they contain are necessary for overall system processing. For this reason, system-level tables are the same for all users and cannot be modified in any way. Company-level tables are user defined because the information you establish on them relates specifically to your organization.

The following is a summary of the system-level tables associated with garnishments.

|

Table Name |

Description |

|

WGCDMAST |

This table stores information for all types of garnishments and levies, by jurisdictions, which are supported by Ultimate Software. This table is populated during master company setup. |

|

WGLVMAST |

This table stores amounts exempt from levies for multiple years. |

The following is a summary of the company-level tables associated with garnishments.

|

Table Name |

Description |

|

WGCDCOMP |

This table stores federal and user-defined information for garnishments and levies, by jurisdictions that are applicable across component companies. The federal codes are populated during master company setup. The information stored in this table is used to link the deduction code assigned to the garnishment type. |

|

GEXCLERN |

Because some jurisdictions allow you to declare some earnings as exempt, this table stores earnings that are excluded from the disposable pay calculation. For example, a state may not consider third-party sick payment earnings for disposable income calculation purposes. |

|

GINCLDED |

Because there are some jurisdictions that allow you to include certain deductions when calculating disposable income, this table stores deductions that are included in the disposable pay calculation. For example, a state may allow employees to exclude life insurance deductions. |

You establish deduction information and attachments for garnishments and levies on the Deduction/Benefit Plans code setup window. For garnishment and levies, most of the deduction information you configure is similar to other deduction codes, such as the code, description, and pay period schedule. This chapter includes only the deduction code information that is specific to garnishment and levy deduction codes. For additional information about setting up deduction codes, refer to Chapter 9, "Establishing Deduction and Benefit Plans."

You can also group multiple garnishment deduction codes together for reporting purposes by establishing a deduction type and a deduction report category for garnishments. For additional information about deduction types and deduction report categories, refer to Chapter 8, "Establishing Deductions and Benefits."

After you configure the company deduction code for the garnishment, you must assign the deduction code a deduction group. Then you can assign the deduction code to any applicable who has a deduction group that includes the garnishment deduction code. For additional information about setting up deduction groups, refer to Chapter 8, "Establishing Deductions and Benefits."

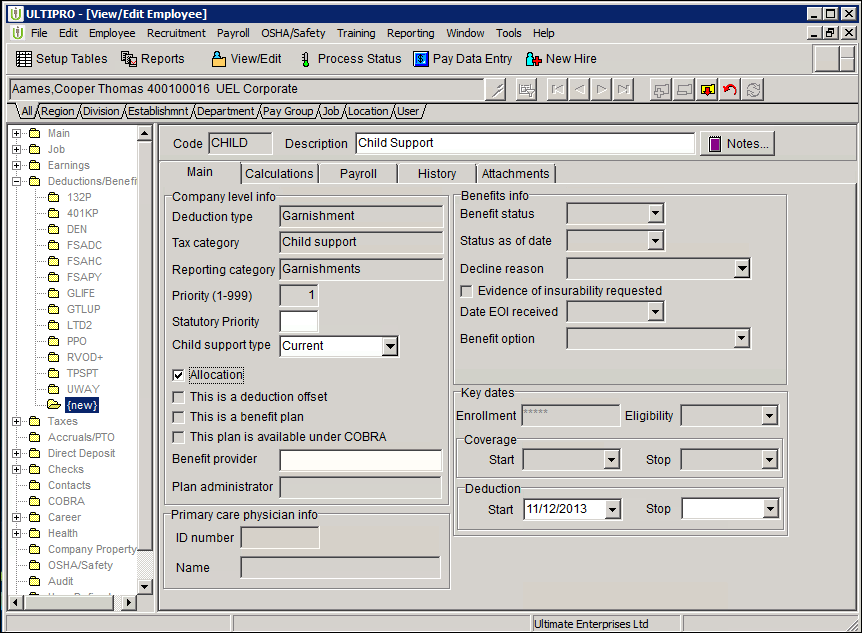

To configure a company-level deduction code, on the Main window of the Deduction/Benefit Plans window, select the applicable tax category.

|

To deduct: |

Select this tax category: |

|

Garnishments for child support payments |

Child support |

|

Wage garnishments for leans or other liabilities |

Garnishment |

|

Levies against wages for tax jurisdictions |

Tax levy |

You do not need to populate coverage or deduction rules fields, since you generally need to begin deducting garnishment and levy amounts as soon as you get notice of them. Depending on the type of garnishment or levy, you may want to have the deduction applied to additional or manual checks, and you may want to deduction partial amounts when the employee's pay is not sufficient to deduct the entire amount.

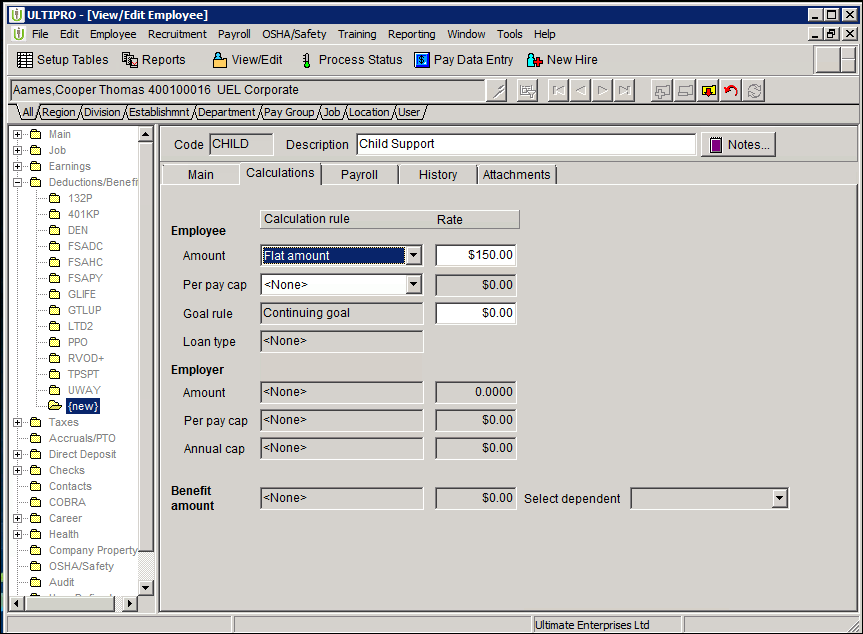

Also configure the Calculations window of the Deduction/Benefit Plans page tab. Generally, for garnishments you will designate a calculation rule, per pay cap, and goal amount at the employee level. For tax levies, the calculation rule is determined at the system level and you cannot assign a calculation rule, however, you designate the per pay cap at the employee level.

To establish company level deduction codes for garnishments and levies

From the File menu, select Setup, then Codes.

In the navigator picklist, select Deduction/Benefit Plans.

From the toolbar, click the Add Code button.

Enter the code and description for the garnishment or levy deduction code. For example, for a child support garnishment you can use the code "Child" and the description "Child Support."

In the Tax category field, select the applicable tax category.

|

To deduct: |

Select this tax category: |

|

Garnishments for child support payments |

Child support |

|

Wage garnishments for leans or other liabilities |

Garnishment |

|

Levies against wages for tax jurisdictions |

Tax levy |

Designate any additional information you want to apply to the garnishment or levy, such as whether you want the deduction applied to additional or manual checks.

Click the Calculations tab.

Designate the calculation information.

|

For this type of deduction: |

Designate this information: |

|

Garnishment |

|

|

Levy |

The goal amount, if applicable |

From the toolbar, click the Save button.

After you configure a garnishment or levy deduction code and assign it to deduction/benefit groups, you can assign the deduction to applicable employees. Remember, you can only assign a deduction code to an employee if the deduction code is in the employee's deduction group.

Garnishments may not exceed the lesser of:

25% of an employees disposable earnings

or

The amount by which the employee’s disposable earnings for the week exceed 30x’s the federal minimum wage then in effect.

Note: These limits do not apply to: bankruptcies, federal and state tax levies, or child support.

Child support amounts can be increased to 55% and 65%, respectively, if the employee is at least 12 weeks in arrears.

Garnishments exempt items are:

Unemployment compensation benefits

Workers’ compensation benefits

Annuity and pension payments under the Railroad Retirement Tax Act

Certain armed service-connected disability payments

Certain public assistance payments (welfare and supplemental social security benefits)

Amounts ordered withheld under a previously issued court order for child support

Under current tax regulations these exempt items may be subject to a continuing levy on up to 15% of these payments.

Wages already subject to withholding for levies are not subtracted from gross earnings to determine disposable earnings. However, if a tax levy or bankruptcy order has priority over the current child support order, the amount required to be deducted under the order(s). Priority must be taken into account when determining whether the maximum limit has been reached.

Note: If an employee requests a tax levy for a flat amount, the employee does not have a "tax levy". What the employee has is a voluntary payment agreement, which is configured as a flat amount deduction. Form 668-W must be applied to the employee for it to be a true tax levy.

You can configure a garnishment to continue automatically depending upon the employee’s pay frequency and deduct the following percentage from the employee’s pay after all allowable deductions are taken:

If paid weekly - 6 1/4%

If paid bi-weekly or semi-monthly - 12 1/2%

If paid monthly - 25%

The priority chart is provided to help you set priorities when your employees have multiple garnishments. Court orders are unique to the employee. In some court orders medical benefits are court mandated and must be included in computing the garnishment. Recognize that if there are multiple wage attachments for the same employee, the combined total cannot exceed 25 percent of his or her disposable earnings. You need to calculate the garnishment amount yourself and adjust the garnishment accordingly.

The following chart indicates the competing priorities of various types of garnishments and wage attachments.

|

Garnishment Type |

Priority |

Minimum |

Maximum |

Garnishment Formula |

|

Bankruptcy Chapter 13 -Reorganization |

First & Only |

None specified. |

No specified limit. |

Pursuant to the court order. This order encompasses ALL garnishment and support amounts as determined by the court. |

|

Federal Tax Lien/Levy |

Second, unless child support order was in before date of levy. |

None specified. |

No specified limit. Determined by the 668-W |

All amounts paid to an employee are subject to levy except Exempt items. |

|

State Tax Lien/Levy |

Third, unless child support order was in before date of levy. |

None specified. |

Individual states may impose their own limits. |

Pursuant to individual states’ formulas. |

|

Child Support |

Second, but only if order is in before date of tax levies. |

None specified. |

50% of disposable earnings if supporting another child. 60% of disposable earnings otherwise. 55% & 65% if in arrears |

Disposable Earnings = Gross Earnings - Federal – State – Local – Social Security – Medicare – Disability - State Retirement Plans |

|

Loans Student |

No guidance as to priority, except that child support takes priority over student loans. |

None specified. |

10% of disposable earnings, if state guarantee loan. 15% of disposable earnings, if federal loan. (1) |

Disposable Earnings = Gross Earnings - Federal – State – Local – Social Security - Medicare - Disability – State Retirement Plans |

|

Wage Attachment |

In order which received by employer. |

None specified. |

Lesser of 25% disposable earnings OR amt. To which exceeds 30xFedMinWage- States do restrict amount |

According to each individual state’s law, you can have a percentage (%) or fixed dollar ($) amount. |

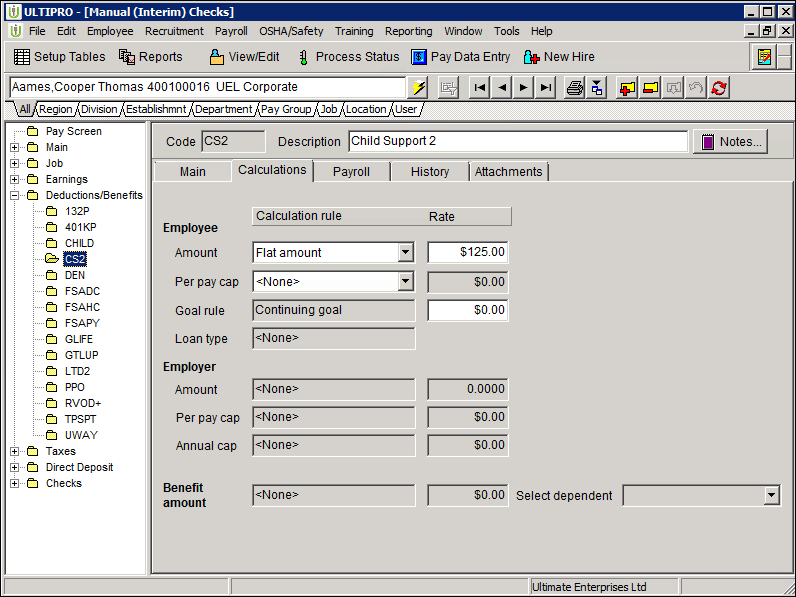

On the Calculations page tab of the employee Deductions/Benefits window, designate the employee's deduction amount, per pay cap, and goal amount for the garnishment or levy.

On the Payroll page tab of the employee Deductions/Benefits window, indicate additional information for the garnishment or levy.

In addition to the general deduction information you configure on the Payroll page tab (such as whether you want the deduction applied to additional and manual checks), indicate the following information for the garnishment or levy deduction.

In the Payee field, select to whom you send the funds for the garnishment or levy. This field includes the payees you configure at the company-level on the Providers, Admin., Vendors and Payees company code setup window.

In the Member/case number field, enter the employee's case number for this garnishment or levy.

In the Fed/state indicator field, select the state (or Federal) with jurisdiction for this employee's garnishment.

In the Garnishment/wage attachment type field, select the type of garnishment or levy for this deduction.

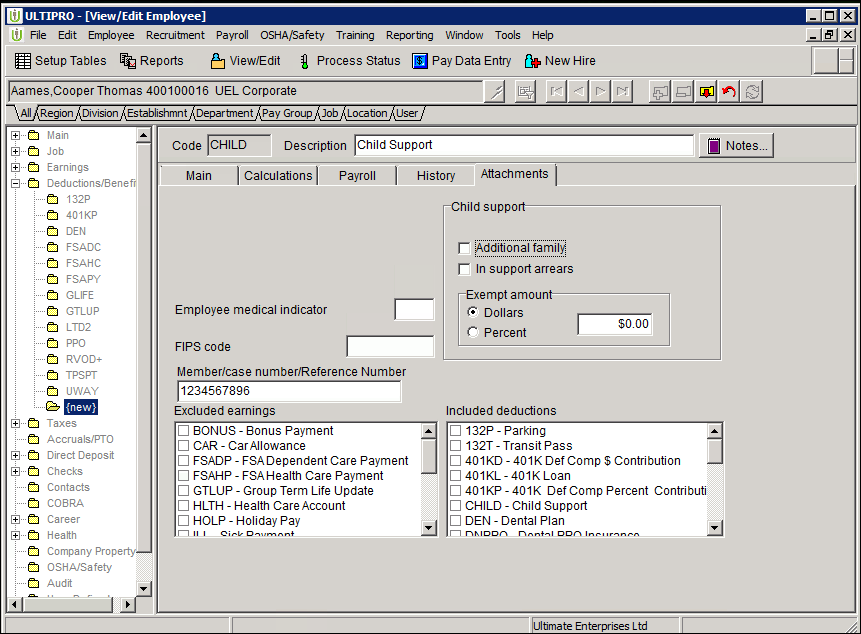

The Attachments page tab appears slightly differently based on whether the tax category at the company-level is garnishment, child support, or tax levy.

On the Attachments page tab, designate the following information for a garnishment.

From the list of earning codes, indicate which earnings are excluded from the deduction calculation. When the employee receives these earnings, the earning amounts will not be included to calculate the deduction amount.

From the list of deduction codes, indicate which deductions are included in the deduction calculation. The garnishment or levy amount is calculated before these deductions are subtracted from the employee's pay.

The Levy information group box appears on the Attachments window only if the Tax Levy tax category is selected for the company-level deduction code. The Levy information group box contains fields that provide information specific to how much take home pay can be subjected to levies and what amounts, if any, are exempt.

Filing Status indicates the employee’s status for levy purposes only, such as single, married, divorced, etc. This information can be found on the third window of the employee's Form 668-W. This is not the employee's tax filing status for payroll purposes.

Tax Year indicates for which tax year the employee's wages are being levied.

Exemptions are the allowable number of dependents the employee can have for tax levy purposes.

Additional exemptions are any additional exemptions the employee claims that you can verify.

The Child support group box appears on the Attachments page tab only if the Child Support tax category is selected for the company-level deduction code. The Child support group box contains fields that provide information on the percentage amount of the attachment when the employee is supporting an additional family or is in arrears.

The Additional family field indicates the percentage amount of the attachment when the employee is supporting an additional family (per child support orders).

The In support arrears field indicates the percentage amount of the attachment when the employee is in arrears (per child support orders).

The Exempt amount field indicates the percentage or dollar amount of the attachment when additional amounts are to be excluded from the calculation.

Note: When specifying an exempt amount in dollars, the field does not accept dollar amounts been $0.01 and $0.99. The message "Invalid amount - .00 to .99 cents is not permitted with the dollars option" appears when an invalid entry is made.

When using the North or South Dakota garnishment code (NDGAR or SDGAR, respectively), different fields appear on the Attachment page tab to indicate the number of dependents and the exempt amount. In these states, the maximum amount subject to garnishment for any work week must be reduced by a specific amount (exempt amount) of the disposable income total for each dependent family member residing with the employee (other than the employee himself).

In the Exemptions field, enter the number of dependent family members residing with the employee (other than the employee himself).

In the Exempt amount field, enter the dollar amount exempt for each exemption (dependent):

For North Dakota (NDGAR), the maximum amount subject to garnishment for any work week must be reduced by $20.00 of the disposable income total for each dependent.

For South Dakota (SDGAR), the maximum amount subject to garnishment for any work week must be reduced by $25.00 of the disposable income total for each dependent.

Note: The Total Exemption amount is calculated based on the number of exemptions and the exemption amount ($) entered.

To configure an employee garnishment or levy deduction

From the Employee menu, select View/Edit.

Use the Super Finder to select the employee.

In the navigator outline, select Deductions/Benefits. The Deductions & Benefits Summary window appears.

From the toolbar, click the Add Code button. The Deduction/Benefit Add Dialog window appears.

Select the garnishment or levy deduction code that pertains to the employee, and click OK.

On the Main window, enter the effective date. If it is greater than the current date, the change will take effect immediately.

Click the Calculations tab and indicate the following information, as applicable:

how the employee's deduction amount is calculated

the cap amount for each pay period

the goal amount

Click the Payroll tab and indicate the following information for this garnishment or levy:

to whom are the garnishment or levy funds paid

the employee's member or case number

the state in which the garnishment or levy is applied

the type of garnishment or levy

Click the Attachments tab and indicate the following:

which earning amounts are not included to calculate the garnishment or levy deduction amount

which deduction amounts are included to calculate the garnishment or levy deduction amount

If you are setting up a levy deduction, in the Levy information group box indicate the following information:

the employee's filing status applicable to this levy

the tax year for which the employee's wages are being levied

the employee's exemptions applicable to this levy

the employee's additional exemptions applicable to this levy

If you are setting up a child support deduction, in the Child support group box indicate the following information:

additional family

in support arrears

exempt amount (dollars or percent) of $1.00 or greater

allocation

child support type

If you will be exporting child support payments for employees, indicate the following information:

whether the non-custodial parent (the parent paying child support) provides medical coverage for the child

the Federal Information Process Standard (FIPS) code of the child support entity receiving the transaction

If you are setting up a North or South Dakota garnishment, enter the following information in the fields that appear:

Exemptions (number of dependents)

Exemption amount (dollar)

From the toolbar, click the Save button. The Deductions/Benefits History window appears.

Select the reason you are adding the deduction, then click OK.

The ACH Child Support Export option enables you to automatically submit employees' child support payments, via a National Automated Clearing House Association (NACHA) file transfer format, to a centralized state collection bank. This state-specific NACHA file contains only child support payment information for employees who have state-issued support orders.

Currently, specific Universal NACHA templates are provided for employee child support payments in Illinois and Massachusetts. However, these templates can be copied (Save as) and renamed to use for child support payments in other states that support this method of payment.

When using the Illinois and Massachusetts Garnishment templates, you must define the following bank details in Record 6 of the NACHA file template:

|

Bank Information |

Beginning Position |

Length |

|

Routing number |

4 |

8 |

|

Routing number check digit |

12 |

1 |

|

Account Number |

13 |

7 |

Refer to Chapter 4 of the Import/Export Guide for additional information about customizing the Universal NACHA templates.

Note: Ultimate Software uses the Memo field (Trx_Rec7Memo) in the '7' Addendum record of the templates for standard information that cannot be edited. If your state requires different data in this field, you must contact Ultimate Software Customer Support and request the necessary changes.

Note: For best results, create and verify a test file before transmitting your child support payments.

To create a child support export file:

From the Tools menu, select ACH Child Support Export. The ACH Child Support Export Manager window appears.

Select the predefined garnishment code for this export.

Select the Universal NACHA template for the associated state.

Select the employer bank.

Select the pay date.

Define the export file name.

Click on the Create file button.

Refer to the following sections of this chapter for details and examples on how UltiPro supports the various types/combinations of multiple wage attachments:

UltiPro provides the ability to assign multiple child support orders to an employee with disposable income limits applied across all orders.

Total child support deductions may not exceed the state specified limits of disposable income ( limits include 50%, 55%, 60%, and 65%). These limits vary based on selections made on the Attachments page tab in the employee view/edit Deductions & Benefits window.

To configure multiple child or spousal support deductions for an employee, select the Allocations check box on the Main page tab in the employee view/edit Deductions & Benefits window. When a support deduction is marked for Allocation and an employee does not have enough disposable income in payroll to satisfy all of his/her support deductions, UltiPro will allocate the available wages to each deduction according to state requirement.

In order for UltiPro to calculate the allocation correctly in payroll, each

support deduction assigned to an employee must be configured with the same

information for specific deduction fields.

The following fields must be

identical for each support deduction assigned to an employee:

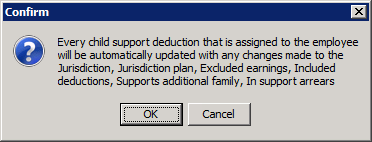

Note: When an employee has an existing support deduction marked for allocations, any new support deductions added will synchronize with the existing aligned fields and will automatically be marked for Allocation. Changes to the aligned fields on existing support deductions will automatically affect the other allocated support deductions.

Once a support deduction is configured for allocations, you cannot automatically revert back to the original configuration by unchecking the allocation box on an existing deduction. You must configure all the support deductions again without allocation checked if you no longer want to allocate.

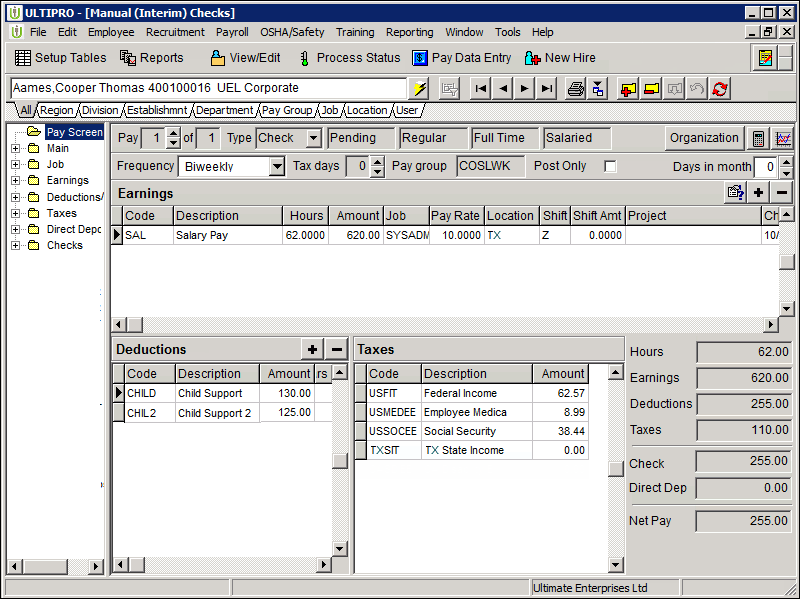

This example illustrates how employee deductions for two child support orders are configured, calculated, and withheld when the employee does not have enough disposable income to satisfy all of the orders. The allocation method used in this example is Equal Distribution.

Note: The allocation method is determined by the state that the employee works. Kansas, Texas, Washington and Guam are the only states that currently use the Equal Distribution method for child support allocations.

Deduction Setup: In this example, the following two deduction codes are used. The statutory priority is defaulted to zero. When the Statuary Priority is zero, the deduction will calculate according to the priority listed in the tax category.

Deduction 1

The first child support order, CHILD, is requested for $150.00.

Texas state rule for employees is 50% of disposable income.

Texas uses the Equal Distribution method of allocating child support orders.

The deduction is considered Current on payments.

Refer to the figures below for the deduction configuration details in this example.

Note: The jurisdiction is determined by the employee’s work-in state (the state at which the employee earns his or her wages). If an employee works a different state while paying a child support deduction, the Jurisdiction and Jurisdiction Plan fields will need to be updated to the new state.

Deduction 2

The second deduction, CHIL2, is requested for $125.00.

Texas state rule for employees is 50% of disposable income.

Texas uses the Equal Distribution method of allocating child support orders.

The deduction is considered Current on payments.

Note: Both child support deductions are marked for Allocation. When Allocations is checked, the following fields will align across all of the employees’ child or spousal support deductions: Jurisdiction, Jurisdiction Plan, Excluded Earnings, Included Deductions, In Support Arrears, and Supports Additional Family.

Resulting Calculations: In this example, the total of the two child support deductions (CHILD + CHIL2) is divided by 50%. This is the highest percent that can be deducted from the employee's disposable income. The highest percentage is used to ensure that the total of the deductions does not exceed the highest allowed disposable income across all deductions.

$275.00 / 0.50 = $550.00

The resulting amount of $550.00 is the disposable income threshold. If the

employee's disposable income is less than this threshold amount, then the total

amount withheld for all garnishment deductions CANNOT exceed 50% of the

employee's disposable income.

Based on the values shown below for gross

earnings ($620.00) and taxes ($110.00), the employee's disposable income for

this example is $510.00.

$620.00 - $110.00 = $510.00

Final Deduction Amounts: Since the employee's disposable income ($510.00) is LESS than the threshold amount of $550.00, only 50% of the employee's disposable income may be deducted as the total amount for all child support deductions.

$550.00 * 0.50 = $255.00 (this is the maximum amount that may be deducted)

Because the maximum disposable income that can be deducted is less than the total amount of the child support deductions ($255.00 < $275.00), the allowed disposable income will be allocated using the Equal Distribution method.

First, UltiPro will divide the available disposable income by the number of child supports that are included in the allocation.

$255.00 / 2 = $127.50

Then, UltiPro applies the allocated amount to each deduction in turn.

Note: Using the Equal Distribution allocation method, if the allocated amount is greater than a particular support order, any remaining amount will be allocated to the next available support order.

The second order, CHIL2 is sufficed with $125.00 leaving a remaining disposable income of $2.50. This amount will be allocated for the order that cannot be sufficed. In this case, CHILD receives an additional $2.50 for a final withholding balance of $130. 00

CHILD: $127.50 + $2.50 = $130.00

CHIL2: $125.00

Therefore, in this example, $130.00 will be withheld for the firsts support deduction (CHILD) and $125.00 will be withheld for the second deduction (CHIL2), so as not to exceed the 50% limit.

$125.00 + 130.00 = $255.00

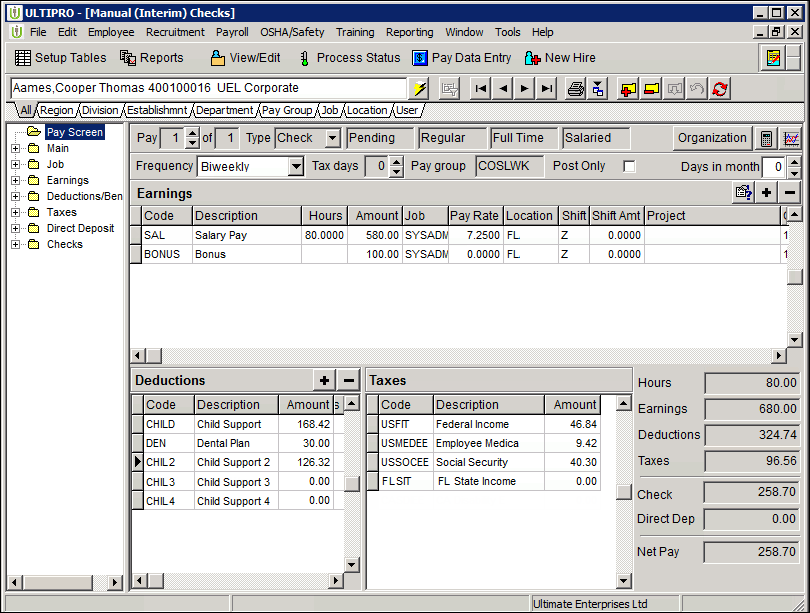

This example illustrates how employee deductions for two child support orders are configured, calculated, and withheld when the employee does not have enough disposable income to satisfy all of the orders. The allocation method used in this example is Pro Rata.

Deduction Setup: In this example, the following two deduction codes are used. The statutory priority is defaulted to zero. When the Statuary Priority is zero, the deduction will calculate according to the priority listed in the tax category.

Deduction 1

The first deduction, CHILD, is requested for $200.00.

The jurisdiction is Florida State and the employee is supporting an additional family. With these factors applied, the deduction cannot exceed 65%.

Florida uses the Pro Rata method of allocating child support orders.

The deduction is considered Current on payments.

Review the figures below for the deduction configuration details in this example.

Note: The jurisdiction is determined by the employee’s work-in state (the state at which the employee earns his or her wages). If an employee works a different state while paying a child support deduction, the Jurisdiction and Jurisdiction Plan fields will need to be updated to the new state

Deduction 2

The second deduction, CHIL2, is requested for $150.00.

The jurisdiction is Florida State and the employee is supporting an additional family. With these factors applied, the deduction cannot exceed 65%.

The deduction is considered Current on payments.

Refer to the figures below for the deduction configuration details in this example.

Note: Both child support deductions are marked for Allocation. When Allocations is checked, the following fields will align across all of the employees’ child or spousal support deductions: Jurisdiction, Jurisdiction Plan, Excluded Earnings, Included Deductions, In Support Arrears, and Supports Additional Family.

Resulting Calculations: In this example, the total of the two child support deductions (CHILD + CHIL2) is divided by 65%. This is the highest percent that can be deducted from the employee's disposable income. The highest percentage is used to ensure that the total of the deductions does not exceed the highest allowed disposable income across all deductions.

$350.00 / 0.65 = $538.46

The resulting amount of $538.46 is the disposable income threshold. If the employee's disposable income is less than this threshold amount, then the total amount withheld for all garnishment deductions CANNOT exceed 65% of the employee's disposable income.

Based on the values shown below for gross earnings ($680.00), taxes ($96.56), excluded earnings ($100), and included deductions ($30), the employee's disposable income for this example is $453.44.

$680.00 - $96.56 - $100.00 - $30.00 = $453.44

Final Deduction Amounts: Since the employee's disposable income ($453.44) is LESS than the threshold amount of $538.46, only 65% of the employee's disposable income may be deducted as the total amount for both child support deductions.

$453.44 * 0.65 = 294.74 (this is the maximum amount that may be deducted)

Because the maximum disposable income is less than the total amount of the child support deductions ($294.74 < $350), the allowed disposable income will be allocated using the Pro Rata method.

First, UltiPro determines the percentage of each child support deduction against the total child support amounts:

CHILD: $200.00 / $350.00 = 57.14%

CHIL2: $150.00 /

$350.00 = 42.86%

Next, UltiPro calculates the percent of each child support to the total available disposable income.

CHILD: $294.74 * 57.14% = $168.42

CHIL2: $294.74 *

42.86% = $126.32

Therefore, in this example, $168.42 will be withheld for the first child support deduction (CHILD) and only $126.32 will be withheld for the second deduction (CHIL2), so as not to exceed the 65% limit.

$168.42 + $126.32 = $294.74

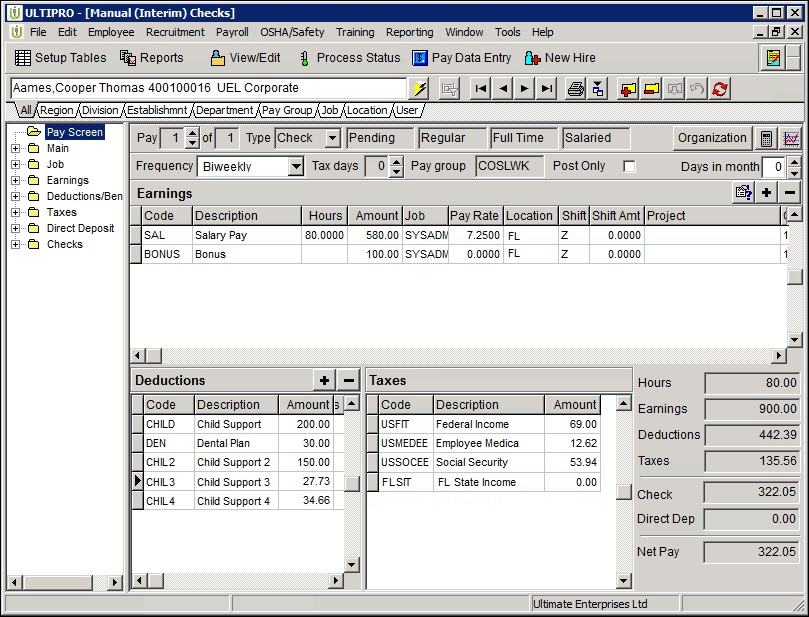

This example illustrates how employee deductions for four child support orders are configured, calculated, and withheld when the employee does not have enough disposable income to satisfy all of the orders. The allocation method used in this example is Pro Rata.

Deduction Setup: In this example, the following four deduction codes are used. The statutory priority is defaulted to zero, however, you are able to update if needed. When the Statuary Priority is zero, the deduction will calculate according to the priority listed in the tax category.

Deduction 1

The first deduction, CHILD, is requested for $200.00.

The jurisdiction is Florida State and the employee is supporting an additional family. With these factors applied, the deduction cannot exceed 65%.

Florida uses the Pro Rata method of allocating child support orders. Each state determines the allocation method (Pro Rata or Equal Distribution).

The deduction is considered Current on payments.

Refer to the figures below for the deduction configuration details in this example.

Deduction 2

The second deduction, CHIL2, is requested for $150.00.

The jurisdiction is Florida State and the employee is supporting an additional family. With these factors applied, the deduction cannot exceed 65%.

Florida uses the Pro Rata method of allocating child support orders. Each state determines the allocation method (Pro Rata or Equal Distribution).

The deduction is considered Current on payments.

Refer to the figures below for the deduction configuration details in this example.

Deduction 3

The third deduction, CHIL3, is requested for $50.00.

The jurisdiction is Florida State and the employee is supporting an additional family. With these factors applied, the deduction cannot exceed 65%.

Florida uses the Pro Rata method of allocating child support orders. Each state determines the allocation method (Pro Rata or Equal Distribution).

The deduction is considered in Arrears on payments.

Refer to the figures below for the deduction configuration details in this example.

Deduction 4

The fourth deduction, CHIL4, is requested for $40.00.

The jurisdiction is Florida State and the employee is supporting an additional family. With these factors applied, the deduction cannot exceed 65%.

Florida uses the Pro Rata method of allocating child support orders. Each state determines the allocation method (Pro Rata or Equal Distribution).

The deduction is considered in Arrears on payments.

Refer to the figures below for the deduction configuration details in this example.

Note: All child support deductions are marked for Allocation. When Allocations is checked, the following fields will align across all of the employees’ child or spousal support deductions: Jurisdiction, Jurisdiction Plan, Excluded Earnings, Included Deductions, In Support Arrears, Supports Additional Family.

Resulting Calculations: In this example, the total of the four child support deductions (CHILD + CHIL2 + CHIL3 + CHIL4) is divided by 65%. This is the highest percent that can be deducted from the employee's disposable income. The highest percentage is used to ensure that the total of the deductions does not exceed the highest allowed disposable income across all deductions.

$440.00 / 0.65 = $676.92

The resulting amount of $676.92 is the disposable income threshold. If the employee's disposable income is less than this threshold amount, then the total amount withheld for all deductions CANNOT exceed 65% of the employee's disposable income.

Based on the values shown below for gross earnings ($900.00), taxes ($135.56), excluded earnings ($100), and included deductions ($30), the employee's disposable income for this example is $634.44:

$900.00 - $135.56 - $100.00 - $30.00 = $634.44

Final Deduction Amounts: Since the employee's disposable income (634.44) is LESS than the threshold amount of $676.92, only 65% of the employee's disposable income may be deducted as the total amount for all child support deductions.

$634.44 * 0.65 = $412.39 (total that may be deducted)

Because the allowed maximum disposable income that can be deducted is less than the total amount of the child support deductions ($412.39 < $440.00), the allowed disposable income will be allocated using the Pro Rata method. The Current orders are included with the available disposable income and will be deducted first. The remaining disposable income will be allocated between the arrears orders.

First, the Current child support orders will be deducted.

$412.39 – $350.00 = $62.39

Note: Child Support Type field determines if the deduction is current or in arrears.

Then, UltiPro determines the percentage of each arrears child support deduction against the total arrears child support deduction amount:

CHIL3: $50.00 / $90.00 = 55.56%

CHIL4: $40.00 / $90.00

= 44.44%

Next, UltiPro calculates the percent of each arrears child support to the total available disposable income.

CHIL3: $62.39 * 56% = $34.66

CHIL4: $62.39 * 44% =

$27.73

Therefore, in this example, $34.66 will be withheld for the third support deduction (CHIL3) and only $27.73 will be withheld for the fourth deduction (CHIL4), so as not to exceed the 65% limit.

$34.66 + 27.73 = $62.39

Total of the deductions may not exceed the specified limit of 25% of the employee's disposable income.Total of the deductions may not exceed the specified limit of 25% of the employee's disposable income.

Because multiple garnishment orders will all have the same deduction tax category statutory priority, the user must enter priority numbers at the employee level for the deductions to be taken in a certain order. If priority numbers are not entered, the deductions will be taken alphabetically or in the order in which they appear in the Deductions Payroll Batch (D-batch) table.

There is no specified total limit for tax levies. The specific rule for each state will be followed.

Because multiple tax levy orders will all have the same deduction tax category statutory priority, the user must enter priority numbers at the employee level for the deductions to be taken in a certain order. If priority numbers are not entered, the deductions will be taken alphabetically or in the order in which they appear in the Deductions Payroll Batch (D-batch) table.

Child support has a higher deduction tax category statutory priority and will ALWAYS be deducted first.

The total of the child support deductions may not exceed the specified limits (50%, 55%, 60%, or 65%) of disposable income (based on selections made on the Attachments tab in the employee view/edit Deductions & Benefits window).

If the total amount(s) deducted for child support already exceeds 25% of the employee's disposable income, then $0.00 can be deducted for the garnishment.

If the total amount(s) deducted for child support DOES NOT exceed 25% of the employee's disposable income, then the remaining amount UP TO 25% of disposable income can be deducted for the garnishment.

Because child support and tax levy orders will all have the same deduction tax category statutory priority, the user must enter priority numbers at the employee level for the deductions to be taken in a certain order. If priority numbers are not entered, the deductions will be taken alphabetically or in the order in which they appear in the Deductions Payroll Batch (D-batch) table.

The total of the child support deductions may not exceed the specified limits (50%, 55%, 60%, or 65%) of disposable income (based on selections made on the Attachments tab in the employee view/edit Deductions & Benefits window).

Even if the total amount(s) deducted exceed 25% of the employee's disposable income, tax levy deductions can still be withheld. There is no specified total limit for levies. The specific rule for each state will be followed.

A tax levy has a higher deduction tax category statutory priority than a garnishment, and will ALWAYS be deducted first.

If the total amount(s) deducted for a tax levy already exceed(s) 25% of the employee's disposable income, then $0.00 can be deducted for the garnishment.

If the total amount(s) deducted for tax levy DOES NOT exceed 25% of the employee's disposable income, then the remaining amount UP TO 25% of the disposable income can be deducted for the garnishment.