Employee Maintenance Guide

The Employee Checks window allows you to view a summary of each individual employee's check history. You can view an employee's check history by summary, detail or year to date.

The main topics in this chapter include:

The application is delivered with a set of system-level tables. The information stored in these tables, along with the data and preferences you establish on the company level validate the data you record on the employee level. System-level tables are termed just that because the values they contain are necessary for overall system processing. For this reason, system-level tables are the same for all users and cannot be modified. Company-level tables are user-defined in that the information you establish on them relates specifically to your organization.

The following employee-level tables are used to view an employee's earning information and pay history.

|

Table Name |

Description |

|

EMPEARN |

The employee Earnings table stores each earning code an employee has, along with summary YTD totals. |

|

EMPCOMP |

This table stores an employee's current job information that displays on the employee Job windows. The table contains only company-specific fields which may vary from company to company. The information includes both personal and organizational information that relates to the employee's job. |

|

EMPDED |

The employee Deductions/Benefits table stores each benefit and deduction code an employee has. |

|

EMPMLOC |

This table is used for tax jurisdictions, especially multi-state employees. |

|

EMPTAX |

The employee Taxes table stores each tax code applicable to an employee. This table contains information particular to each jurisdiction, such as the employee's withholding allowances, filing status and tax blocks. |

|

PAYREG |

The PAYREG table is a history file that is updated during the "posting" process from the M_Batch table. This table contains the total earnings, deductions and taxes for each pay check and is linked to the other history tables by the GenNumber which is a unique identifier for each check issued. The PAYREG table also stores the employee’s net pay for each check and whether the check has been cleared (reconciled). |

|

PACCHIST |

The Pacchist table contains accruals details of each earning paid for a pay period along with any accruals posted with the payroll. |

|

PEARHIST |

The Pearhist table contains the payroll-by-payroll detail of each earning paid for a pay period along with any allocations posted with the payroll. |

|

PDEDHIST |

The Pdedhist table contains the payroll-by-payroll detail of each deduction for a pay period along with any employer contributions posted with the payroll. |

|

PTAXHIST |

The Ptaxhist table contains the payroll-by-payroll detail of each employee and employer taxes incurred for a pay period along with the gross wages, taxable wages and other amounts affecting the taxable gross. |

|

PDIRHIST |

The Pdirhist table contains the payroll-by-payroll detail of each direct deposit for a pay period. |

The employee check window allow you to view your employee's pay check history quickly and efficiently.

From the Employee menu, click View/Edit and the employee window appears. In the navigator outline, select the Checks folder to view the checks windows.

You can also click View/Edit from the speed bar to enter the employee windows.

To view the employee check windows, select the Checks folder from the navigator outline.

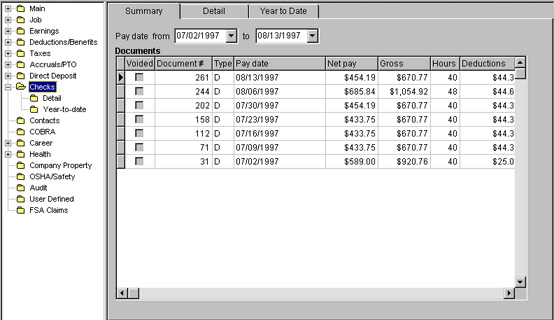

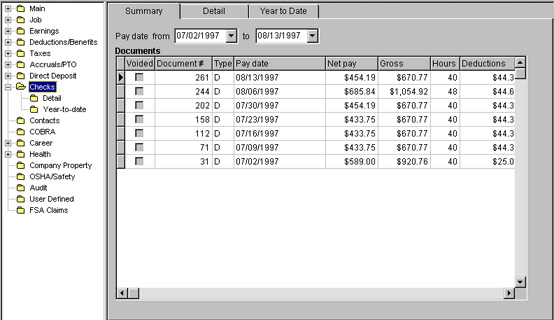

The Summary window provides you with a quick view or snapshot of the documents that the employee has received. It is a display-only window that summarizes the three windows of detailed information contained in the employee Checks windows. The system displays the documents in pay date (PerControl) order with the most recent pay date at the top of the list.

The fields on the Summary window are defined as follows:

The Pay date from/to fields are display-only. You can narrow the range of checks to be within certain pay dates. The default is that these fields are blank, meaning that you see the entire range of documents in the PayReg file for the employee.

The Documents grid contains summary data, such as net and gross pay, pay dates and hours worked, for the employee.

The Voided check boxes indicate whether a document, such as a check or direct deposit, has been voided.

Document # is a display-only field that indicates the number on the check or direct deposit.

Type is a display-only field that indicates what type of document an employee received, for example: C=check, DD=direct deposit, V=void.

Pay date is a display-only field that designates the date you distribute the pay statements for the current pay period.

Net pay is a display-only field that shows the actual amount an employee received for each pay date listed.

Gross is a display-only field that shows the total earnings an employee earned for each pay date listed.

Hours is a display-only field that shows the number of hours an employee was paid for each pay date listed.

Deductions is a display-only field that shows the total of deductions taken from an employee's pay check for each pay date listed.

Taxes is a display-only field that shows the total of taxes taken from an employee's pay check for each pay date listed.

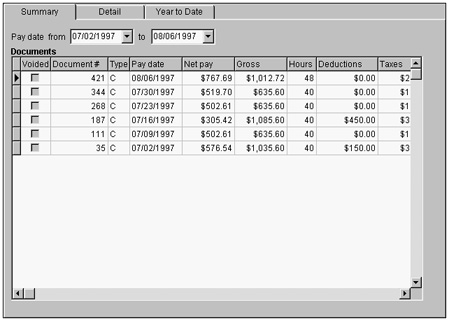

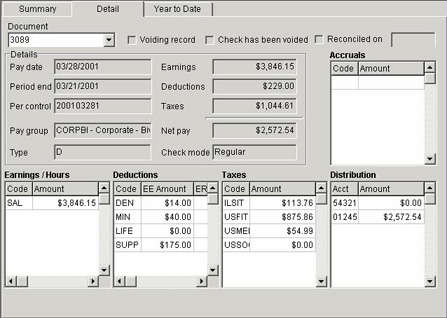

The Detail window displays the specific information from the history tables for the document selected from the Summary window. You can access this screen by: double-clicking the document in the summary grid, by clicking the Details tab or by clicking the sub-node Details.

Only the Document field can be changed on this window; all other information is display-only. The information is a combination of information from the PearHist, PdedHist, PtaxHist and PayReg tables.

The Detail window field descriptions are defined as follows:

Document allows you to select a document to view by selecting a document number from this combination box. The document numbers given are related to the Document # field from the Summary window.

The Voiding record field indicates whether the pay statement has been voided.

The Reconciled check box is used to indicate whether the pay check has been reconciled. If selected, the system displays the date the check was reconciled.

Pay date is a display-only field that designates the date you distributed the pay statements for the current pay period.

Period end is a display-only field that designates the last day of the current pay period.

Per control is a display-only field that displays the unique period control number for each pay period in the processing calendar. The system uses the control number to ensure accurate reporting throughout the system. The control number consists of nine characters comprised of following information, using period control number 199707021 as an example.

|

Table Name |

Description |

|

1st, 2nd, 3rd and 4th |

Represents the pay year. In the example, '1997' represents 1997. |

|

5th and 6th |

Represents the pay month. In the example, '07' represents July 1997. |

|

7th and 8th |

Represents the pay day. In the example, '02' represents the 2nd day of the month, thus July 2, 1997. |

|

9th |

Represents the payroll number for the applicable pay date. In the example, '1' represents the first payroll that is schedules for July 2, 1997. |

Pay group is a display-only field that includes the code, description and pay frequency of all active pay groups for the company. It defines how and when the employee is paid. Pay groups designate employee pay frequency, also known as pay period.

Type is a display-only field that indicates what type of document an employee received, for example: C, Check.

Earnings is a display-only field that shows the total amount of earnings the employee received for that pay period.

Deductions is a display-only field that shows the total amount of deductions taken out of the employee's pay check for that pay period.

Taxes is a display-only field that shows the total amount of taxes taken out of the employee's pay check for that pay period.

Net pay is a display-only field that shows the employee's total take-home pay. The amount is derived from subtracting the deductions and taxes from the earnings.

The Check mode field indicates whether the pay statement was a regular pay, manual check, or an adjustment.

The system affords the flexibility of establishing separate accrual options for all types of employee accruals and paid time off applicable to your company. The accrual code is used as the link with the earning codes used to compensate employees for paid time off.

Code is a display-only field that lists all accrual codes that were effective in the check paid. The system displays the accrual code and amount accrued for the pay period.

Amount is a display-only field that designates the maximum dollar amount or number of hours that can be entered for any employee using this earning code.

The earnings area displays the codes and amounts paid in the check.

Code is a display-only field that lists all earning codes paid on the pay statement.

Amount is a display-only field that lists the amount for each earning code. All of the amounts add up to the total earnings.

The deductions area displays the codes and amount deducted from the check.

Code is a display-only field that lists all deduction codes deducted on the pay statement.

Amount is a display-only field that lists the amount each deduction code is allotted.

The Taxes grid shows the federal, state and local tax codes applicable to the employee.

Code is a display-only field that lists all tax codes deducted from the employee's check.

Amount is a display-only field that lists the amount deducted for each tax code.

Acct is a display-only field that displays the bank account where the funds were deposited.

Amount is a display-only field that lists the amount each account receives.

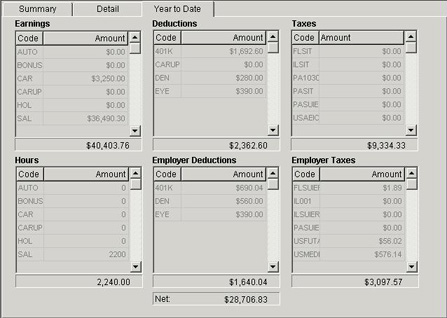

The Year to Date window provides a year-to-date view for all of the employee's earnings, deductions and taxes, as well as the employer's taxes and deductions.

The Year to Date window field descriptions are defined as follows:

All earnings paid to an employee for the current year display with the YTD totals.

Code is a display-only field that lists all earning codes assigned to the employee.

Amount is a display-only field that lists the amount each earning code is allotted. All of the amounts add up to the total earnings for the year-to-date.

Each benefit plan your company offers to its employees is assigned a unique code that is associated with a unique deduction.

Code is a display-only field that lists all deduction codes assigned to the employee from the deductions group.

Amount is a display-only field that lists the amount each deduction code is allotted. All of the amounts add up to the total deductions for the year-to-date.

The Taxes grid shows the federal, state and local tax codes applicable to the employee, as well as jurisdiction information (ID numbers and percentage rates).

Code is a display-only field that lists all tax codes assigned to the employee.

Amount is a display-only field that lists the year-to-date amount for each tax code. All of the amounts add up to the total taxes for the year-to-date.

The Hours grid shows the number of hours for which the employee has been paid.

Code is a display-only field that lists all earning codes assigned to the employee.

Amount is a display-only field that lists the year-to-date number of hours for which the employee has been paid for each earning code. All of the amounts add up to the total hours for the year-to-date.

Employer taxes area displays all tax codes and year-to-date amounts paid by the employer on behalf of the employee.

Code is a display-only field that lists all employer tax codes.

Amount is a display-only field that lists the amount for each employer tax code. All of the amounts add up to the total employer taxes for the year-to-date.

Employer deductions area displays all deduction codes and year-to-date amounts paid by the employer on behalf of the employee.

Code is a display-only field that lists all employer deduction codes.

Amount is a display-only field that lists the YTD amount for each employer deduction code. All of the amounts add up to the total employer deductions for the year-to-date.