Administrators can configure Recruiting to have job applicants complete WOTC screening assessments provided by third party vendors.

Recruiting now allows you to use third party screening providers to screen your applicants for Work Opportunity Tax Credit (WOTC) eligibility.

The Work Opportunity Tax Credit (WOTC) is a U.S. Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment. For more information about WOTC and eligible targeted groups, see the WOTC page on the IRS website.

Important:

The Outmatch assessment integration is not compatible with the new WOTC screening integration API. Currently, you cannot use both integrations with Recruiting at the same time.

- If you currently use Outmatch for candidate assessments: WOTC screening integration is not available.

- If you do not currently use Outmatch for candidate assessments: WOTC screening integration is available. Outmatch assessment integration is not available.

To switch between the Outmatch integration and WOTC Screening, contact your customer service representative.

In order to use one of our partners for WOTC screening, you must obtain a contract with the partner. The partner provides your organization with account information that you enter in Recruiting.

Recruiters can add WOTC screening to Opportunities on the Screening tab. See Configure the Screening Tab.

When a candidate applies to an Opportunity with WOTC screening, the candidate sees a link to each WOTC screening assigned to the Opportunity. The candidate can complete their WOTC screening on the partner site. If needed, the candidate can view their assigned WOTC screenings in their candidate Presence.

Note:

If the screening questions in your Opportunity include a knockout question, any applicants whose answer eliminates them from consideration do not receive any third party assessments or screenings.

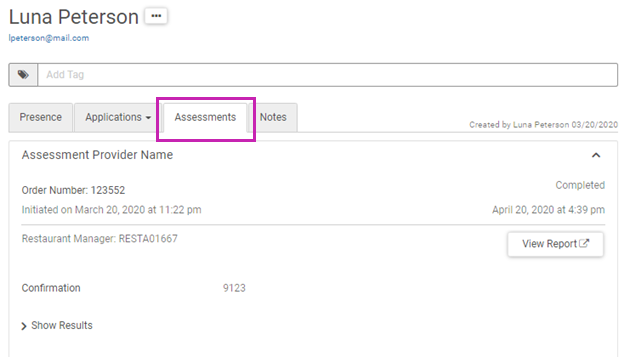

To view details about a candidate's WOTC screening, view the candidate's details page and select the Assessments tab.

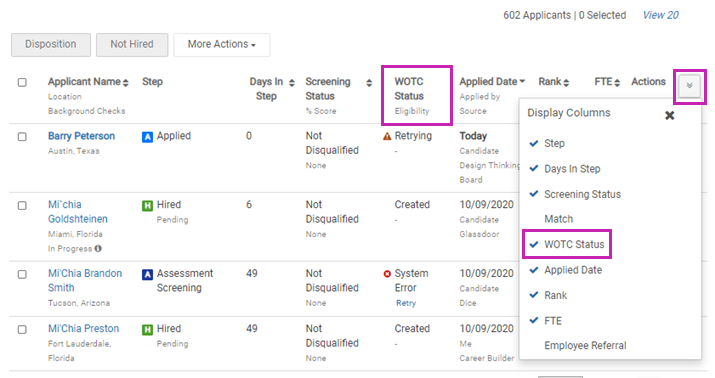

In the applicant list of an Opportunity, you can add the new WOTC Status column to your view, and sort or filter the list of applicants by their WOTC Status value.